Larry Ellison, the co-founder, chair, and CTO of Oracle (ORCL 0.02%), became the wealthiest person in the world on Sept. 10 after Oracle surged 36%. The stock popped in response to a highly ambitious five-year roadmap to grow Oracle Cloud Infrastructure (OCI) from around $10 billion in annual revenue to a staggering $144 billion.

If Oracle achieves this goal, OCI will surpass the current size of the leading three cloud giants by revenue -- Amazon Web Services (AWS), Microsoft Azure, and Alphabet's Google Cloud.

On Thursday, a 6.2% decline in Oracle, paired with a 6% jump in Tesla, led to Ellison slipping $1 billion below Elon Musk on the billionaire leaderboard, according to Bloomberg. Regardless, Ellison is now in a virtual tie with Musk as the richest person in the world because of his massive stake in Oracle.

Here's why Ellison's ownership of Oracle is great news for long-term investors, and whether the growth stock is a buy now.

Image source: Getty Images.

The billionaire throughline

A common theme among the world's richest people is that the primary source of their wealth is existing ownership in one company. With the exception of the three Walton children, who inherited large stakes in Walmart, the other nine people on the list of the 10 richest billionaires all played pivotal roles in growing a business, and still hold meaningful positions in those businesses.

|

Name |

Total Net Worth (Billions) |

Main Source of Wealth |

|---|---|---|

|

Elon Musk |

$384 |

Around 13% ownership of Tesla |

|

Larry Ellison |

$383 |

Around 42% ownership of Oracle |

|

Walton Family |

$369 |

Around 45% ownership of Walmart |

|

Mark Zuckerberg |

$264 |

Around 13% ownership of Meta Platforms |

|

Jeff Bezos |

$252 |

Around 8% ownership of Amazon |

|

Larry Page |

$210 |

Around 3% ownership of Alphabet |

|

Sergey Brin |

$196 |

Around 3% ownership of Alphabet |

|

Steve Ballmer |

$172 |

Around 4% ownership of Microsoft |

|

Bernard Arnault |

$162 |

Around 48% ownership of LVMH Moët Hennessy Louis Vuitton SE |

|

Jensen Huang |

$154 |

Around 3.5% ownership of Nvidia |

Data source: Bloomberg.

Ellison is unique because he owns such a massive amount of Oracle, whereas other founders have decreased positions in their businesses over time. So even though Oracle isn't worth as much as other "Ten Titans" stocks like Tesla, Alphabet, Meta Platforms, Amazon, Microsoft, or Nvidia, Ellison's massive stake can put a charge in his net worth when Oracle soars.

NYSE: ORCL

Key Data Points

From a legacy stalwart to a cutting-edge AI play

Founder-led companies can be especially effective in the ever-changing technology sector. Ellison's large ownership stake and role as CTO make him heavily involved in Oracle's strategic direction.

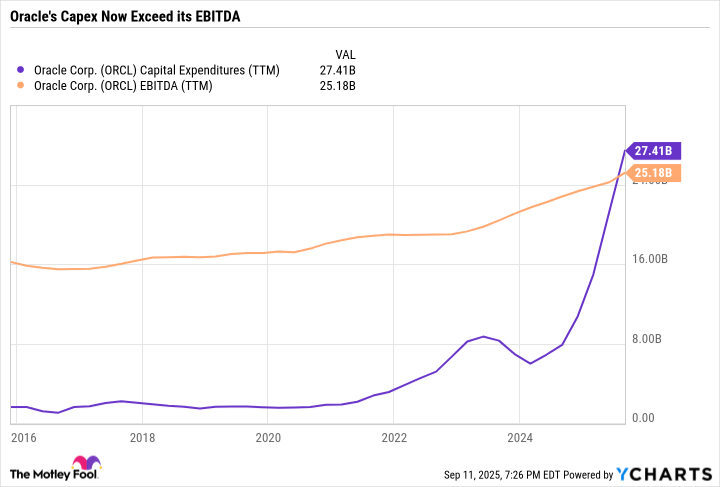

Oracle has completely transformed its business model from a large database infrastructure and enterprise software model to a cloud computing giant. To pull it off, Oracle has had to invest a ton of capital, and fast, as the cloud computing race is highly competitive. Its capital expenditures (capex) have exploded higher -- outpacing revenue and earnings growth. So Oracle has taken on a considerable amount of debt to foot the bill.

Oracle is spending so much so quickly that its capex is now higher than its earnings before interest, taxes, depreciation, and amortization (EBITDA). Most of its capex is going toward building data centers. It's worth noting that capex doesn't even factor into Oracle's operating expenses with its existing businesses. This illustrates the extent of Oracle's leverage.

ORCL Capital Expenditures (TTM) data by YCharts.

Oracle's spending is sky high and adds a considerable amount of risk to Oracle's investment thesis. With so much skin in the game, Ellison clearly saw this move as the right one for the long-term growth of the company. Ellison co-founded the company nearly 50 years ago in the late 1970s. So in this vein, Ellison's position is like Bill Gates still being a part of the top brass at Microsoft and having a massive stake in the company.

Oracle still has room to run

Ellison isn't calling all the shots at Oracle, but his large stake gives the company a level of credibility and a vote of confidence for individual investors interested in buying or holding the stock. If Ellison is putting his chips on the table and taking this big bet on cloud, then he must really believe it's the right long-term move, even if it takes a sledgehammer to Oracle's balance sheet and cash flow in the near term.

Wall Street was around. Oracle has nearly doubled in the last year and is up over 300% in the last three years. Investors often prefer capital-light, high-margin business models like those of Nvidia and Apple. Both companies design their products and outsource manufacturing, leading to high margins. But in Oracle's case, its capital-intensive strategy is a strength, as it is at the cutting edge of the future of hyper-efficient cloud computing.

Oracle isn't cheap by any means, but the stock could still be a good long-term investment for risk-tolerant investors seeking innovative companies where founders still have substantial financial incentives to make growth investments pay off.