As of Aug. 21, the S&P 500 (^GSPC +0.12%) is up a healthy 18.6% over the past year and is only 1.7% off of the all-time high it set earlier this month. If the stock market is any indication, the U.S. economy is absolutely booming.

Economic data from Aug. 14, however, has investors wringing their hands. These days, everyone is talking about inflation. While consumer prices seemed to be getting back under control, inflation is heating up for producers.

The Producer Price Index increased 0.9% in July from the previous month. That might sound trivial, but it was the biggest increase in three years.

Image source: Getty Images.

When there's inflation for producers, it means their costs are going up. Some economists believe this is happening because of tariffs put in place by the Trump administration. The rising inflation for producers could soon trickle down to inflation for consumers as companies increase prices to offset the higher costs.

Considering the stock market is soaring and inflation is rising, is it only a matter of time before stocks crash back down to earth?

How inflation can hurt stocks

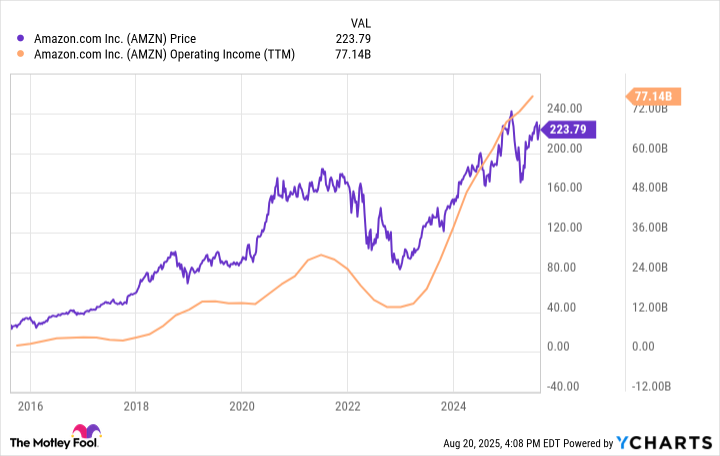

Perhaps it's best to take a step back and consider why stocks go up in the first place. Generally speaking, long-term growth in profits leads to long-term stock price appreciation. Let's use Amazon stock as an example. Over the last decade, its operating profit has skyrocketed, leading to a nearly 800% gain for the stock.

Data by YCharts.

Herein lies the problem with inflation for producers: When their costs go up, their profits go down. To get their profits back, they either have to figure out ways to bring costs down or they must raise their end prices to consumers.

However, raising prices can be tricky as well. Consumers don't have unlimited budgets. As prices increase, consumers get more picky when it comes to discretionary spending.

Moreover, ongoing inflation encourages the Federal Reserve to raise interest rates, which slows the economy down as well.

On the surface, it would seem like the Producer Price Index is a canary in the coal mine: July inflation heated up, which could send ripples through the economy and sink stocks.

Let's tap the brakes

Perhaps it sounds like I've outlined a reasonable argument for investors to panic. Again, it makes sense to take a step back and this time, get some perspective from some of the greatest investors of all time.

It would seem that a market crash is imminent, perhaps even before the end of 2025. But investing great Warren Buffett had this to say in his 1992 letter to Berkshire Hathaway shareholders:

We've long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.

Buffett's right-hand man Charlie Munger agreed with this sentiment and said many years later, "Sometimes we had a tailwind from the economy and sometimes we had a headwind. Either way, we just kept swimming."

In his book Beating the Street, Peter Lynch said: "I can't recall ever once having seen the name of a market timer on Forbes' list of the richest people in the world. If it were truly possible to predict corrections, you'd think somebody would have made billions by doing it."

Perhaps one can predict a stock market crash will happen within the next 12 months. Perhaps inflation for producers is pointing to a crash sooner rather than later. But Buffett, Munger, and Lynch are three of the best to ever invest -- even doing half as well as this trio would make you a very successful investor. And yet, all three agree that trying to predict the timing of a market crash is futile.

For this reason, I wouldn't personally sell my stocks in anticipation of a downturn from inflation or any other headwind -- a winning investment approach keeps you mostly invested through thick and thin.

That said, there is a way to prepare. Crashes do frequently occur on the stock market, and irrational fear can lead to some incredible bargains. Knowing that pullbacks are normal can help mitigate this fear, while having some cash on the sidelines ready to invest can allow prepared investors to take advantage of opportunities as they come up.

The jump in producer prices could eventually lead to some pain in stocks, and new tariffs could exacerbate the problem. In the meantime, consider taking the advice from Munger and just keep swimming.