Shares of Lyft (LYFT 0.73%) were moving higher last month after the No. 2 ride-sharing company delivered a solid second-quarter earnings report and benefited from increased expectations that interest rates would soon go down.

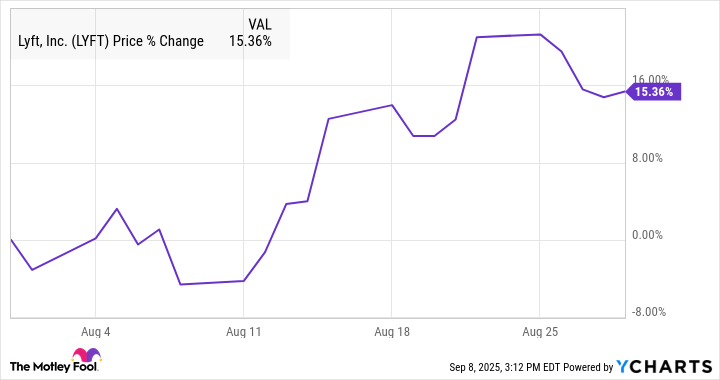

Lyft also received generally positive commentary from Wall Street analysts during the quarter, a response to the momentum building in the business. According to S&P Global Market Intelligence, the stock gained 15% in August.

As you can see from the chart, it was a volatile month for the company, but Lyft took several steps higher during August.

Lyft is on stable ground

Lyft rose on its second-quarter earnings report last month, but the response was muted, as the stock gained just 1.6% in response to the news.

Still, the results were strong and generally ahead of expectations. Gross bookings were up 12% to $4.5 billion, driving revenue up 11% to $1.59 billion, which was slightly below estimates at $1.61 billion.

The company reported solid growth in both rides and active riders, and initiatives like Lyft Silver, which focuses on seniors, are outperforming expectations, with an 80% revenue rate.

On the bottom line, margins continue to improve, with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) up 26% to $129.4 million, and generally accepted accounting principles (GAAP) earnings per share jumping from $0.01 to $0.10, ahead of the consensus at $0.04.

Roth Capital upgraded Lyft to buy in response to the report, calling out its accelerating growth and improving bottom-line metrics.

The company received some other positive notes during the month as analysts commented on its robotaxi partnerships, strong third-quarter guidance, and potential growth from its Free Now acquisition, giving it exposure to Europe for the first time.

The stock also jumped 8% on Aug. 22 after Fed Chair Jerome Powell signaled that the central bank was ready to start lowering rates, which would help stocks like Lyft.

Image source: Getty Images.

What's next for Lyft?

Looking ahead, the company sees solid growth in the third quarter, which includes two months of benefit from its Free Now acquisition. It expects gross bookings up 13%-17% and mid-teens growth in rides. It also called for adjusted EBITDA of $125 million-$145 million.

Not too long ago, there were serious concerns about Lyft's ability to be stable and profitable, and defend its market share against Uber. It's now proven that it can, and there are still a lot of upsides for the company ahead as the market expands, and it rolls out new products.