McDonald's (MCD +0.11%) is one of history's most successful restaurant chains. What started as a hamburger restaurant in Southern California has grown into a global chain with over 44,000 locations in more than 100 countries.

While such growth bodes well for long-term investors, it could bring uncertainty to future growth plans. That complicates the prospects for turning $10,000 in McDonald's stock into $50,000 over the next five years. Here's why.

Image source: Getty Images.

Achieving fivefold growth

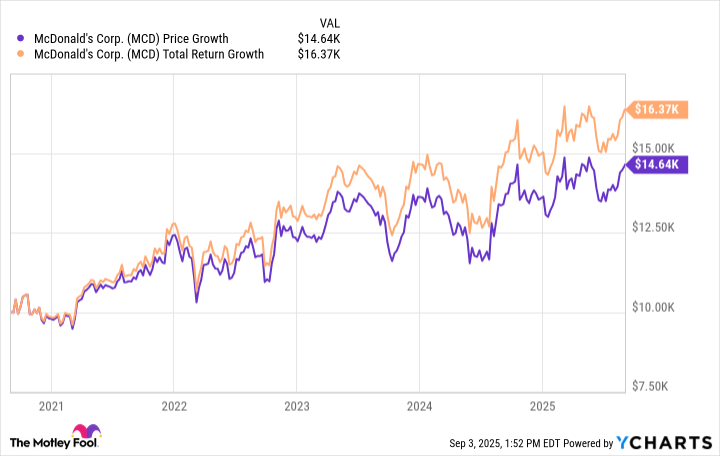

Unfortunately for McDonald's stock bulls, its recent history does not point to fivefold gains over five years. If one had invested $10,000 five years ago, that position would be worth less than $14,600 today. If including dividend income, which has risen every year since 1976, that grows to less than $16,400.

This is not to say McDonald's is a poor choice. Its business model revolves around 95% of its locations operating as franchises. After paying a franchising fee, franchisees must rent the properties from McDonald's and pay a royalty fee amounting to 4% or 5% of sales. Since the fixed expenses define most of this arrangement, it makes the company's business model highly recession resistant.

NYSE: MCD

Key Data Points

Nonetheless, its financial growth may not inspire fivefold gains over the next five-year period. In the first six months of 2025, revenue of $12.8 billion grew by only 1% yearly. While it kept cost and expense increases in check, the $4.1 billion in net income in the first half of the year was only a 4% yearly gain.

Moreover, its 27 P/E ratio is slightly under the S&P 500 (^GSPC +0.55%) average of 30. That gives its stock an average valuation, decreasing the likelihood that an expanding earnings multiple would drive it dramatically higher.

As a company, McDonald's should continue to benefit from revenue from its franchisees and rising dividends. Although that should bring positive returns to the company, its financial growth will likely not turn a $10,000 investment into $50,000 over the next five years.