Finding bargain stocks in the artificial intelligence (AI) space isn't an easy task. The sector is quite popular, and the amount of money being spent to fund this arms race is jaw-dropping. However, I think there's one stock that looks like an excellent buy that's also reasonably priced: Alphabet (GOOG 2.98%) (GOOGL 3.10%).

Alphabet is involved in the AI arms race in multiple ways. While Microsoft got the jump on Google by investing in OpenAI and incorporating ChatGPT into its browser, Alphabet has caught up and remains a top way to invest in AI at a reasonable price.

Image source: Getty Images.

Google Search is still doing well despite calls for its downfall

Alphabet is the parent company of Google, YouTube, the Android operating system, and Waymo. It has a wide-reaching umbrella, but a significant chunk of its tech empire derives revenue from advertising, specifically from the Google Search engine. Current market sentiment assumes that Google Search will be replaced by generative AI in the future, which will harm Alphabet's base business significantly.

However, Google isn't going silently into the night.

It already launched AI search Overviews, which provide a generative-AI-powered summary of a Google search, integrating a traditional search experience with a new-age generative AI product. This combination is likely enough generative AI for most consumers, and should allow Google to remain top of mind for consumers accessing the internet.

This seems to be how it's playing out right now, as Google Search's revenue increased by 12% year over year in the second quarter. That's an acceleration from Q1's 10% growth pace, indicating that Google Search is doing quite well despite fears of replacement.

But that's not the only way Alphabet is exposed to AI.

Google Cloud is a growth machine for Alphabet

The demand for computing power to handle AI workloads is booming, and most users are running their workloads on the cloud. This is a major boost for cloud computing providers like Google Cloud, which have seen an uptick in demand alongside the AI arms race. Google Cloud built a massive network of data centers filled with high-powered computing devices for AI workloads, and other less powerful units for more generic ones. It became one of the top platforms in the industry for running AI workloads on, and even landed the business of one of its AI competitors, OpenAI.

Google Cloud isn't a large part of Alphabet today; it only made up 14% of total revenue, but it is the fastest-growing segment. In Q2, Google Cloud's revenue rose by 32% year over year, so it could be a much bigger contributor to the company's overall revenue in the coming years, especially when you consider the projected growth in the cloud computing space.

Alphabet's cheap price tag is a huge reason to buy the stock

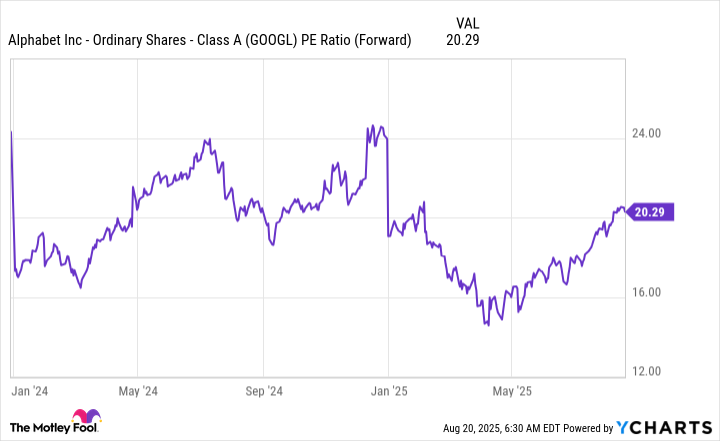

Despite Alphabet's business operating at a high level, overall revenue rising by 14% in Q2 and diluted earnings per share (EPS) rising by 22%, the market still has no respect for Alphabet's stock. The stock trades at a discount to the broader market, as measured by the S&P 500, which trades for 24.1 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts

Alphabet trades for a far more reasonable 20.3 times forward earnings, making it an excellent bargain compared to the broader market. Additionally, this price tag is much lower than its big tech peers, despite Alphabet growing at a faster rate than some of them, such as Apple.

Alphabet isn't in as bad a place as many investors feared just a few months ago, and is posting excellent results to boot. With Alphabet's legacy cheap price tag still hanging around, I think there are few better places in the market to invest than Alphabet's stock right now.