It has been a rollercoaster year for Fluor Corporation (FLR +0.70%). In early 2025, shares fell from $55 to just $30. In the following weeks, shares surged back to $55 again, only to slide back to $40 per share today.

Some analysts believe that now is the time to invest in this engineering and construction giant. But how have shares performed over the long term? You might be surprised by the answer.

NYSE: FLR

Key Data Points

Has Fluor Corporation made long-term investors rich?

Fluor has a long and storied history. It was originally founded in 1912 as a small, local construction company in California. Within decades, the company was involved in many major infrastructure projects, including the building of pipelines, refineries, nuclear facilities, and mining operations.

Importantly, most of these end markets are cyclical. That means that they regularly go through boom and bust cycles. One decade might bring in a huge backlog of projects, while the next might bring relative hardship.

Image source: Getty Images.

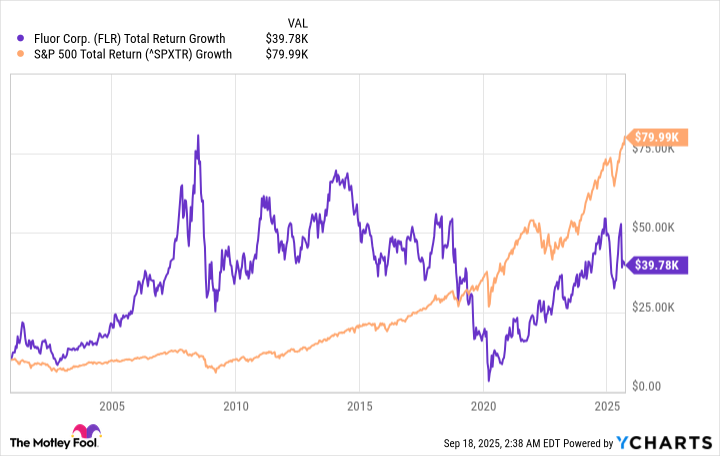

Fluor's long-term price chart reveals these boom and bust cycles. In 2007, for example, commodity prices were going through the roof. Natural resource firms were expanding aggressively, resulting in big business for Fluor. When the global financial crisis hit in 2008, commodity prices tumbled. Many natural resource projects were suddenly deemed not economically viable. That resulted in cancellations in Fluor's revenue pipeline, sending the stock crashing. Because of these ups and downs, $10,000 invested in Fluor in 2000 would be worth about $39,780 (with dividends reinvested) compared to $79,980 if that same $10,000 was invested in the S&P 500.

FLR Total Return Level data by YCharts

Since 2020, Fluor stock has performed incredibly, rising by more than 300%. But the long-term picture differs greatly, with Fluor shares heavily underperforming the market since 2000. Fluor investors today should understand that the company is highly cyclical. Expect booms and busts for the company's stock price, but not necessarily superior long-term performance.