If you're familiar with the emergence of trillion-dollar technology companies over the past decade, you might think that the Nasdaq-100 index has been a great place to invest. And you'd be right.

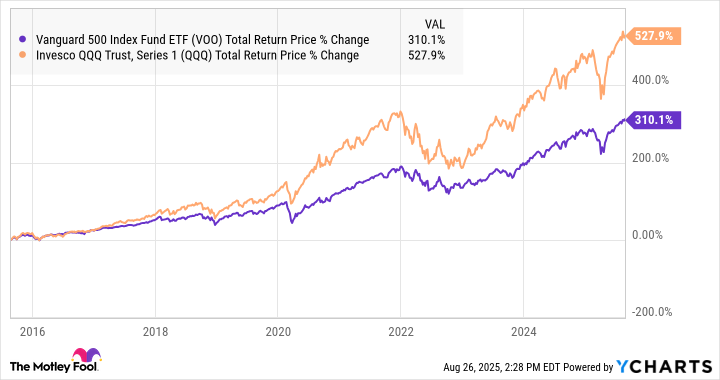

Over the past 10 years, a $1,000 investment in the Invesco QQQ Trust (QQQ +0.32%) -- an exchange-traded fund (ETF) that tracks the Nasdaq-100-would have grown to $6,280. That a remarkable 20.2% annualized total return. Not only that, but the Nasdaq-100 has also outperformed the S&P 500 benchmark index by 218 percentage points over that period.

VOO Total Return Price data by YCharts

Why has the Invesco QQQ Trust performed so well?

In a nutshell, the Invesco QQQ Trust tracks a benchmark index, the Nasdaq-100, which has performed incredibly well over the past decade. And as a weighted index, it has a disproportionate level of exposure to the largest technology companies in the world. In fact, the "Magnificent Seven" represent just 7% of the companies in the index, but accounts for 42% of the ETF's assets. Nvidia (NVDA +1.60%) and Microsoft (MSFT +3.45%), the top two holdings, each account for about 9%.

Image source: Getty Images.

This also explains the outperformance versus the S&P 500, which has delivered historically excellent returns itself. While all of the large-cap tech stocks in the Nasdaq-100 are also components of the S&P 500, they make up a larger weight due to the more concentrated portfolio. For example, Nvidia makes up 9.2% of the Invesco QQQ ETF but less than 8.1% of the Vanguard S&P 500 ETF (VOO +0.04%).

Now, it remains to be seen whether the Invesco QQQ ETF will deliver such strong performance over the next 10 years. But with the AI boom and several other exciting trends to watch, it could certainly be an interesting index fund to watch.