Artificial intelligence (AI) companies have been soaring in recent years -- so you wouldn't necessarily think that these players could be undervalued. But some, even high-quality companies that have proven themselves, still offer investors amazing buying opportunities. And as the next phases of the AI story unfold, certain undervalued players could take off.

One that I have on my radar screen is a market giant and a member of the "Magnificent Seven" technology stocks that have led the S&P 500 higher in recent years. The stock has advanced more than 140% over the past three years, but it still remains inexpensive and is the cheapest member of the Magnificent Seven. Could this undervalued AI giant be a 10-bagger in five years? Let's find out.

Image source: Getty Images.

Already winning in AI

The company that I'm referring to has already benefited from the AI boom in two ways -- it uses AI to improve its own operations, and it offers AI solutions to customers. I'm talking about Alphabet (GOOG 0.85%) (GOOGL 0.67%), owner of the world's No. 1 Search engine, Google Search, and owner of leading cloud provider Google Cloud.

Alphabet generates billion-dollar revenue through both of these businesses. The Google platform brings in the lion's share as companies advertise across these platforms to reach us, their target audience. In the recent quarter, Google ads delivered more than $71 billion in revenue, while Google Cloud brought in about $13 billion.

How does AI fit into this story? Alphabet has developed its Gemini large language model, and this tool powers everything from optimized search results to the data that advertisers use as they create their campaigns. This is positive as it should keep users and advertisers happy -- a combination that may support advertising growth.

On top of this, the company's cloud unit offers customers access to Gemini as well as a wide variety of AI products and services. One of these is Vertex AI, a fully managed platform for AI development, offering customers a fast and easy way to get their AI projects rolling.

NASDAQ: GOOGL

Key Data Points

Demand for AI capacity

The need for capacity for AI workloads has been strong according to cloud providers industrywide, and Alphabet, as a leading cloud company, has two big advantages: It already has a solid customer base that might immediately choose Google Cloud for AI projects, and it has the resources to build out infrastructure to keep up with demand. In its recent earnings report, Alphabet said it would increase capital spending this year to $85 billion from earlier guidance of $75 billion to support this growth.

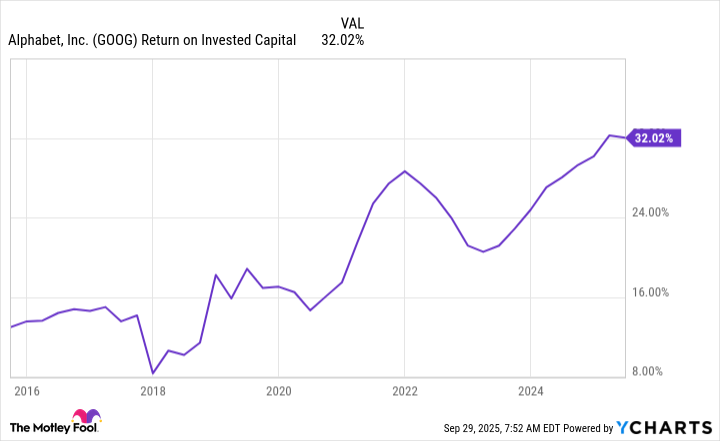

So, though Alphabet is pouring investment into AI and that's costly, the company is already benefiting from this investment. It has also shown over time that it's made the right investment decisions, and we can see this through its pattern of return on invested capital.

GOOG Return on Invested Capital data by YCharts

Moving forward, Alphabet is likely to see earnings gain as the infrastructure buildout stage continues and then as customers apply AI to their businesses -- and for all of this, customers need cloud capacity. At the same time, Alphabet's ongoing development of Gemini should continue to streamline its own operations.

How much could Alphabet rise?

All of this supports the idea of share price growth -- but could this undervalued company become a 10-bagger in five years? Today, Alphabet is cheap, trading for 24 times forward earnings estimates, offering the stock room to run.

But if the stock rises by 10 from today's level, it would trade for $2,470 per share and that would suggest a market value of more than $29 trillion. That's likely out of reach.

But the stock could still be a multi-bagger over the coming five years. For example, if it climbed by three, that would lift its valuation to $8 trillion -- and if the general AI market soared, with AI chip giant Nvidia reaching a $10 trillion market value as some (including me) have predicted, that could happen. Even better, Alphabet -- regardless of the exact gain it registers in the coming five years -- is well positioned to advance farther out into the future thanks to its leading search and cloud businesses.

So, though this undervalued AI player may not become a 10-bagger over the next five years, the stock still could advance significantly and score investors a major win as the AI boom marches on.