Berkshire Hathaway (BRK.B 0.09%) (BRK.A 0.03%) is a legendary stock with decades of above-average performance. Yet, even legends can fade. And, in recent years, it seems as though more and more stocks are surpassing Berkshire's market cap.

For example, 10 years ago, Berkshire's market cap stood at around $330 billion. There were only a few American companies with a higher market cap: Apple ($640 billion), Alphabet ($420 billion), and Microsoft ($340 billion).

Yet, as of this writing, there are eight American companies with market caps greater than Berkshire's $1.05 trillion market cap. Nvidia's market cap alone is 4 times larger than Berkshire's -- and 10 years ago, Nvidia's market cap was a scant $12 billion.

Let's have a look at two companies that I believe will surpass Berkshire in market cap value by 2030.

Image source: Getty Images.

1. Tesla

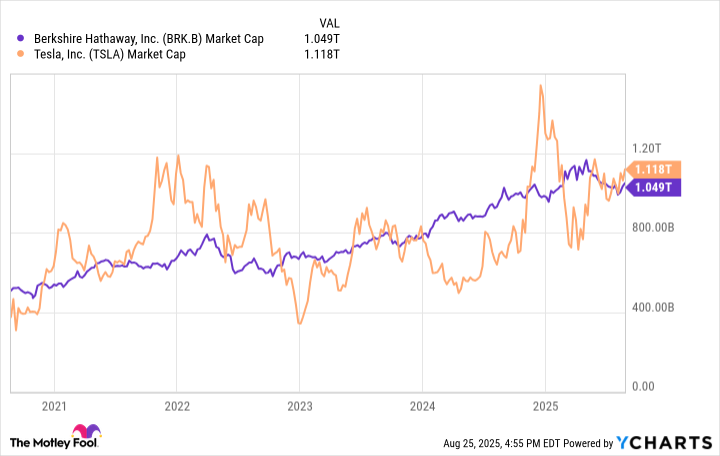

First up is Tesla (TSLA +0.87%). With a market cap -- as of this writing -- of $1.12 trillion, Tesla's market cap already exceeds Berkshire's $1.05 trillion total.

However, these two companies have played leapfrog in terms of market cap for the last five years.

Data by YCharts.

The reason I believe Tesla will permanently pull ahead of Berkshire over the next five years is simple: Technological innovation and maturation will benefit Tesla far more than Berkshire. For starters, Tesla should get a boost from improvements in autonomous driving. The company has already rolled out robotaxis in Austin, Texas. By the end of this year, the company may expand into other cities in California, Florida, Arizona, and Nevada.

Second, investors shouldn't overlook Tesla's energy and battery division. The company's energy generation and storage division generated over $10 billion in calendar year 2024 revenue, equating to about 10% of total revenue. As individuals and organizations continue to shift toward renewable forms of energy generation, Tesla should benefit.

NASDAQ: TSLA

Key Data Points

Finally, robotics is another area that could propel Tesla's stock over the next five years. Simply put, humanoid robots could be the next big thing -- if the technology continues to improve and costs come down. Organizations of all shapes and sizes would eagerly switch to humanoid robots to reduce labor costs. Tesla plans to produce nearly 1 million Optimus robots by 2030.

In summary, technological advancements in autonomous driving, sustainable energy, and robotics will greatly benefit Tesla, which should help it pull ahead of Berkshire for good.

2. Oracle

Next, there's Oracle (ORCL +3.10%). As of this writing, Oracle has a market cap of $661 billion. That makes it the 13th-largest American company. However, its market cap still trails Berkshire's by nearly $400 billion.

So, how is it possible for Oracle to close the gap in just four years? In short, it's due to Oracle's critical position within the artificial intelligence (AI) ecosystem. Oracle is one of the biggest players in the data center market. It currently has dozens of live data center facilities, spanning regions across the globe, with plans to expand to well over 100 facilities.

NYSE: ORCL

Key Data Points

Why is this important? Well, because cloud data centers are some of the most highly prized real estate on the planet right now. Organizations that are racing to develop cutting-edge AI applications need the massive computing power and platforms housed within Oracle's data centers to train and run their models.

This surging global demand should drive Oracle's stock price higher over the long run. Indeed, the company's market cap has already increased by roughly $300 billion in the past year. In five years' time, Oracle could very well surpass Berkshire.