Shares of Upstart Holdings (UPST 2.14%) were pulling back last month as the artificial intelligence (AI)-based consumer loan origination platform posted strong results in its second quarter, but a falling take rate, doubts about macro pressures around inflation, and a high valuation seemed to prompt a post-earnings sell-off.

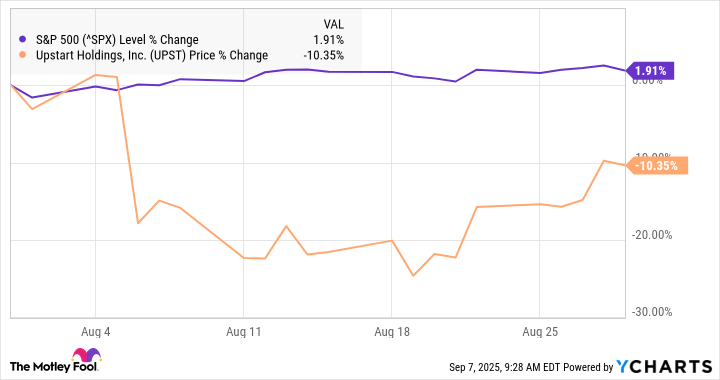

Still, signs increased last month that interest rates could come down, which would be favorable for Upstart, as that would encourage more borrowing. But by the end of August, the stock was down more than 10%, according to data from S&P Global Market Intelligence.

As you can see from the chart, the stock recouped some of those early losses, but still finished down double digits.

Upstart takes a step down

Upstart fell following its second-quarter earnings, losing 19% on Aug. 6 despite strong results.

Revenue jumped 102% to $257.3 million, which easily beat estimates at $225.4 million. Transaction volume surged 159% to 372,599 loans, representing a conversion rate of 23.9%, up from 15.2% in the quarter a year ago and its highest in several quarters.

Total originations surged 154% to $2.8 billion. However, some analysts expressed concerns about the company's falling take rate, or the percentage of originations that turn into revenue from fees, which was 8.6% in the quarter. Management noted that in its core personal loan business, its take rate improved, though the overall metric was pressured by growth in new businesses like the home and auto loan segments, which "still have immature unit economics."

On the bottom line, the company's progress toward profitability improved, as it reported a generally accepted accounting principles (GAAP) profit of $0.06 and an adjusted profit per share of $0.40, ahead of the consensus at $0.25.

Over the rest of the month, the stock recouped some of those losses as it jumped on Aug. 22, when Fed Chair Jerome Powell hinted at rate cuts during his Jackson Hole address. The stock also gained on an upgrade from J.P. Morgan, which raised its rating to overweight, noting favorable credit trends, the potential for rate cuts, and an attractive risk/reward compared to other loan originators.

Image source: Getty Images.

What's next for Upstart?

Upstart raised its full-year guidance in the earnings report, calling for $1.055 billion in revenue, up from a previous target of $1.01 billion, and it raised its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin from 19% to 20%.

Despite the post-earnings sell-off, the company is executing well, and it should benefit from lower interest rate cuts. The future still looks bright for Upstart.