C3.ai (AI) was one of the world's first enterprise artificial intelligence (AI) companies when it was founded in 2009. Today, it offers over 130 turnkey applications, which help businesses in 19 different industries accelerate their adoption of AI.

The company was founded by Thomas Siebel, who served as its CEO until the start of this month, when he stepped down for health reasons. Siebel played an active role in the sales process by working with customers and helping the company close major deals, so his departure is already having an effect across the business.

In fact, C3.ai reported a very disappointing set of operating results for its fiscal 2026 first quarter (ended July 31) last Wednesday, revealing a sharp drop in revenue and a massive net loss. The disruptions have caused a 33% decline in C3.ai stock over the past month alone, but with a new CEO now in place, could the dip be an opportunity for investors?

Image source: Getty Images.

Helping businesses adopt AI

Not every business has the financial resources or the technical expertise to develop AI software in-house, so C3.ai's ready-made solutions are increasingly popular, especially because they can be customized to suit different needs.

Oil and gas companies use the C3.ai Reliability application to monitor their critical equipment. It can predict potential failures, which allows companies to conduct preventive maintenance. Banks and financial institutions use the C3.ai Smart Lending application to assess loan applications, reducing the time to accurately qualify and approve a borrower by an average of 30%.

Businesses can access C3.ai's applications through many of the cloud platforms they already use, including Amazon Web Services and Alphabet's Google Cloud. They can leverage the data center capacity on offer from those providers to scale C3.ai's applications as required. Since the business doesn't have to maintain its own hardware infrastructure, this is a very cost-effective way to deploy AI software.

Its new CEO could right the ship

C3.ai generated $70.3 million in revenue during the fiscal 2026 first quarter, which was way below management's forecast range of $100 million to $109 million. It also represented a 19% year-over-year decline, which set off alarm bells for investors because shrinking businesses tend to erode shareholder value over time.

In fact, C3.ai couldn't slash costs fast enough to offset the sudden decline in revenue, so its Q1 net loss surged by an eye-popping 85% to $116.7 million on a GAAP (generally accepted accounting principles) basis.

Outgoing CEO Siebel called the Q1 results "unacceptable" and attributed them to two things. First, he was less involved in the sales process than he normally is because of his health issues. Second, C3.ai completely restructured its sales department, which disrupted several deal closures during the quarter.

The restructure is now complete, so it shouldn't be a long-term headwind, but management still thinks the company's revenue could decline by up to 24% year over year during the current second quarter (which ends on Oct. 31). Therefore, it's clearly going to take some time for the sales department to get back on track.

C3.ai's new CEO, Stephen Ehikian, has an incredible amount of experience as a business leader, which could help him right the ship. He has served as an executive in private and public organizations, and he even founded two AI start-ups called RelateIQ and Airkit.ai, which were both successfully acquired by Salesforce. With that said, Siebel will make himself available to help with the transition as necessary, especially as it relates to sales processes, which should minimize further disruptions.

Should investors buy C3.ai stock on the dip?

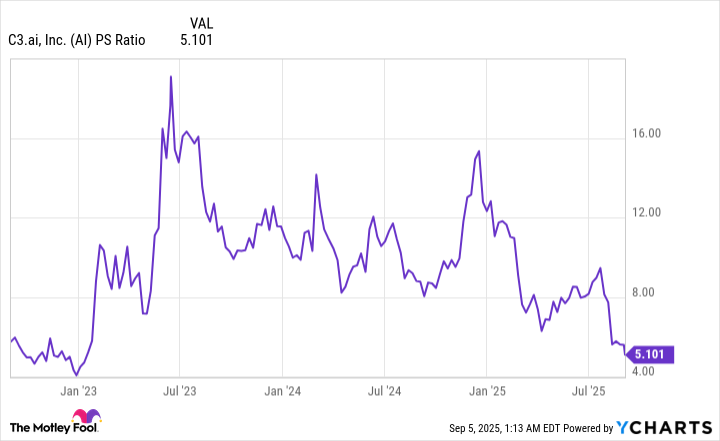

C3.ai stock is trading at a price-to-sales (P/S) ratio of around 5.1, which is near the lowest level in three years. That means the stock is quite cheap relative to its history, which somewhat compensates investors for the risk they are taking if they were to buy it.

AI PS Ratio data by YCharts.

However, C3.ai stock will probably trend even lower if the company's revenue continues to decline, so a cheap valuation won't mean anything in that case. Plus, management will have to slash expenses to prevent further blowout losses at the bottom line. If those cuts come from growth-oriented line items like marketing, it will become even harder to turn this situation around.

As a result, investors might want to avoid C3.ai stock until the company proves it can return to sustainable growth.