The most prominent statistic around AGNC Investment (AGNC +1.91%) right now is probably its 14.8% dividend yield. That's a huge yield and one that is likely to draw the attention of many dividend investors. There's just one problem: AGNC isn't really meant for investors looking to live off the income their portfolios generate.

Here's what you need to know and what type of investor might still want to buy this mortgage real estate investment trust (REIT).

The problem with AGNC Investment's huge yield

AGNC Investment is a real estate investment trust, a company structure that is designed to pass income on to shareholders. But that fact has to be juxtaposed against other facts when looking at the massive dividend yield this stock is offering up.

Image source: Getty Images.

First, AGNC isn't a traditional property-owning REIT. It is a mortgage REIT. It owns mortgages that have been pooled together into bond-like securities. In some ways, it's more akin to a mutual fund than a REIT, since its portfolio of mortgage securities represents, effectively, the value of the business, and the value of those securities changes daily. Second, the dividend that AGNC pays isn't expected to be progressive or even remain static, as investors would likely expect from a property-owning REIT. It fluctuates up and down along with the portfolio of mortgage securities it owns.

The chart below highlights that volatility. But notice how the stock price tends to follow along with the dividend as the dividend rises and falls. Given the math behind the dividend yield statistic, that has resulted in AGNC's yield hovering in the double-digit space most of the time, even when the dividend has been falling for years on end.

Data by YCharts.

Most dividend investors are likely trying to find a company with a sustainable, if not growing, dividend payment. That way, the investor can use dividends to pay for everyday living expenses. The chart above shows that AGNC Investment clearly isn't the kind of stock you can rely on for this when it comes to dividends.

AGNC Investment is good at what it does

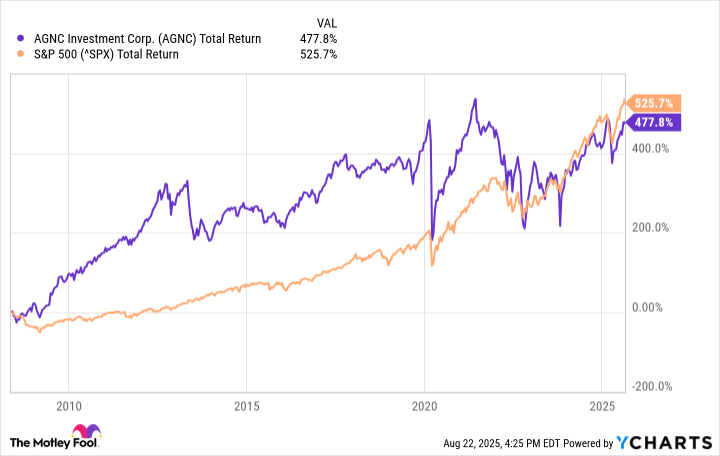

This is where things get interesting, because AGNC, despite the huge yield, isn't actually trying to be an income stock. The company's goal is total return, which requires investors to reinvest dividends, not spend them. Looking at total return, AGNC has done a pretty solid job of rewarding investors over time, as the chart below shows. Notice that the performance graph isn't moving in lockstep with the S&P 500.

Data by YCharts.

There are two big takeaways here. First, AGNC isn't an income stock; it is a total return stock. Second, the performance history suggests it will be a good diversifying asset, since it doesn't appear to track closely with stocks in general. So, if you're working with an asset allocation approach, which inherently focuses on total return, AGNC Investment could be an attractive addition to your portfolio.

NASDAQ: AGNC

Key Data Points

The problem here is that asset allocation is normally something that larger investors do. Think institutional-level investors like pension funds and insurance companies. Small investors, those that would likely be most drawn to an ultra-high yield, usually don't use an asset allocation approach. That's why you need to be sure you really understand what AGNC Investment is trying to do before you buy it. If you don't dig into the details, you could end up with less income and less capital, which is pretty much the worst possible outcome for an income-focused investor.

AGNC Investment is great, but only for the right investors

AGNC Investment is a difficult business to understand. It does what it aims to do and does it fairly well, given the historical total return performance. But that lofty dividend yield might give some investors the wrong impression of what AGNC is trying to do. That could leave income-focused investors with an investment that doesn't live up to their expectations.