Most artificial intelligence (AI) development happens inside data centers, which deliver enormous amounts of processing power thanks to advanced chips and networking equipment. Broadcom (AVGO +0.15%) is a leading supplier of that AI hardware, and the company's surging sales have catapulted it into the exclusive $1 trillion club.

Broadcom has an enormous addressable market that could fuel even more upside to its valuation over the long term, but its stock isn't cheap right now by any traditional metric. The company is scheduled to release its financial results for its fiscal 2025 third quarter (ended July 30) on Sept. 4, which will give investors a fresh look into its booming AI business. Is Broadcom stock a buy ahead of the report? Read on for the surprising answer.

Image source: Getty Images.

Tech giants are buying Broadcom's AI hardware hand over fist

Broadcom has been a pioneer in the computing hardware space since the 1960s, developing everything from cable modems to optical mouse sensors to Wi-Fi chips. It merged with semiconductor giant Avago Technologies in 2016, which expanded its footprint, and since then, the combined companies have spent almost $100 billion acquiring other enterprises like Symantec, CA Technologies, and VMware.

But Wall Street's attention remains firmly on Broadcom's hardware business because of its expanding role in the AI revolution. Several hyperscalers (like Alphabet) are buying Broadcom's data center chips called AI accelerators, which can be customized to suit their specific requirements. This offers them more flexibility compared to buying ready-made graphics processing units (GPUs) from suppliers like Nvidia.

At least three of Broadcom's hyperscale customers plan to run up to 1 million AI accelerators each in 2027, creating a serviceable addressable market of between $60 billion and $90 billion in that year alone.

Broadcom is also a key supplier of networking equipment for data centers. It sells Ethernet switches, which regulate how fast data travels between chips and devices, and the latest Tomahawk Ultra variant offers industry-leading low latency and high throughput. This sets the stage for faster processing speeds with less data loss, which is a huge advantage in AI workloads where mountains of information are constantly on the move.

NASDAQ: AVGO

Key Data Points

Broadcom's AI revenue is soaring

Broadcom delivered $15 billion in total revenue during its fiscal 2025 second quarter (ended May 4), which was up 20% year over year. Within that number was $4.4 billion of AI revenue, which soared by 46%.

According to management's guidance, Broadcom will likely show $15.8 billion in total revenue when it reports its Q3 results on Sept. 4, with AI revenue soaring by 60% year over year to $5.1 billion. If those figures come in above expectations, it would likely be very bullish for Broadcom stock. Moreover, Q4 guidance that points to another acceleration in AI revenue growth would also be a big positive.

Wall Street will also be watching Broadcom's bottom line, because the company has been carefully managing costs to generate higher profits over the last few quarters, which is a welcome payoff for patient investors who endured the post-2016 acquisition spree.

During Q2, Broadcom's generally accepted accounting principles (GAAP) net income surged by 134% year over year to $4.9 billion. On the other hand, its non-GAAP (adjusted) earnings before interest, taxes, depreciation, and amortization (EBITDA) climbed by 35% to $10 billion. This figure strips out one-off and non-cash expenses, so it's a better indication of how much money Broadcom's business is actually generating.

Management's guidance suggests Broadcom's adjusted EBITDA likely came in at around $10.4 billion in Q3, so there is real momentum building in the company's bottom line.

Should you buy Broadcom stock before Sept. 4?

Broadcom's business is firing on all cylinders right now, and one quarter probably won't change its positive long-term trajectory. But whether or not investors should buy its stock ahead of the Sept. 4 report might come down to their time horizon, because it's undeniably expensive, which could keep a lid on any potential upside in the short term.

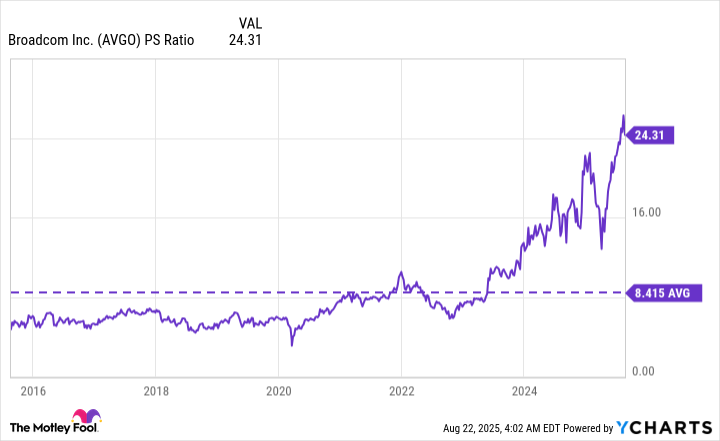

The stock is trading at a price-to-sales (P/S) ratio of 24.3, which is near the most expensive level on record, and it's almost three times higher than its 10-year average of 8.4:

AVGO PS Ratio data by YCharts

Moreover, Broadcom's trailing-12-month earnings of $2.67 per share places its stock at a price-to-earnings (P/E) ratio of 108.4. That makes it three times as expensive as the Nasdaq-100 technology index, which is trading at a P/E ratio of 33.5. In other words, Broadcom might be overvalued relative to its big tech peers -- and by a very wide margin.

Broadcom will eventually grow into its sky-high valuation if its AI revenue and overall earnings continue to grow at the current pace. However, it could still take years for the stock to trade at a market multiple, unless it suffers a significant correction.

As a result, short-term investors who are looking for gains over the next 12 months or so should probably avoid Broadcom stock ahead of Sept. 4. However, those who are willing to hold it for the next five years (or more) could still do very well despite its high valuation, as long as the company's AI-driven momentum continues.