Prior to Oracle's (ORCL -0.51%) fiscal first-quarter earnings report on Sept. 9, the stock had already climbed roughly 33% on the year -- narrowly outpacing Nvidia's 27% gain over the same period.

But after delivering a blowout quarter highlighting a record $455 billion in remaining performance obligations from its cloud infrastructure division, Oracle stock went parabolic. As of Sept. 22, Oracle stock has gained a jaw-dropping 97% year to date -- more than doubling the return of Nvidia stock over the same period. This surge underscores how pivotal Oracle's cloud platform has become in the broader discussion around artificial intelligence (AI).

Let's explore why Oracle's cloud strategy carries so much weight and assess whether today's elevated share price still presents an attractive buying opportunity for investors.

Oracle is reinventing itself through its GPU-as-a-service platform

Rather than competing directly with Nvidia in chip design or with hyperscalers by building headline-grabbing generative AI applications, Oracle has pursued a more subtle -- yet highly lucrative -- path into the AI realm. The company identified a critical imbalance early on in AI development: soaring demand for high-performance compute far outpaces the available supply of GPUs.

To capitalize, Oracle invested aggressively to secure GPUs, equip them in large-scale data center clusters, and rent out access to this scarce hardware through the cloud. In essence, Oracle created a business model to address the bottleneck of AI development -- procuring and provisioning compute. By delivering this capacity through a cloud-based infrastructure, the company has transformed GPU access into a recurring, on-demand service.

This GPU-as-a-service model has attracted a roster of marquee customers to Oracle Cloud Infrastructure (OCI) -- including OpenAI, Elon Musk's xAI, and ByteDance (the parent company of TikTok).

The key advantage of infrastructure services lies in flexibility. OCI allows enterprises to scale training and inference workloads without the rigidity and ecosystem lock-in often associated with denser platforms like Microsoft Azure or Amazon Web Services (AWS).

For many developers, this model provides a compelling, cost-efficient and time-effective alternative to traditional hyperscaler solutions -- helping reduce capital expenditures while accelerating time to production.

Image source: Getty Images.

Is Oracle stock a buy now?

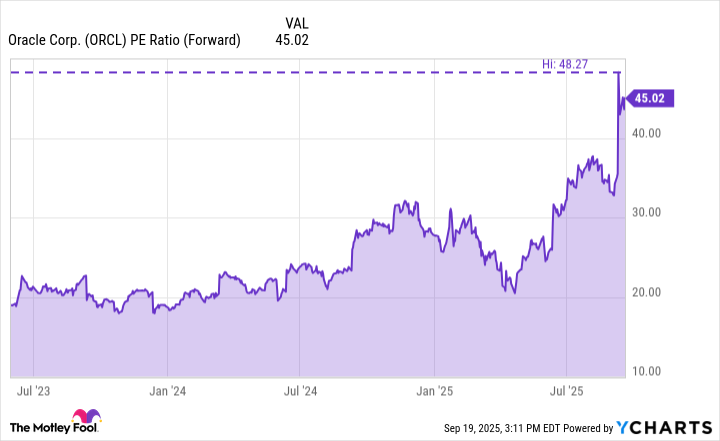

Given Oracle's sharp price appreciation over the past several weeks, investors can clearly see notable valuation expansion reflected in the chart below. What's more telling is that with a forward price-to-earnings (P/E) multiple of 45, Oracle is now trading at its most expensive level since the dawn of the AI revolution.

Data by YCharts.

Why does this matter? Because such pronounced expansion indicates that a significant portion of future upside is already priced into Oracle stock. Put simply, investors are placing a premium on Oracle's cloud infrastructure playbook in its current form.

I see an issue with that. Some of Oracle's headline infrastructure deals raise questions about their substance. For instance, while a reported $300 billion partnership with OpenAI sounds great on paper, the reality is that the ChatGPT developer lacks adequate capital to fund such a commitment. These dynamics call into question how much near-term revenue Oracle can truly capture from these arrangements.

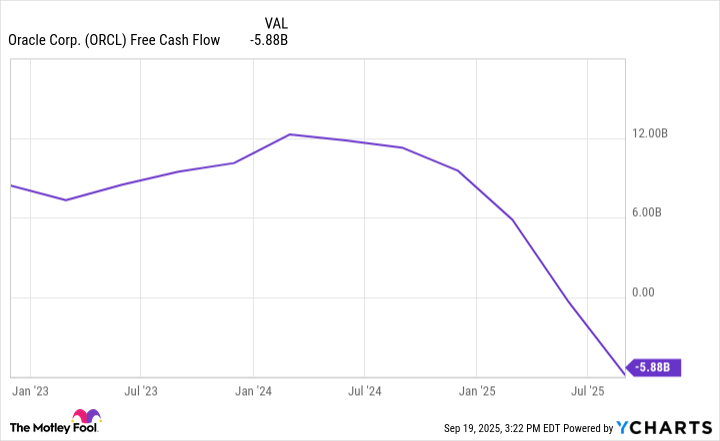

This is becoming an increasingly important point as the company's infrastructure investments are taking a toll on free cash flow. This begs the question: When will Oracle's cloud strategy actually begin to pay off and generate positive unit economics at scale?

Data by YCharts.

While Oracle undoubtedly benefits from secular tailwinds tied to AI infrastructure demand, the durability and monetization potential of the broader infrastructure opportunity remains cloudy. Moreover, I tend to shy away from investing in momentum stocks and buying at the peak anyway, so I recommend investors be cautious about chasing Oracle stock at its current valuation.