Over the past year, a new corner of the artificial intelligence (AI) landscape started capturing investor attention. While the dominant narratives continue to focus on chip procurement, data center buildouts, and increasingly sophisticated software, an emerging frontier, quantum computing, is gaining momentum.

What's notable, however, is that the spotlight regarding this sector hasn't fallen on the usual "Magnificent Seven" tech titans. Instead, smaller players are drawing interest. Companies such as Rigetti Computing, D-Wave Quantum, and the aptly named Quantum Computing Inc. have each experienced significant volatility as investors speculate on their long-term potential. Among these emerging names, one stands out as particularly unique: IonQ (IONQ 3.55%).

In contrast to many of its peers, IonQ has carved out a subtle -- albeit lucrative -- competitive edge. Let's examine what differentiates IonQ and assess why its first-mover advantage makes it a company worth watching.

Image source: Getty Images.

IonQ's quantum integrations are a compelling selling point

For many companies exploring quantum applications, the conversation often revolves around technical milestones -- qubit counts, error correction rates, or experimental breakthroughs that, while impressive, offer little practical utility today. IonQ is taking a different path. Rather than focusing purely on physics, the company emphasizes distribution and accessibility.

Instead of building expensive stand-alone quantum supercomputers with limited near-term commercial marketability, IonQ has adopted a quantum-as-a-service (QaaS) model. Its systems are integrated into major cloud infrastructures such as Microsoft Azure, Amazon Web Services (AWS), and Alphabet's Google Cloud Platform (GCP).

While peers like Rigetti and D-Wave also offer access through certain cloud platforms, their scope is narrower and more closely tied to specific hardware. IonQ's first-mover advantage stems not from exclusivity, but from its deliberate execution to become a broader and more developer-friendly platform that allows users already embedded in major ecosystems to seamlessly experiment with quantum tools -- without the hefty, capital-intensive investments typical of hardware buildouts.

By sidestepping uncertain bets in photonics or annealing technologies that may never scale, IonQ is positioning quantum not as a theoretical pursuit, but as a legitimate service within existing enterprise AI toolboxes.

NYSE: IONQ

Key Data Points

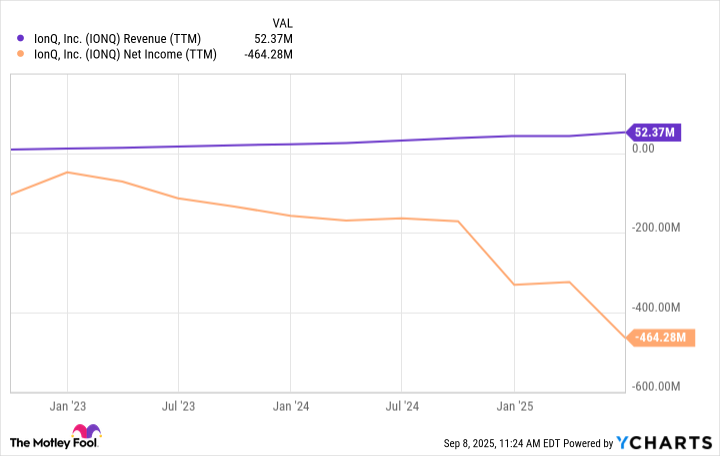

An aspirational business with little to show for it

One of the clearest bear cases for quantum computing is that real-world applications remain limited. Most current applications serve as proofs of concept rather than production workloads delivering measurable business efficiencies. For IonQ, this translates into a lack of large-scale commercial contracts -- leaving little visibility into near-term revenue or profit generation.

Data by YCharts.

While embedding its services into hyperscaler platforms has helped IonQ gain some reach today, longer-term strategies could prove disruptive. Should Amazon, Microsoft, or Alphabet choose to vertically integrate their own quantum solutions into one bundle, they could restrict IonQ's exposure or cut it out of the picture entirely -- creating additional headwinds for the company's trajectory.

Is IonQ stock a buy?

IonQ's integration-first strategy remains a genuine differentiator for now. By meeting developers where they already experiment with AI applications, the company lowers barriers to entry and reduces friction around quantum adoption. This approach gives IonQ a practical edge over peers that are still bogged down by theoretical breakthroughs with lengthy, costly timelines that prohibit business momentum.

That said, IonQ operates in a field that largely hinges on uncertainty -- technological, competitive, and financial. While its unique distribution channels are noteworthy, the company ultimately represents a high-risk bet in an industry that has yet to go mainstream. The upside potential is meaningful, but so is the volatility.

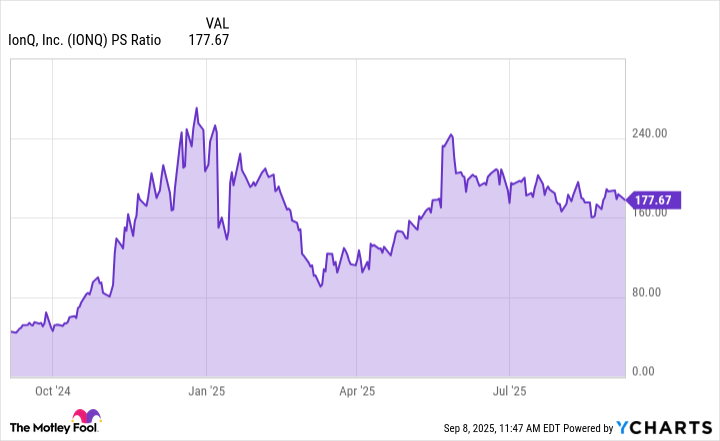

Valuation compounds this risk. IonQ trades at levels that already exceed multiples seen during prior stock market bubbles. Scaling to justify (or grow into) these valuations could take years or even decades as enterprise adoption of quantum applications remains muted.

Data by YCharts.

In my eyes, IonQ is too risky to warrant buying for prudent investors right now. Investors comfortable with volatility might consider a small, speculative allocation, but they should do so with the understanding that they are paying a premium today for a technology that is still far from broad commercialization. For most investors, patience and caution are the wiser course.