There is no sugarcoating it: Vertex Pharmaceuticals (VRTX +1.71%) has faced significant issues this year that have sunk its stock price. The company's shares are down 2% year-to-date, while the S&P 500 is up 9%. But none of that means the biotech company is no longer attractive.

In fact, Vertex's challenges this year might have created a solid entry point for a company that can be an excellent growth stock in the next five years and perhaps beyond. Here's why investors shouldn't give up on this biotech stock just yet.

Image source: Getty Images.

It has done it before

In 2012, Vertex Pharmaceuticals made a breakthrough when it earned approval for Kalydeco, the first medicine that treated the underlying causes of cystic fibrosis (CF). In the 13 years since, the biotech has launched many other, and even better, treatments for the disease. The latest is Alyftrek, which earned the green light in December. Other pharmaceutical companies have tried to challenge Vertex, but none have been successful.

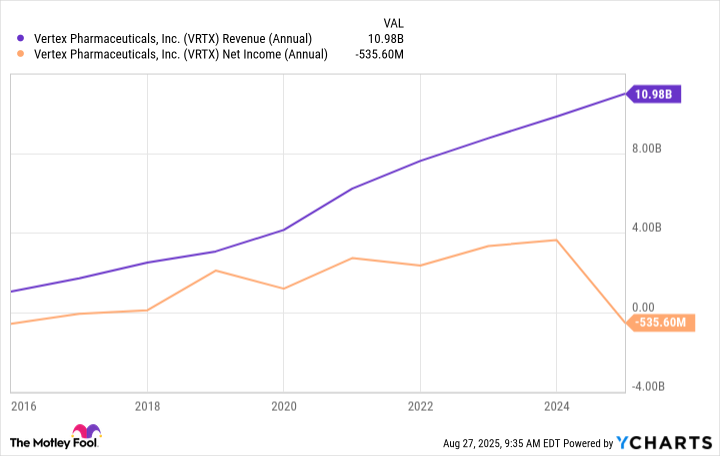

As the only company in this niche, Vertex has strong pricing power. It's also worth pointing out that many CF patients must take daily medication for their entire lives. The company's drugs treat the underlying causes of the disease but don't cure it. Vertex has been riding the wave of its CF breakthroughs over the past decade. Revenue and earnings have generally grown rapidly, although the bottom line was in the red last year due to expenses related to an acquisition.

VRTX Revenue (Annual) data by YCharts

Even with that, the general trend is clear. And the best news is that Vertex Pharmaceuticals still has room to grow in its core area of cystic fibrosis. Patients are now living longer, partly thanks to the company's medicines. Thousands more eligible people with CF have yet to start treatment. And Vertex is working on newer medicines for the few who don't qualify for any of its current therapies.

Given the company's track record, there is a good chance it will crack the code once again. Vertex's CF franchise alone should help power solid growth through the end of the decade at the very least.

New products will kick in

Vertex Pharmaceuticals has earned approval for two non-CF products in the past few years. The first is Casgevy, a medicine it developed with CRISPR Therapeutics. Casgevy is a one-time, gene-editing cure for beta-thalassemia (TDT) and sickle cell disease (SCD), two rare blood-related conditions. The second is Journavx, a non-opioid pain inhibitor (the first of its kind) approved for the acute treatment of pain.

These products are not yet making a significant impact on Vertex's financial results. Journavx was only approved in January, so that's not surprising. But the medicine fills a need. Opioid-based therapies come with severe side effects and the very real potential of addiction and abuse. Vertex sees a market of at least 80 million patients who could benefit from the medicine, and the company has already secured third-party coverage for large populations in the U.S.

Once sales of this medicine start ramping up, it should improve Vertex Pharmaceuticals' already solid results. Casgevy, approved in 2023, is a complex therapy to manufacture and administer, which is why it has yet to make a meaningful contribution to Vertex's top line. But with 60,000 patients, a price of $2.2 million in the U.S., and very little competition, it could eventually become a blockbuster drug, further improving Vertex's financial results.

NASDAQ: VRTX

Key Data Points

The pipeline is in good shape

Many of Vertex's issues over the past year have been due to pipeline setbacks. Some of the company's clinical trials, such as VX-993 for acute pain and Journavx for lumbosacral radiculopathy (LSR), were unsuccessful. The biotech also had to give up the development of a medicine for type 1 diabetes (T1D). Even with all those challenges, Vertex's pipeline remains pretty strong.

VX-993 was abandoned as a potential monotherapy for acute pain, but it is being tested in diabetic peripheral neuropathy (DPN). Vertex will no longer pursue an indication for Journavx in LSR, but is also testing the medicine in a phase 3 study for DPN. Furthermore, the biotech plans to submit regulatory applications for zimislecel, a therapy for T1D, next year.

Vertex Pharmaceuticals has several more late-stage pipeline candidates and others in earlier stages of development. The company should add at least one product to its lineup relatively soon. Solid clinical progress could propel Vertex's shares in the next few years, while the company continues to record consistently growing revenue and earnings.

The company can still be a growth powerhouse despite the challenges it has faced lately. That's why the stock looks like a buy, especially at current levels.