The Federal Reserve looks poised to cut interest rates for the first time in about nine months at its next meeting later this month, at least if you ask traders in the futures market, who are placing a high likelihood on such an event happening. Furthermore, as of this writing, these traders were betting on six rate cuts between now and the end of 2026, although keep in mind that these probabilities change constantly.

The crypto sector is new compared to traditional publicly traded stocks, so it's not always so clear what drives the sector or specific tokens, but similar to the broader stock market, interest rate moves have been a big driver of crypto prices in recent years. Will a Fed rate cut help or hurt XRP (XRP 1.42%), the third-most valuable cryptocurrency in the world?

Image source: Getty Images.

What history tells us

Cryptocurrencies have been highly volatile during the past 15 years or so since the sector got started. The idea behind cryptocurrencies was to make an alternative financial system. The idea really came to life during the Great Recession, when distrust of the established financial system was at an all-time high. However, this vision hasn't exactly materialized. Sure, you can definitely make purchases using cryptocurrencies, but it's still not that common.

Rather, investors began trading them as highly speculative assets and have done quite well, especially those who had the foresight to purchase many of the larger cryptocurrencies five or 10 years ago. Cryptocurrencies are quite different from stocks, however, mainly because they don't generate earnings, revenue, or cash flows, which is largely how investors value stocks.

That said, interest rates and other monetary actions have been highly influential for cryptocurrencies, which have more or less traded like high-growth tech stocks. High-growth assets tend to benefit when rates fall, for a number of reasons. For one, safer assets like U.S. Treasury bonds don't yield as much as before, forcing investors to seek riskier assets for returns.

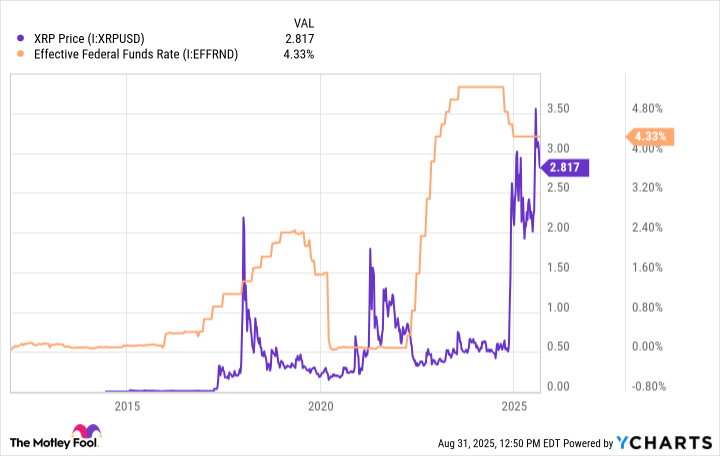

U.S. Treasury yields are also frequently used in discounted cash flow models, and lower discount rates -- which are influenced by interest rates -- lead to higher valuations. Finally, given that cryptocurrencies have historically traded with an inverse correlation to the U.S. dollar, it makes sense that they would perform better when rates fall because that typically leads to a weaker dollar. Here's how XRP has traded relative to interest rates since it formally launched in 2012.

As you can see from the chart above, XRP's price tends to decline when the Fed's benchmark federal funds rate rises and increase when it falls. More recently, the token has risen, despite rates being fairly high, but the crypto sector has been bolstered by President Donald Trump's deregulation push and the market increasingly pricing in rate cuts.

It's about more than September

Given historic patterns, I fully expect a rate cut in September to help XRP. In fact, it likely already has because investors make decisions based on the future and not necessarily based on what's happening at the moment. However, one cut in September is not the whole story and investors need to be cognizant of that.

For many months, the market has been pricing in five or six cuts between now and the end of 2026. The primary reason for this has to do with the Fed's concern about a weakening labor market. But the Fed has also been dealing with stubbornly high inflation, and more specifically, Trump's tariffs' impact on consumer prices. Many believe they will result in a one-time increase in inflation, but the outcome is far from certain. If inflation data continues to remain high or rises, and the labor market holds better than expected, it will be hard for the Fed to make the case for five or six rate cuts during the next year.

This would likely hurt crypto, XRP, and most growth assets, which tend to struggle in a higher-rate environment. So while a September cut would help XRP, investors need to carefully watch what happens during the longer term.