Some investors thought Roku (ROKU 0.93%) was a pure hero of the coronavirus lockdown era. The media-streaming technology expert's stock soared in 2020, stalled in 2021, and took a long, consistent swan dive over the next couple of years.

Image source: Getty Images.

It was fair to call Roku's stock overvalued in 2021, but the company's growth story never ended. In fact, I think Roku has many more high-growth chapters to share over the next several years, and the stock looks wildly undervalued these days.

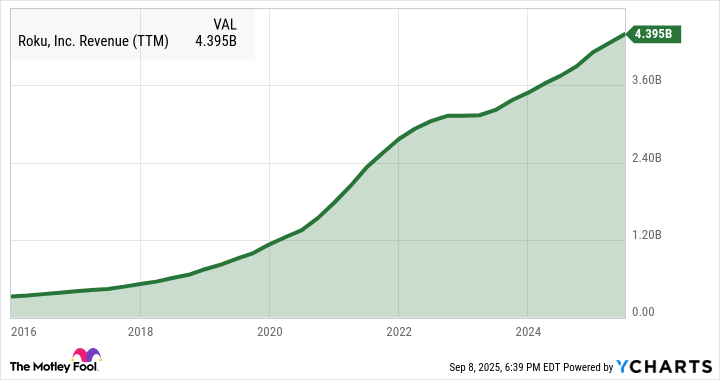

And I only need one simple chart to illustrate this concept. As you can see in the graph below, Roku's revenues are still experiencing explosive revenue growth:

ROKU Revenue (TTM) data by YCharts

Roku plays the long game

Sure, you see an abnormal bump around the COVID-19 era. Roku saw a few quarters of unsustainable user and revenue increases there, followed by a whiplash-inducing slowdown in the inflation-based market panic of 2023. Roku's top-line sales growth hit the brakes pretty hard at that point.

Some of that was a clear-eyed and voluntary long-term growth strategy. You see, Roku saw a user-grabbing opportunity in the inflation-fighting crash. Consumers were more price-sensitive than ever and most of Roku's streaming platform rivals were staving off inflation-based costs by raising prices. Yep, those companies contributed to the very inflation problem they were battling.

NASDAQ: ROKU

Key Data Points

Not Roku. The company held service and hardware prices steady throughout the golden lockdown years and the following penny-pinching crash. As a result, the active user count rose from 70 million at the end of 2022 to 80 million a year later and 90 million in Q4 2024.

Atop this expanding user base, Roku is building a massive long-term business. Revenues quickly picked up speed after the 2023 pause, as seen in that handy chart. In July's Q2 2025 report, free cash flow rose 23% year over year while adjusted EBITDA jumped 76%. And these are still the early innings of a long growth game.