Chipmaker Nvidia (NVDA 0.72%) has been generating monstrous growth in recent years. Its artificial intelligence (AI) chips have been a necessity for tech companies investing in AI and next-gen technologies. The company's brand has been synonymous with all things AI, given how integral its chips have been in the development of chatbots and other AI-related products and services.

But the nagging concern is that the growth will dry up for Nvidia. Competition will intensify, and companies may cut back on spending, especially if the payoff isn't clear from the investments that they're making in AI. And in recent quarters, Nvidia's growth rate has indeed been slowing down. However, I think there's a good chance it may reverse the trend, and that next year, its growth rate may actually accelerate.

Image source: Getty Images.

The Chinese market is a huge opportunity for Nvidia

Recently, trade conditions between China and the U.S. have been improving. And CEO Jensen Huang is hopeful that the company's cutting-edge Blackwell chip could soon be sold there, saying that it is a "real possibility." For now, it's the company's H20 chip, which is based on older technology, that is expected to be available to China, and even that involved negotiations between Huang and U.S. President Donald Trump. In exchange for selling the chip to Chinese customers, the tech company has agreed that 15% of those sales will go to the government.

Due to the ambiguity and uncertainty around the Chinese market, Nvidia does not include H20 sales as part of its forecast. The company estimates it could sell billions of dollars worth of chips to China, especially if they are its newer Blackwell chips. Huang says China is a top market for AI, calling it a $50 billion opportunity for Nvidia just this year, and he's projecting it to grow by around 50% per year.

If Nvidia can access the Chinese market next year and sell its latest chips, the growth it generates from there could more than make up for declining growth in North America and other markets, thus boosting its overall growth rate.

Nvidia is still growing at a fast clip

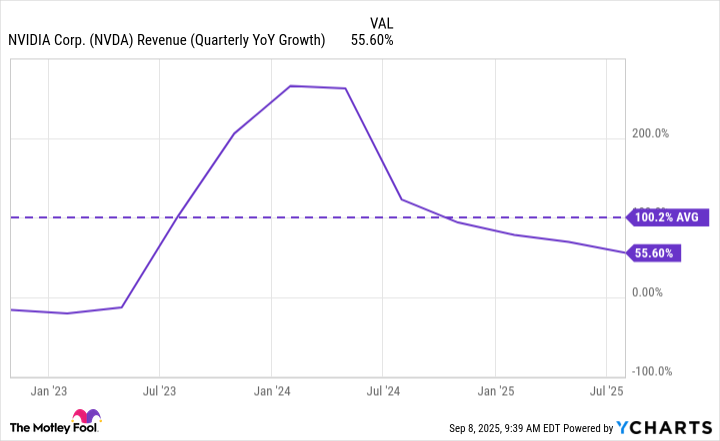

In its most recent quarter, which ended on July 27, Nvidia's revenue totaled $46.7 billion, which represented a year-over-year increase of 56%. This was with the company saying it had no sales of its H20 chip to any Chinese-based customers. While its growth rate has been declining of late, that does come with an asterisk.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

The above chart may indicate a troubling trend, but when you consider that Nvidia has averaged such a ridiculously high rate of growth over the past couple of years, it's inevitable to see a bit of a slowdown; such an impressive performance isn't likely to be sustainable for long.

But what's encouraging is that it's still above 50%, and that's without Nvidia being able to access one of the top AI markets in the world, in China. If Nvidia is able to sell its Blackwell chips to China, that could have a tremendous impact on both its top and bottom lines.

NASDAQ: NVDA

Key Data Points

Could Nvidia stock still be a bargain buy right now?

It may seem tough to make a case that the most valuable company in the world, Nvidia, is still cheap. It has a market cap of more than $4 trillion. But there could be a compelling case to be made for it, given the potential for massive growth opportunities in the Chinese market.

Nvidia trades at a price-to-earnings multiple of 48, but if its growth rate accelerates next year and the company is able to maintain high profit margins, that ratio could conceivably come down. And if it does, that could make it a much cheaper buy than it looks to be. Its price-to-earnings-growth (PEG) multiple of 1.25 also suggests that this isn't a terribly expensive stock to own, given the long-term growth prospects it possesses.

As long as AI spending remains strong, there could still be much more upside ahead for investors who buy shares of Nvidia today, especially if the company is able to access a hot growth market such as China.