There are 500 companies from all 11 economic sectors in the S&P 500 (^GSPC +0.65%), so it's a well-diversified, large-cap index. Companies have to meet a strict criteria to be added to it -- they must be profitable, and they need to maintain a market capitalization of at least $22.7 billion, among other things.

The S&P 500 is weighted by market capitalization, so its largest constituents have a greater influence over its performance than the smallest. As a result, tech giants like Nvidia, Microsoft, and Apple have led the index higher over the last few years.

It has delivered a compound annual return of 10.5% since its inception in 1957, even after accounting for every sell-off, correction, and bear market. But what if there were a similarly diversified investment option that would offer investors the chance to do even better?

Image source: Getty Images.

Meet the S&P 500 Growth index

The S&P 500 Growth index currently holds around 212 of the best-performing stocks in the S&P 500, and excludes the rest. The stocks that make the cut are selected based on factors like their momentum and the sales growth of the underlying companies.

That means high-growth sectors tend to have a much higher representation in the Growth index. The information technology sector, for instance, has a weighting of 42.1%, compared to just 33.5% in the regular S&P 500.

The Growth index rebalances once each quarter, at which time it removes stocks that no longer meet its criteria and adds stocks that do. So a stock could be dropped from the Growth index when it loses upward momentum, but assuming it maintained a market cap sufficient to keep it among the 500 or so largest publicly traded U.S. companies, it could remain in the S&P 500. This is a big reason why the Growth index routinely outperforms the S&P 500 over the long term.

The Vanguard S&P 500 Growth ETF Tracks the S&P 500 Growth index

It's simple to invest in the S&P 500 Growth index, as there are several exchange-traded funds (ETFs) that track it. Among them is the Vanguard S&P 500 Growth ETF (VOOG +0.77%), which holds the same stocks as the index and maintains similar weightings.

These are the top 10 holdings in the Vanguard ETF, and their weightings compared to the regular S&P 500:

|

Rank/Stock |

Vanguard ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Nvidia |

14.9% |

8.1% |

|

2. Microsoft |

7.1% |

7.4% |

|

3. Alphabet |

6.9% |

3.7% |

|

4. Meta Platforms |

5.8% |

3.1% |

|

5. Apple |

4.9% |

5.7% |

|

6. Broadcom |

4.7% |

2.6% |

|

7. Amazon |

4.4% |

4.1% |

|

8. Tesla |

2.9% |

1.6% |

|

9. Visa |

2% |

1.1% |

|

10. Eli Lilly |

2% |

1.1% |

Data source: Vanguard. Portfolio weightings are accurate as of July 31, 2025, and are subject to change.

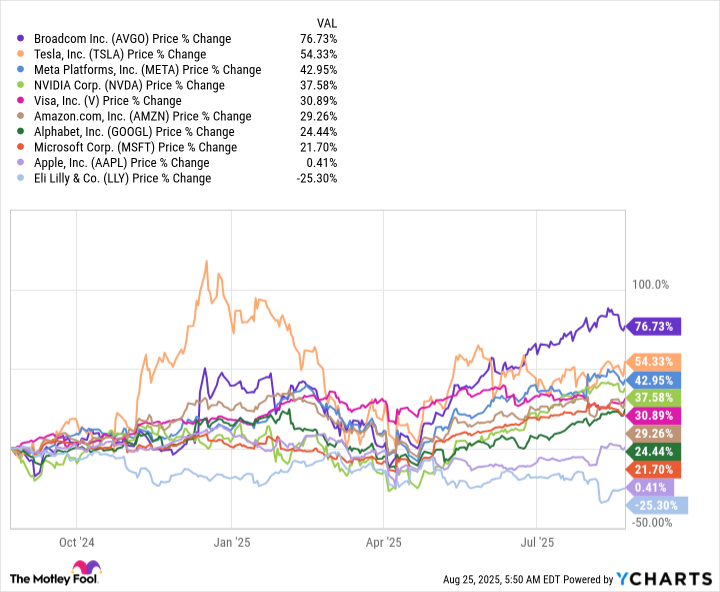

Those 10 stocks have delivered an average return of 29.3% over the past year, and helped propel the Vanguard ETF to a gain of 23.3%. The S&P 500 was up by just 15.1% over the same period, partly because it assigns relatively lower weightings to those high-performing stocks.

Data by YCharts.

The Vanguard ETF can continue beating the S&P 500 over the long term

The past year was no fluke: The Vanguard S&P 500 Growth ETF has generated a compound annual return of 16.5% since it was established in 2010, comfortably beating the S&P 500, which delivered an average annualized gain of 13.7% over that period.

That 2.8 percentage-point difference each year might not sound like much, but it made a big impact in dollar terms thanks to the power of compound growth.

| S&P 500 | Vanguard S&P 500 Growth ETF | |

|---|---|---|

| Starting balance in 2010 | $10,000 | $10,000 |

| 15-year compound annual return | 13.7% | 16.5% |

| Balance in 2025 | $68,613 | $98,830 |

Calculations by author.

Companies like Nvidia, Microsoft, Alphabet, Meta, and Amazon operate at the forefront of the artificial intelligence (AI) revolution, which could fuel significant gains for their respective stocks over the long term. This will feed through to the Vanguard ETF, supporting its continued outperformance.

NYSEMKT: VOOG

Key Data Points

But if AI technology fails to live up to expectations, it could trigger a sharp correction in some of those stocks and cause a shift in market leadership. This might result in a period of sluggish performance for the Vanguard S&P 500 Growth ETF. However, since the Growth index adjusts its holdings each quarter, I think any stretch of weakness for it relative to the S&P 500 is likely to be short-lived.