Since 2012, the S&P 500 (^GSPC +1.16%) has delivered total returns of nearly 500%. The Nasdaq-100 has provided even more substantial total returns during that time, rising 900%.

However, the namesake company behind the Nasdaq-100 index -- and a component of the S&P 500 index itself -- Nasdaq (NDAQ +1.39%), has rocketed past these results, surging 14-fold in value since 2012.

While most investors may know Nasdaq for its technology-focused initial public offerings (IPOs), exchanges, and indexes, there is much more to the company than meets the eye.

Here's Nasdaq's hidden growth engine, and why I believe the company is poised to continue delivering market-beating results.

NASDAQ: NDAQ

Key Data Points

Nasdaq: A safeguard for financial markets

With a staggering 21% of the world's market capitalization trading on its exchanges, it isn't a reach to say that Nasdaq is most recognizable for its exchanges and indexes.

However, after its $2.75 billion acquisition of Verafin in 2020 and $10.5 billion purchase of Adenza in 2023, Nasdaq launched full-speed ahead into becoming the "trusted fabric of the financial system," as Chief Executive Officer Adena Friedman put it.

Image source: Getty Images.

Verafin

By scooping up Verafin, the company plunged headfirst into the world of battling financial crime, such as fraud and money laundering. As of 2023, Nasdaq estimated that criminals laundered $3.1 trillion globally and stole $500 billion through fraud and scams.

Leveraging its cloud and artificial intelligence (AI) capabilities, Nasdaq's full suite of financial crime management technologies helps its banking customers avoid falling victim to these schemes. Since Nasdaq bought Verafin its sales have increased by 23% annually, and management expects the unit to experience mid-20% growth over the next few years.

With the company recently launching new AI analytics to detect terrorist financing and drug trafficking this year -- while also landing its first European banking customer -- I'm not going to doubt management's rosy outlook.

Adenza

Whereas Verafin safeguards Nasdaq's financial customers from fraud and money laundering, the Adenza acquisition added new mission-critical capabilities, including risk management, regulatory reporting, and capital markets software for them.

In simplest terms, Adenza modernizes these often outdated processes for financial institutions, helping them prepare for a world steadily shifting toward digital assets such as stablecoins and cryptocurrencies.

Most importantly for investors, by combining Adenza with Nasdaq's existing Verafin, surveillance, and market technology businesses, the company became a one-stop shop for its financial customers, creating an environment conducive to cross-selling.

In the two years since Nasdaq bought Adenza, cross-sells (such as a customer using regulatory reporting services, then adding risk management solutions) have grown to account for more than 15% of the financial technology unit's deal pipeline.

Ultimately, management expects the regulatory and market capital technology segments that Adenza integrated into to generate sales growth in the high-single digit percentages to low-double digits during the next few years.

Robust free cash flow, a growing dividend, and fair valuation

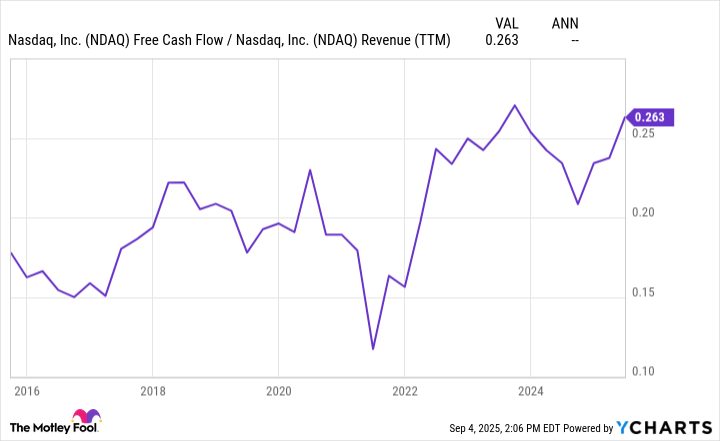

Powered by the double-digit percentage growth provided by these high-margin, up-and-coming business units, Nasdaq has seen its free cash flow (FCF) margins near all-time highs.

Fundamental Chart data by YCharts

This margin expansion has helped the company's FCF—what's left of cash flow after capital expenditures—grow by 15% annually during the past decade.

More importantly for dividend investors, this growth made it possible for Nasdaq to increase its dividend by an impressive 19% during the same period. Despite this lofty dividend growth, the company only uses 27% of its FCF to support its 1.1% dividend yield.

This low cash payout figure leaves plenty of room for further increases in the future, especially once Nasdaq finishes paying down debt and deleveraging from its hefty Adenza acquisition.

But with its FCF rocketing to new all-time highs, Nasdaq's share price has followed, rising about 80% during the past two years.

After this run, Nasdaq trades with an enterprise value-to-FCF (EV/FCF) ratio of 29 -- slightly above its 10-year average of 26.

However, I believe the new-look Nasdaq is worthy of this premium, thanks to the unfortunate megatrend of skyrocketing financial crime and the necessity of modernizing the financial ecosystem.

These growth areas, paired with the company's IPO listing leadership and the (currently) booming trading environment -- not to mention its recent 13% dividend hike -- keep me happily adding to my Nasdaq shares in September.