There's a lot of uncertainty in the markets right now due to tariffs and what impact they will have on business operations, both directly and indirectly. Even if a business isn't importing a lot of goods, rising costs could still affect its consumers and lead to a decline in demand.

Retailers who don't sell a lot of groceries are particularly vulnerable right now because a slowdown in discretionary spending means a grimmer outlook for their near-term growth opportunities. Big-box retailer Target, for example, has sunk to multiyear lows as it looks to find ways to generate more traffic and revenue growth.

But there are exceptions. One retailer that depends on discretionary spending is doing well and even raised its guidance recently, even as it braces for the effects of tariffs. And that's TJX Companies (TJX -1.21%).

Image source: Getty Images.

TJX boosts guidance after better-than-expected results

On Aug. 20, off-price retailer TJX reported its latest earnings numbers, which showed solid top- and bottom-line growth. For the period ended Aug. 2, its sales rose by 7%, totaling $14.4 billion for the period. Its comparable same-store sales also rose by 4% for the second quarter, which was higher than the range of 2% to 3% that it was previously forecasting. And on the bottom line, its diluted per-share profit of $1.10 was up 15% year over year.

Management says that the third quarter is also looking promising and bumped up its guidance for the full fiscal year (which ends in January) across multiple metrics.

| Metric | New Full-Year Guidance | Previous Guidance |

|---|---|---|

| Comparable sales growth | 3% | 2% to 3% |

| Diluted earnings per share | $4.52 to $4.57 | $4.34 to $4.43 |

| Pretax profit margin | 11.4% to 11.5% | 11.3% to 11.4% |

Source: Company filings. Table by author.

While this isn't a huge upgrade to the guidance, it's particularly noteworthy given that it's based on the assumption "that the current level of tariffs on imports into the U.S. as of August 20, 2025 will stay in place for the remainder of the year. The company's guidance assumes that it can offset the significant pressure it expects from tariffs throughout fiscal 2026."

TJX's business benefits from other retailers holding on to excess inventory they can't sell and need to get rid of. TJX can then buy it at low prices and pass on savings to its shoppers. It makes for an intriguing bargain-hunting experience which can be a way for people to buy discretionary items without having to make a big dent in their budgets.

The biggest problem for investors may be the stock's inflated valuation

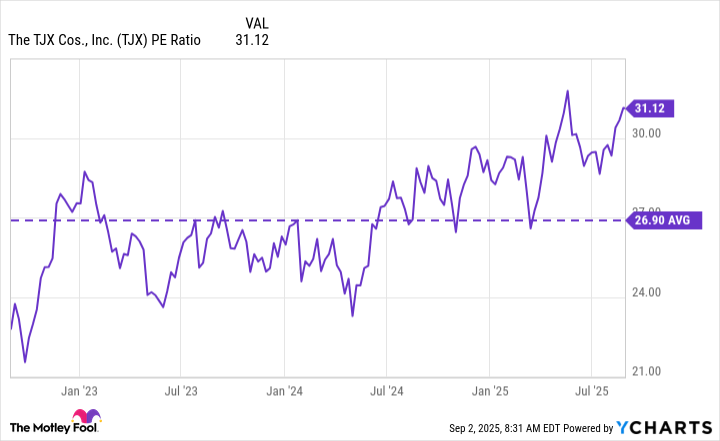

TJX has been performing well this year, and its share price is up 13% since January, which is better than the S&P 500 (up around 10%). The challenge, however, will be whether it can continue to rally higher, as the retail stock isn't all that cheap. It currently trades at a price-to-earnings multiple of 31, higher than normal for TJX.

TJX PE Ratio data by YCharts

The elevated valuation effectively prices in more growth ahead. But TJX is expecting just single-digit growth. Has the premium become a bit excessive?

Is TJX stock worth buying today?

TJX's business looks to be in great shape, and whether you should buy the stock right now may ultimately depend on your outlook for its future. If it continues to outperform, it may be a safe-haven investment that investors are willing to a pay a premium for. If it doesn't, a correction may be inevitable.

Given the uncertainty in the economy these days, I believe TJX should still benefit from better-than-anticipated growth in the near future. Its valuation is a bit high, but not to the point where it is excessive. It can still be an excellent investment to add to your portfolio today, especially if you're looking for a stock you can hang on to for years.