On July 31, shares of internet design company Figma (FIG +0.34%) began trading at $85 and finished their first day at over $115. The following day, Figma stock closed at $122 per share, but it's been all downhill since then.

The stock dropped 39.2% in August even though the S&P 500 was up 1.9% for the month. And things haven't improved in September. Whereas the S&P 500 is enjoying an unusually strong month with a 3.6% gain as of Sept. 22, Figma stock has plunged another 16.4%.

Image source: Getty Images.

Adding it all up, the stock reached an all-time high on its second day of trading and is already down 59% from that peak. With this big of a drop, is Figma now a bargain for long-term investors?

Two reasons Figma stock is down

This isn't one of my two reasons, but it's worth mentioning that Figma had its initial public offering (IPO) only weeks ago. Regardless of whether an IPO stock is high quality or low quality, volatility is common in these early months.

Figma was practically guaranteed to give investors a wild ride, simply because it's a recent IPO. It's why some investors avoid IPO stocks entirely.

General IPO volatility aside, Figma reported results for the second quarter of 2025 on Sept. 3, its first report as a publicly-traded company, and it underwhelmed the investor community. This is one of the reasons the stock is down.

NYSE: FIG

Key Data Points

In the second quarter, the company generated revenue of $250 million, which was good for 41% year-over-year growth. In isolation, 41% growth is absolutely stellar.

But there is a twofold concern here. First, this is a deceleration from the 46% growth it reported in the first quarter. Second, the deceleration is only just beginning, according to management.

For the third quarter, Figma expects 33% revenue growth at the midpoint of its guidance range. Again, this is a strong number in isolation but a sharp drop-off for its growth rate nevertheless. And for all of 2025, the company is guiding for a 37% jump from the previous year. This full-year guidance implies just a 30% growth rate for the fourth quarter.

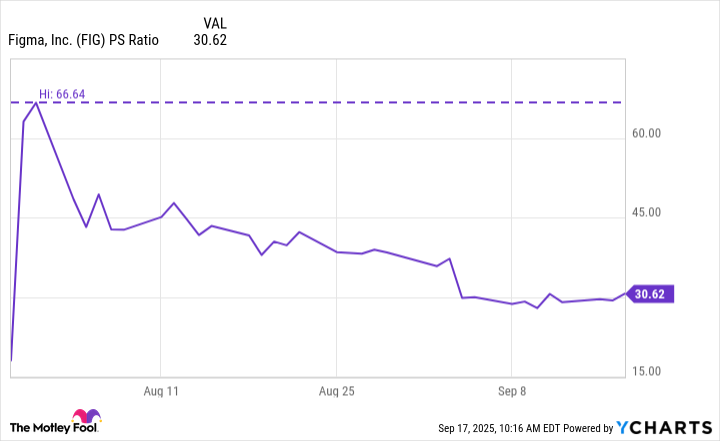

Figma went public and initially surged based on its potential as a growth stock, but its growth is quickly slowing -- that's the first problem. Here's the second problem: At its peak, the stock traded at over 66 times sales.

Data by YCharts; PS ratio= price-to-sales ratio.

I've seen stocks trade at a lofty valuation such as this and still provide investors with positive long-term returns. That being said, this is usually the case for businesses that are still accelerating their top line.

In short, it seems that investors were willing to pay a high price for Figma stock out of the gate, assuming its growth would continue to impress. But looking beyond the initial hype, revenue growth is trending downward, and investors are rethinking the valuation.

Projecting Figma's performance from here

The Forbes 2000 is a list of 2,000 of the largest publicly-traded companies in the world -- these are big fish. And to its credit, Figma has already landed most of them. It counts 78% of the Forbes 2000 as customers, showing how widely adopted its software is.

Moreover, around two-thirds of its customers use three or more of its software products. As far as software businesses go, that's a strong adoption rate.

However, for investors looking to buy the stock today, this is counterintuitively a headwind. There are relatively few big customers that it could win from here. And upselling its customers to more services is challenging because of how many have already adopted multiple Figma products. With this context, a slowdown in growth makes perfect sense.

In other words, Figma's business is already so successful that it makes incremental growth harder to find. Some investors may object to this statement, considering the company is still calling for double-digit growth in 2025.

But consider that the company raised its prices by over 20% earlier this year. Much of the growth it's projecting comes from charging higher prices, which can't be too regular an occurrence without risking excessive customer churn.

Personally, I believe Figma stock will underperform the market going forward. After all, it's still trading at over 30 times sales despite the recent sell-off, making it one of the more richly valued software stocks out there. If its revenue growth continues to slow, the valuation will likely keep coming down.

Figma needs something that will truly help the business sustain its growth. The good news is it has $1.6 billion in cash and marketable securities at its disposal that can fund a lot of research and development or fuel acquisitions. But for now, the valuation risk is elevated due to its slowing growth -- I wouldn't buy the stock right now, even after its 59% drop.