Nvidia (NVDA +2.06%) has been one of the top-performing stocks over the past decade. If you invested $10,000 in the stock a decade ago, you'd have a position worth $3 million now. It's success stories like that that keep ambitious investors hunting for the less known stocks today that have the potential to provide similar gains from here.

Artificial intelligence (AI) is a massive investment theme right now, and traditional computing has gone a long way toward developing that technology. However, there are many who believe that quantum computing could boost the capabilities of AI systems.

IonQ (IONQ 6.53%) was the first pure-play quantum computing company to go public, and has seen a ton of investor interest over the past month. It offers several leading technologies in its niche, and it also has asserted that its technology could provide a massive boost for AI. So could IonQ become the Nvidia of the 2030s?

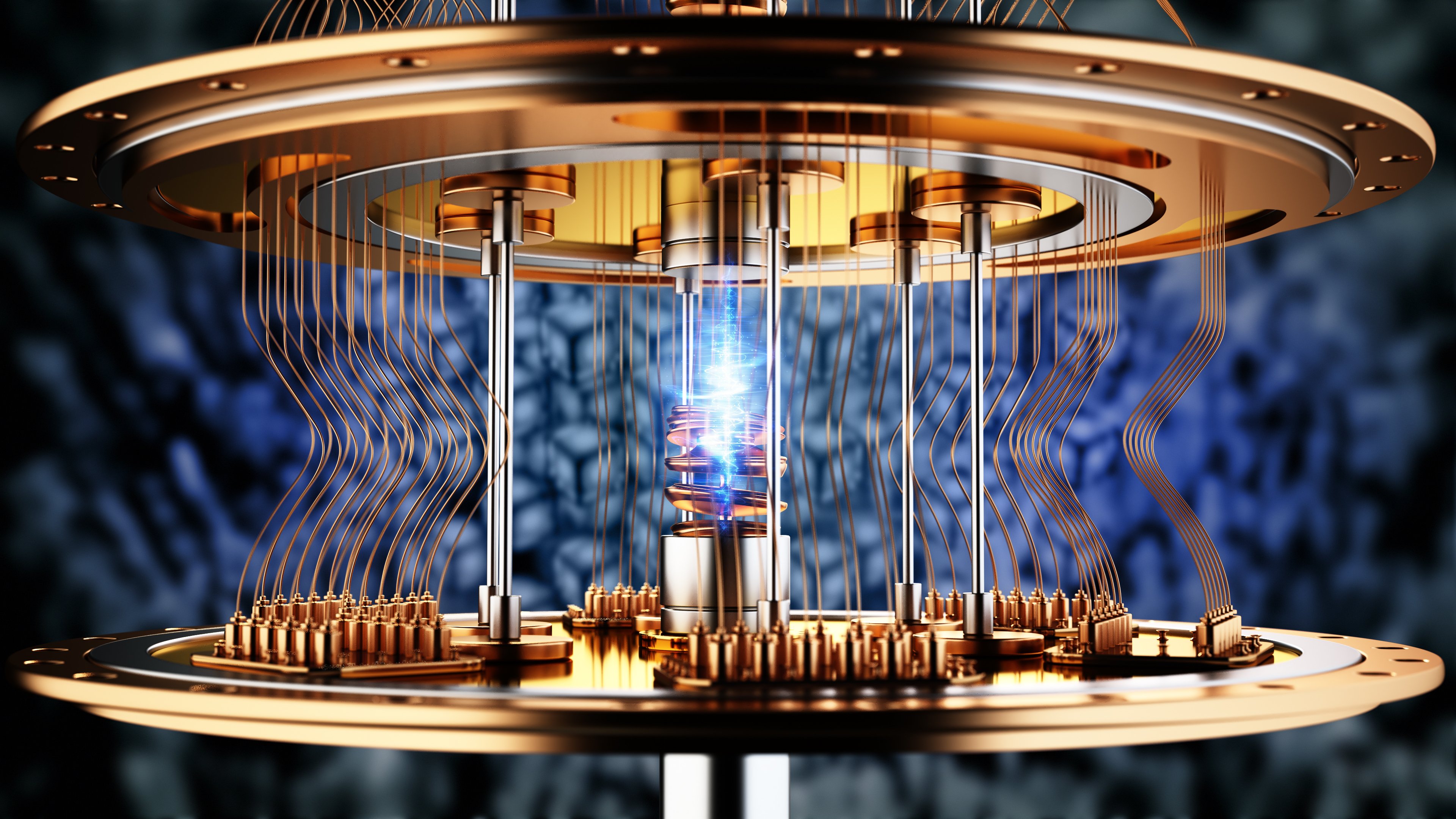

Image source: Getty Images.

IonQ's technology could separate it from the competition

The primary reason why quantum computing isn't commercially viable yet is a lack of accuracy. Traditional computer chips have error rates of about 1 calculation in a 1 quintillion. (That's 1 billion times 1 billion.) Today's best quantum computers' error rates are closer to 1 in 100,000, so they still have a long way to go before they're similarly reliable. This is clearly an issue.

One reason IonQ has become a leader in this space is its world-record-holding technology. IonQ holds world records in 1-qubit (99.999%) and 2-qubit gate (99.97%) fidelity tests. Most of IonQ's competitors are celebrating being in the 99% to 99.9% range in the 2-qubit gate fidelity test. So IonQ is about an order of magnitude ahead of its quantum computing competition -- but still nowhere near as accurate as a conventional computer.

Assuming IonQ can maintain its lead in accuracy, it will have a shot at releasing commercially viable quantum computers faster than its competition. Being the first mover in an important industry is a huge advantage -- just look at how OpenAI's ChatGPT has performed.

NYSE: IONQ

Key Data Points

There are numerous technological approaches to quantum computing, and each has its benefits and drawbacks. For IonQ, processing speed is one of them. It uses a trapped ion technology that has slower processing speeds than the superconducting qubit tech that many of its rivals are using. However, I think that potential clients will be more likely to favor a more accurate solution over a faster one, especially while the tech world is still trying to assess quantum computing's relevance.

This is critical. IonQ will need to win market share early if it hopes to repeat what Nvidia has done.

Being a first mover is a huge advantage that IonQ must achieve

Over the past few years, Nvidia's graphics processing units (GPUs) have become the primary computing hardware of choice for handling artificial intelligence workloads. Companies could have used chips from rivals such as AMD instead, but Nvidia's software and hardware were the best at the start, so it won a massive share of the data center computing market. Some estimates still peg Nvidia's share of the data center market at over 90%.

If IonQ is the player with the best technology at the moment when quantum computing goes mainstream, it has the potential to become the next Nvidia. It also has massive implications in the AI sector as a hybrid quantum computing approach, where IonQ's technology is combined with traditional computing hardware like Nvidia's GPUs to boost performance. Perhaps the biggest boost is that this hybrid approach would offer significant energy savings -- and electricity is a huge input cost and growth bottleneck for AI hyperscalers.

For IonQ to become the Nvidia of the 2030s, it will need to get its technology adopted widely at the onset of the period when quantum computing becomes commercially viable. However, it is worth noting that while quantum computers can perform some types of calculations vastly faster than traditional machines, the number of potential use cases for quantum computers is far smaller. With that in mind, investors should keep their performance expectations for IonQ's stock in check. Still, if it can commercialize its machines ahead of the pack and dominate the quantum computing market, IonQ has the potential to make patient investors a lot of money.