Schwab US Dividend Equity ETF (SCHD 0.70%) offers a 3.7% dividend yield, which might fall a little shy of the yield that dividend investors are looking for. And for that reason, it could be flying under investor radar screens even though it is a very compelling dividend-focused exchange-traded fund (ETF). Here's why you need to look at more than the yield when you consider Schwab US Dividend Equity ETF.

What's the yield worth?

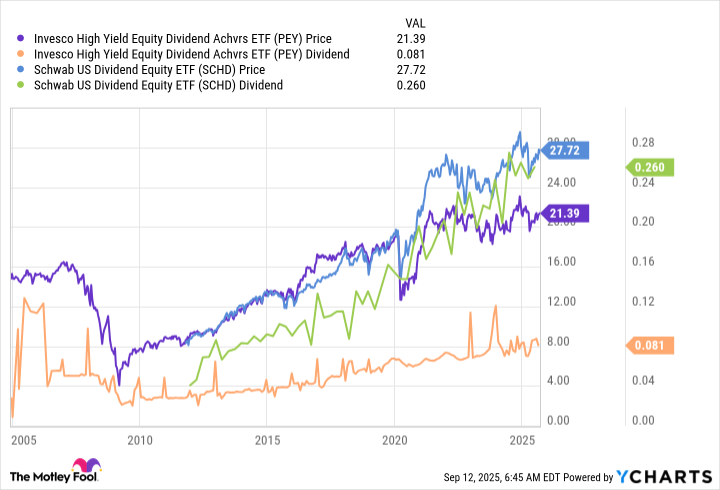

The S&P 500 index (^GSPC 0.41%) is currently providing investors with a yield of around 1.2%. That makes Schwab US Dividend Equity ETF's 3.7% yield look very compelling, since it is nearly three times larger. But there are other exchange-traded funds out there with far higher yields. For example, Invesco High Yield Equity Dividend Achievers ETF (PEY 0.51%) has a yield of roughly 4.5%.

Image source: Getty Images.

You might not think that's a huge difference, but for many investors 4% is a key hurdle point. That ties back to the 4% retirement withdrawal rule of thumb that suggests using 4% of your retirement savings each year will likely allow you to have a lifetime of income. If you collect a 4% dividend yield, you don't need to tap principal and, theoretically, you'll never outlive your savings.

Clearly, Invesco High Yield Equity Dividend Achievers ETF gets you over that 4% while Schwab US Dividend Equity ETF does not. And, thus, Schwab US Dividend Equity ETF's dividend yield could easily be overlooked by investors focused on yield alone. Ignoring the lower yield here might be a mistake.

What does Schwab US Dividend Equity ETF do?

Without going too deep into Invesco High Yield Equity Dividend Achievers ETF's approach, it basically just buys the 50 highest- yielding companies that have increased their dividend annually for at least 25 years. But that will often mean buying troubled businesses. Any ETF that focuses on yield alone will likely subject its investors to this kind of business risk.

By comparison, Schwab US Dividend Equity ETF takes a vastly more nuanced approach. In fact, it basically does what a dividend investor would do if they were buying individual dividend stocks. It looks to find a balance of yield, company quality, and business growth opportunity. The process is a bit complex, but highly differentiated.

First, it only looks at stocks that have increased their dividends for at least a decade (excluding real estate investment trusts from consideration). Then it creates a composite score looking at cash flow to total debt, return on equity, dividend yield, and a company's five-year dividend growth. Using a market cap- weighting approach, the 100 companies with the highest scores get into the ETF.

The big difference between these two ETFs is pretty clear from the graph above. Schwab US Dividend Equity ETF's approach has resulted in a generally rising dividend and share price. Invesco High Yield Equity Dividend Achievers ETF's share price has risen over time, but the dividend growth hasn't been nearly as attractive. You are giving up dividend growth for yield, which is often the trade-off that dividend investors end up making when they are overly focused on yield.

Make sure you fully appreciate the benefit of dividend growth

You might think that it is worth collecting a higher yield today and pass by the opportunity for dividend growth that is offered by Schwab US Dividend Equity ETF. That's fine, but don't forget about the ravages of inflation, which eat away at the buying power of dividends over time.

In fact, given enough time and dividend growth, you might end up with more income from Schwab US Dividend Equity ETF than a higher-yielding ETF that doesn't offer as much dividend growth opportunity. At the end of the day, it might make sense to include Schwab US Dividend ETF along with higher-yielding ETF options to protect yourself from inflation. Or, if you can handle a lower income stream at the start, it could be the sole long-term dividend ETF you own now that you know about its differentiated investment approach.