Target (TGT 3.83%) stock investors haven't had much to celebrate lately. The retailer's shares are down nearly 40% in the three years ended in mid-August, as compared to a 57% rally in the wider market. To add insult to injury, peers like Costco (COST 0.57%) and Walmart (WMT 0.08%) outperformed the S&P 500 by a wide margin in that period.

Yet investing is about the future, not the past, and it is possible that Target's bad run is setting shareholders up for a multi-year rally. With that prospect in mind, let's look at the potential for this struggling stock to return to its prior winning ways.

Image source: Getty Images.

Rough results

There's no escaping the conclusion that Target's business is under serious pressure today. Sales declined 2% in the most recent quarter, management said in mid-August, just as they did in Q1. Sure, the 2% drop wasn't as steep as last quarter's 6% slump, but it still represents more market share losses. Walmart recently announced a 5% boost in comparable-store sales, and Costco's sales were up nearly 7% in July.

Looking deeper into Target's results reveals even more cause for concern. Customer traffic is down 2% in the past six months, and the shoppers who are visiting its stores are spending less. These declines came despite increased price cuts, which helped push profitability down to 5% of sales from 6% a year ago.

Under new management

The good news is that Target seems ready to make some big changes. The company announced that Michael Fiddelke, its current chief operating officer, will replace Brian Cornell as CEO starting in early February. Furthermore, the board of directors highlighted Fiddelke's independent streak in the press release, praising his habit of "challenging the status quo to evolve how the business operates, differentiates, and delivers long-term value." Now the big question is whether the incoming CEO will push for the type of dramatic pivots that are needed to reverse the multi-year market share slide.

Fiddelke told investors in mid-August that he's focused first on improving the Target's product selection so it regains "merchandising authority" across all its key categories but especially in its core consumer discretionary aisles. Target is aiming to fix its shopping experience, too, by boosting in-stock levels, employee training, and store cleanliness. "We want to delight our guests who shop with us every time they shop," Fiddelke said.

Looking ahead

The stock's slump immediately following the Q2 news and Fiddelke's appointment suggests that Wall Street isn't convinced that these changes will be enough to get Target back on track. At a minimum, it will take a few quarters before investors can confirm any rebound through improvements in metrics like customer traffic, average spending, and operating profit margin.

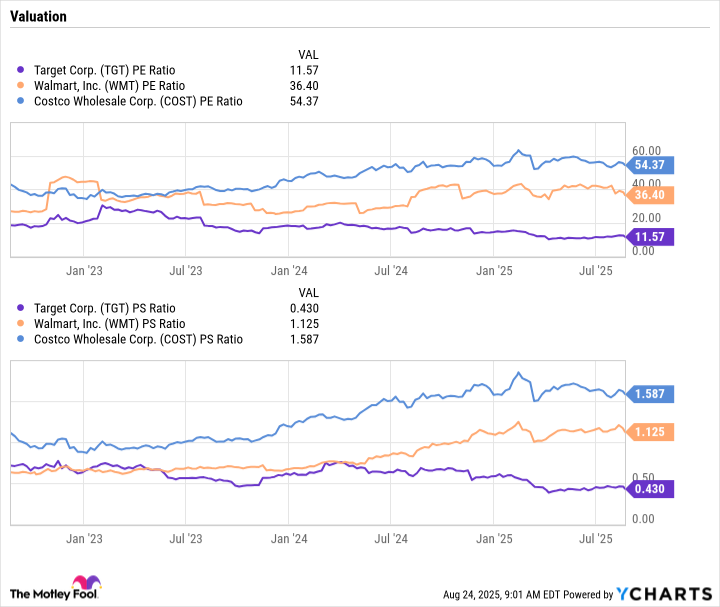

Target's stock is entering the Fiddelke era at its cheapest level in years. Shares are priced at 0.4 times sales and just 12 times earnings, compared to much higher valuations for its retail industry peers.

TGT PE Ratio data by YCharts.

Target will still have to earn a higher premium by demonstrating it can reconnect with its core customers, beginning with the upcoming holiday shopping season. If it succeeds, investors who buy the stock now will profit from holding it through a period of intense pessimism around the business.

Yet that pessimism is warranted right now. As outgoing CEO Cornell said in the Q2 earnings call, "[O]ur performance over the last few years has not been acceptable." It won't be easy, even under new management, to flip that disappointing narrative on its head. Most investors, then, will want to simply watch this value stock for the time being.