During the stock market meltdown in October 2008, The New York Times published an op-ed written by Warren Buffett titled "Buy American. I Am." Buffett noted in the article, "Fear is widespread, gripping even seasoned investors." But he remained optimistic.

Today, the picture looks much different. The S&P 500 (^GSPC +0.01%) is near its all-time high. Investors don't appear to be afraid of what the future holds.

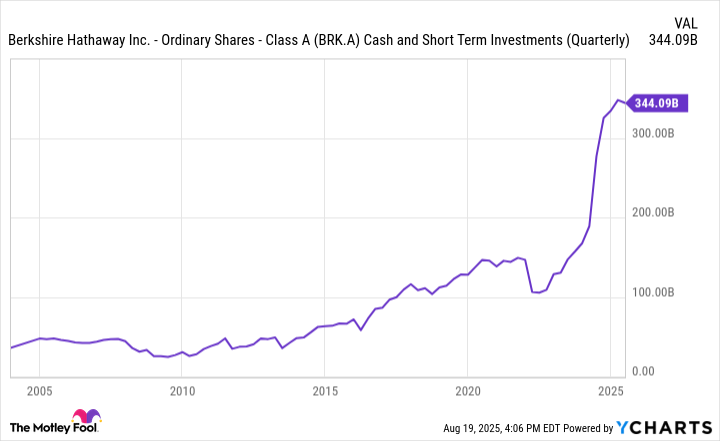

However, Buffett isn't writing an upbeat op-ed piece these days. Instead, he has quietly sent investors a $344 billion warning.

Image source: The Motley Fool.

Buffett's $344 billion warning

If you really want to know what Buffett thinks about the shape of the stock market, look at Berkshire Hathaway's (BRK.A +0.67%) (BRK.B +0.92%) cash position. The more bullish Buffett is, the less cash the conglomerate will have -- because he's spending money buying stocks hand over fist. On the other hand, when Buffett isn't so bullish, Berkshire's cash stockpile will grow.

What's the status of Berkshire's cash position now? At the end of the second quarter of 2025, the company had cash, cash equivalents, and short-term investments in U.S. Treasury bills totaling $344 billion. That's the second-largest cash hoard in Berkshire Hathaway's history, lagging only $3.6 billion behind the company's cash position at the end of the first quarter of 2025.

BRK.A Cash and Short Term Investments (Quarterly) data by YCharts

Unsurprisingly, Buffett isn't loading up on many stocks these days. He isn't even authorizing stock buybacks for Berkshire Hathaway. To the contrary, he has been a net seller of stocks for 11 consecutive quarters.

Is the Oracle of Omaha sounding a warning for investors? I think so. Buffett's actions reflect his view that most stock valuations are too high. Indeed, the stock market valuation metric called the Buffett indicator, which measures the ratio of total stock market capitalization to GDP, is at its highest level ever.

Buffett once stated that when this indicator approaches 200%, investors are "playing with fire." It's at 210% now.

History lessons

What does history say the stock market will do next? It's complicated. For one thing, Berkshire's cash position hasn't been higher than the 2025 levels before. However, we can perhaps learn from the past.

In mid-2005, Berkshire's cash stockpile peaked at roughly $48 billion. The S&P 500 went on to rise more than 30% by October 2007. But one of the worst financial crises in U.S. history then caused a major stock market crash in 2008. It took years for the market to fully recover.

By the way, Buffett wasn't fibbing in his New York Times op-ed in 2008. He really was buying American stocks hand over fist. Berkshire's cash position reflected those investments, eventually declining by nearly 50% as Buffett bought stocks.

Berkshire amassed another record-high cash stockpile in the third quarter of 2021, with cash, cash equivalents, and short-term investments of over $149 billion. The S&P 500 gained another 10% or so by the end of the year. The index subsequently sank nearly 20% in 2022.

The history lessons from the Buffett indicator are even more stark. The valuation metric peaked in 2000, shortly before the dot-com bubble burst and stocks plummeted. After rebounding for years, the Buffett indicator approached 200% in late 2021 -- right before the bear market of 2022 ensued.

What should investors do?

The worst thing investors should do is ignore Buffett's warning. When the billionaire has viewed stock valuations as too frothy in the past, he's eventually been proven right by a significant market pullback.

Perhaps the best strategy is to follow Buffett's lead. As we've seen, he has built up Berkshire's cash position so that he (or Greg Abel, who will succeed him as CEO next year) can invest heavily when valuations are more attractive.

However, Buffett hasn't quit buying stocks altogether. In the second quarter of 2025, Berkshire added to its stakes in nine stocks and initiated new positions in three more. It's fair to say, though, that Buffett and his two investment managers have been highly selective about which stocks they buy. That's a smart approach in a market arguably priced for perfection.

Importantly, Buffett hasn't panicked. Although he's been a net seller of stocks for quite a while, Berkshire still has roughly $295 billion invested in equities. The legendary investor is wary of steep valuations now, but he almost certainly remains optimistic about the long term.