In early August 2018, Apple (AAPL 1.21%) became the first U.S. company to surpass $1 trillion in market cap.

Fast forward seven years, and there are nine S&P 500 (^GSPC 1.52%) components with market caps over $1 trillion: the "Magnificent Seven" consisting of Nvidia (NVDA 1.65%), Microsoft (MSFT 0.56%), Apple, Amazon (AMZN 3.12%), Alphabet (GOOG 2.98%) (GOOGL 3.10%), Meta Platforms (META 2.04%), and Tesla (TSLA 6.18%), plus Broadcom (AVGO 1.48%) and Berkshire Hathaway (BRK.A 0.18%) (BRK.B -0.06%).

The "Ten Titans" include the ten largest growth-focused companies by market cap -- the Magnificent Seven and Broadcom, Oracle (ORCL 1.30%), and Netflix (NFLX -0.20%).

Here's how Oracle and Netflix can join the rest of the Ten Titans in the $1 trillion club by 2030.

Image source: Getty Images.

Oracle is a high-risk, high-potential-reward AI play

Oracle's market cap at the time of this writing is $660.2 billion. Oracle has gone from a dividend-paying tech stalwart to a business unlocking transformational growth in just a matter of years. And investors have responded, as Oracle is up a staggering 70% in the last year and 318% in the last five years.

Oracle's cloud business is growing faster than incumbents Amazon Web Services, Microsoft Azure, and Google Cloud, as Oracle has done a masterful job leveraging cloud with its established data center model, implementing a competitive pricing model, and forming partnerships with the major cloud providers.

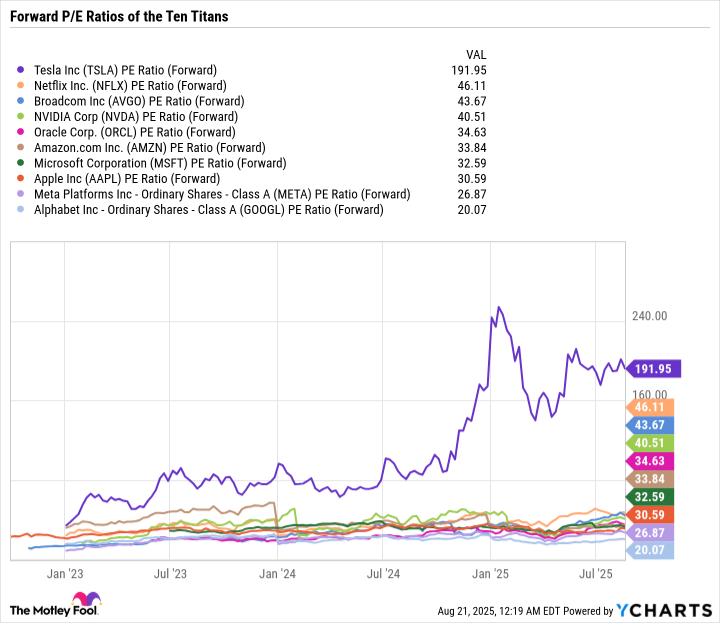

Oracle is pricey, at 34.6 times forward earnings estimates, making it more expensive than the larger, more established cloud players. However, Oracle has a number of advantages that could pole vault its market cap well above $1 trillion by 2030.

TSLA PE Ratio (Forward) data by YCharts.

For starters, Oracle is a pure play enterprise software and solutions company. Unlike Amazon, Microsoft, and Alphabet -- which are basically tech conglomerates -- Oracle doesn't have a consumer-facing business. This gives Oracle a much more focused investment thesis and allows the company to zero in its capital expenditures (capex) on building out its cloud infrastructure and application network.

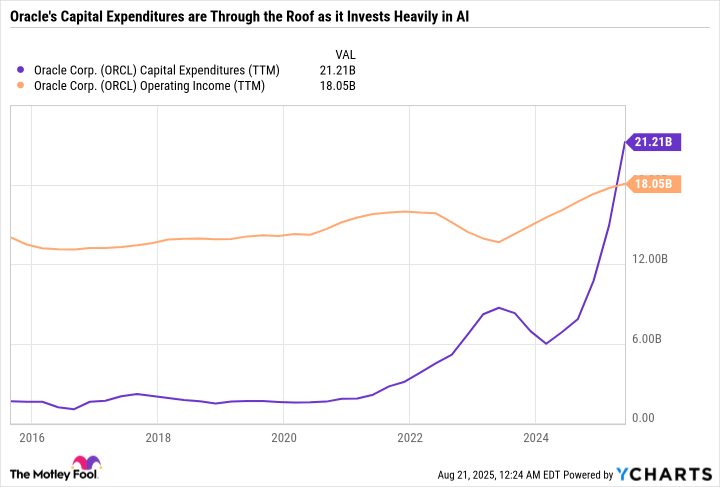

Oracle has been one of the most aggressive companies when it comes to deploying capex into artificial intelligence (AI). As you can see in the following chart, Oracle went from a company that was chugging along and maintaining its legacy business to pouring money into capex even though its operating income hasn't grown nearly as quickly.

ORCL Capital Expenditures (TTM) data by YCharts.

If Oracle's investments translate to earnings growth, the stock could defend its premium valuation and have an easy path to a $1 trillion market cap and beyond.

However, it's worth mentioning that Oracle's balance sheet is highly leveraged with debt, and its free cash flow is negative as it front-loads AI investments.

Buying Oracle is a bet that its ultra-aggressive capex spending is worth it. If it disappoints, Oracle stock could correct and remain beaten down for some time, which could throw a wrench in gaining 51.5% from its current level to $1 trillion in market cap by 2030.

Netflix's road to $1 trillion won't be easy

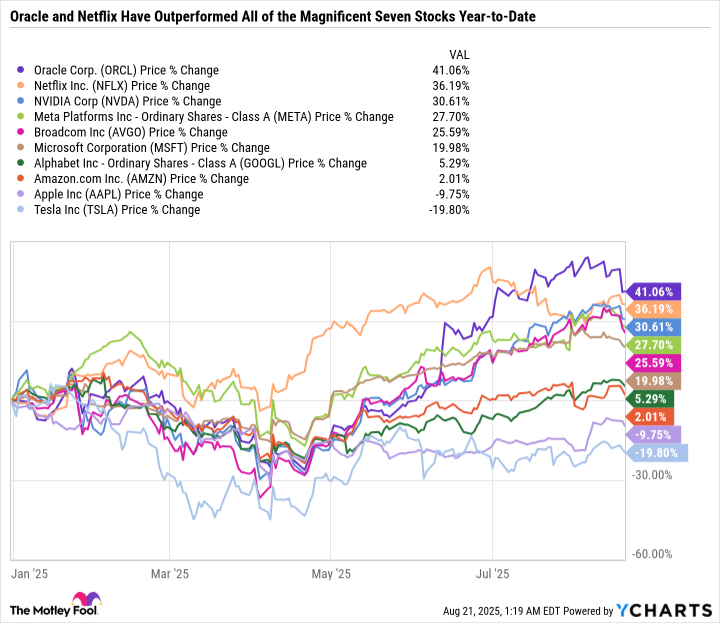

Netflix is the second-best performing Ten Titan year to date behind only Oracle.

Epic gains over the last few years have lifted Netflix's market cap to $515.8 billion at the time of this writing. But the company has a longer way to go than Oracle to reach $1 trillion by 2030. Specifically, the stock would have to achieve a compound annual gain of 14.2% between now and August 2030 to surpass a $1 trillion market cap. For context, the S&P 500 has historically averaged an annual gain of 9% to 10% per year, but that comes with a lot of variance.

Despite the uphill climb, Netflix thinks it can hit the mark. Management has set an internal goal to hit $1 trillion market cap by 2030, as well as doubling revenue and tripling operating income from 2024 levels, giving Netflix a projected $78 billion in revenue and a 40% operating margin for roughly $31 billion in operating income. At a $1 trillion market cap, that would put Netflix's valuation at 32.3 times operating income, which is expensive considering operating income doesn't even account for taxes.

Netflix's road to $1 trillion requires the company to hit its internal goals and maintain its premium valuation. However, Netflix has done a masterful job refining its secret sauce for content quality and quantity while managing spending. So it's reasonable to assume the company should be able to grow its margins over time.

Investing in Ten Titans for the right reasons

The Ten Titans have delivered market-beating returns over the long term. But the group's valuation is relatively stretched, so the "easy" gains are likely in the rearview. This means these stocks will have to rely on earnings growth, rather than earnings growth and valuation expansion, to drive future returns.

The S&P 500's valuation has gone up, and its yield has gone down as the Titans gobble up a higher percentage of the index. Investors should understand that the Ten Titans' influence on the index is a double-edged sword. When earnings are good and optimism is running high, the Ten Titans can drive the market to new heights. But when fear creeps in, the Titans can accelerate a rapid sell-off -- as we saw in April.

I believe Oracle and Netflix will one day reach $1 trillion market caps, but there's a lot that could go wrong between now and 2030 to delay that ascent. So investors considering either name should only do so with a long-term mindset and a relatively high risk tolerance.