The Consumer Price Index (CPI) measure of inflation increased by 8% in 2022, which was a 40-year high and significantly above the Federal Reserve's target annual increase of 2%. High inflation can be devastating for the economy because it erodes consumers' spending power, and it squeezes profit margins for businesses.

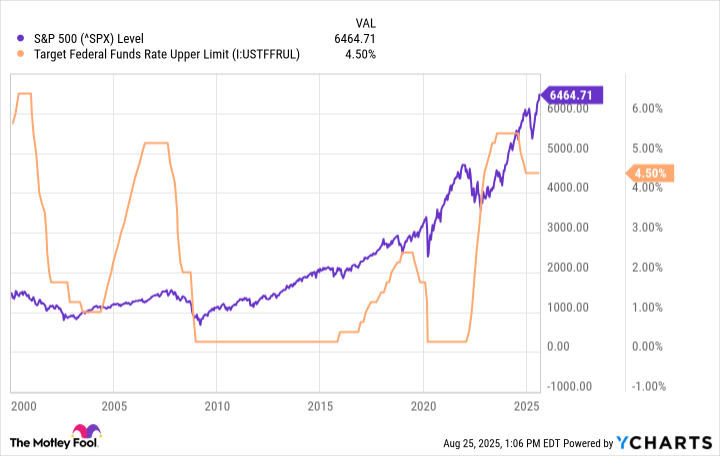

The Fed responded by aggressively hiking the federal funds rate (overnight interest rate), taking it from its pandemic low range of 0% to 0.25% to a two-decade high of 5.25% to 5.5% over an 18-month period, which ended in August 2023. The goal was to slow the economy down, which, in turn, would cool inflation.

Thankfully, it worked. The CPI increased at a much slower rate during 2024, which gave the Fed enough confidence to cut interest rates three times between September and December. After keeping policy on hold during 2025 so far, a further rate cut might be on the table at the central bank's next two-day meeting, which will be held on Sept. 16 and 17.

Conventional wisdom suggests that lower interest rates are great for stocks, but history proves that they can foreshadow some short-term volatility. Here's what it means for the S&P 500 (^GSPC +1.16%) stock market index.

Image source: Getty Images.

Two potential rate cuts before the end of 2025

The CPI increased at a rate of 2.9% in 2024, and it's now increasing at an annualized rate of 2.7% in 2025. In other words, it's trending nicely toward the Fed's 2% target.

In addition to keeping inflation under control, the Fed is also tasked with maintaining a healthy labor market. While the central bank doesn't have a specific target for the unemployment rate, the U.S. economy created far fewer jobs than economists expected over the last few months, sparking concerns among policymakers.

According to the most recent non-farm payrolls report from the Bureau of Labor Statistics (BLS), the economy added just 73,000 jobs during July, which was below the 110,000 jobs expected. To make matters worse, the BLS revised the May and June numbers lower by a combined 258,000 jobs, implying that the economy might be performing significantly worse than economists originally expected.

Fed Chair Jerome Powell cited these risks during his speech at the Jackson Hole Economic Policy Symposium last Friday, saying: "With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance."

Wall Street believes that this comment (among others) signals a September interest rate cut, and according to the CME Group's FedWatch tool, the odds are now a whopping 86%. Moreover, a further cut in December is now the consensus expectation.

SNPINDEX: ^GSPC

Key Data Points

Rate cuts aren't always good for stocks in the short term

Companies typically have a higher borrowing capacity when interest rates are low, which they can use to fuel their growth. The reduced cost of debt is also a direct tailwind for their earnings. Low rates push investors out of risk-free assets like cash, and into growth assets like stocks. All these things are great for the S&P 500.

However, history shows that each major rate-cutting cycle over the last 25 years foreshadowed a correction in the stock market.

Extraordinary circumstances surrounded each of the above easing cycles from the Fed, like the bursting of the dot-com bubble in 2000, the global financial crisis in 2008, and the pandemic in 2020. Therefore, the rate cuts themselves can't be blamed for the market weakness. However, it's clear that investors will disregard the potential benefits of interest rate cuts and sell stocks when economic conditions are uncertain, placing pressure on indexes like the S&P 500 overall.

Is the Fed already behind the curve?

The Fed relies on data to make policy decisions, which is the responsible thing to do. But most data points are stale by the time they are released, and looking in the rearview mirror can distract the central bank from what is happening in the present.

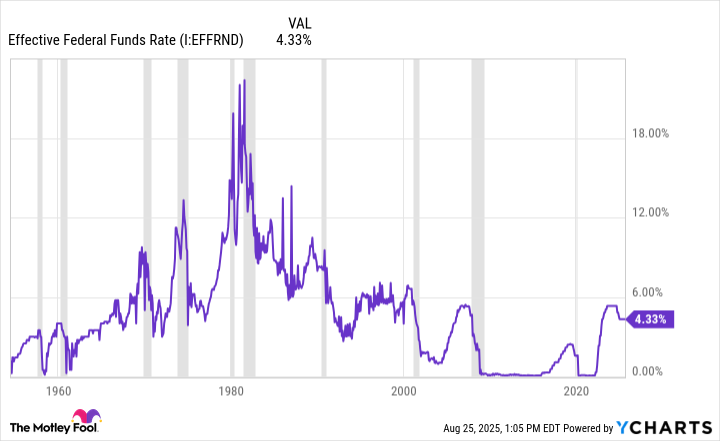

The below chart shows that recessions (represented by the gray shaded areas) regularly follow periods of high interest rates, which implies the Fed often waits too long to start cutting.

Effective Federal Funds Rate data by YCharts.

The weakness in the jobs data over the last few months could suggest an economic slowdown is already underway, and yet the Fed is only now preparing for its next interest rate cut. According to guidance from the Reserve Bank of Australia, it can take between one and two years for an economy to feel the full effects of an interest rate adjustment, so a September cut from the Fed might be too little, too late.

Further economic weakness from here will eventually feed into corporate earnings, which could lead to lower stock prices in the near term. In that case, the S&P 500 might be headed for another temporary correction, even in the face of interest rate cuts.

But before you race off to sell your stock portfolio, just remember that the S&P 500 always trends higher over the long term. Therefore, if history is any guide, a move lower is probably a buying opportunity rather than a reason to panic.