The stock market is buzzing over chip start-up Groq's latest fundraising round. The privately held company announced that it raised $750 million, which more than doubled its valuation to $6.9 billion.

Groq's chips have some specific differences from those made by the biggest chipmaker, Nvidia (NVDA 0.65%). Its chips are made solely for inference, as opposed to Nvidia chips that are designed for training and inference. Groq's language processing units (LPUs) are stripped down compared to Nvidia's graphics processing units (GPUs), and can run AI models to translate text, answer questions, or run bots fast and with lower energy use. That's appealing, considering Nvidia's GPUs cost tens of thousands of dollars apiece.

But while Groq is essentially a potential competitor to Nvidia, the smaller company's new valuation is a tailwind for the mammoth company, which sports a valuation of more than $4 trillion.

Why is Groq's good news also good for Nvidia? Let's take a look.

Image source: Nvidia.

Groq in the AI space

Groq was founded in 2016 by a group of former Google engineers, including Jonathan Ross, who designed the tensor processing unit AI accelerator and became Groq's CEO. While the company started slowly -- and by Ross's admission, nearly folded -- it found new strength after OpenAI unveiled its ChatGPT platform in late 2022.

The company currently offers a cloud product, GroqCloud, that allows users to work with its LPUs in a cloud environment, and GroqRack Cluster, which is an on-site product for customers who are running their own data centers. Groq says more than 1 million developers are currently using the GroqCloud platform.

NASDAQ: NVDA

Key Data Points

The company has completed multiple fundraising rounds, including the latest led by Dallas-based investment firm Disruptive, which has invested nearly $350 million in the company. Disruptive also invested in the launches of Palantir Technologies, Spotify Technology, Hims & Hers Health, and Airbnb.

"As AI expands, the infrastructure behind it will be as essential as the models themselves," Disruptive CEO Alex Davis said. "Groq is building that foundation."

What it means for Nvidia

Nvidia currently is the top chip supplier for data centers that are powering the most sophisticated and challenging AI-powered platforms. Nvidia has an estimated 92% GPU market share for data centers.

GPUs are currently the gold standard for data center work because of their sheer power. They are capable of parallel processing, which means that they can handle millions of calculations at the same time, and they can be bundled to work together. The company's CUDA software allows GPUs to be used for general compute engines and is ideal for modern data center workloads.

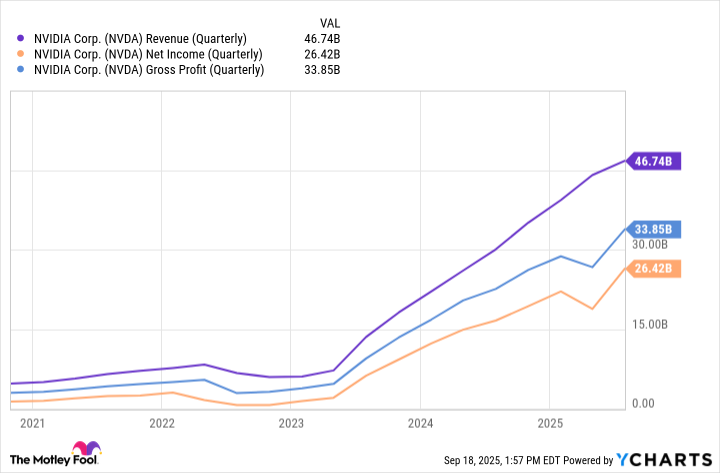

That's meant massive profits for Nvidia as interest in AI and AI platforms skyrocketed in the last three years. Nvidia's revenue for the first quarter of fiscal 2026 (ended July 27, 2025) was $46.7 billion, up 56% from a year ago. Its data center revenue made up the vast majority of that, bringing in $41.1 billion.

NVDA Revenue (Quarterly) data by YCharts

While Groq is certainly a competitor to Nvidia, the two companies aren't on the same playing field yet. Nvidia has a vast array of clients and promotes its GB300 chip on the Blackwell Ultra GPU architecture, which it says sets records for speed of AI inference.

The takeaway

Groq is a $6.9 billion company, merely by showing the potential of cheaper semiconductor chips for AI inference. But it's nowhere close to being on Nvidia's level yet -- or even the level of Advanced Micro Devices, Intel, or Apple. But it does prove how much money and interest remain in chasing AI infrastructure. And with Nvidia's unquestioned scale and ecosystem, it's still the company best positioned to profit in the quarters to come.