Investing in future technologies is what makes Intuitive Surgical (ISRG 0.49%) an intriguing long-term buy. Its robotic-assisted da Vinci surgical systems could revolutionize the healthcare sector in the years to come.

However, the machines are expensive (they can cost over $2 million) and so the big thing investors are always looking for when the company reports earnings is just how much the install base has risen, and what the growth rate in procedures is. Those are crucial metrics as they can quantify just how strong the demand really is.

Unfortunately, tariffs are a big concern these days as they can add significant costs for prospective customers. And the stock has been struggling as a result of those worries. The company reports its latest earnings numbers on Oct. 21, and if the tariff concerns prove to overblown, that could be what's needed to give the stock a boost.

Should you invest in Intuitive Surgical before then?

Image source: Getty Images.

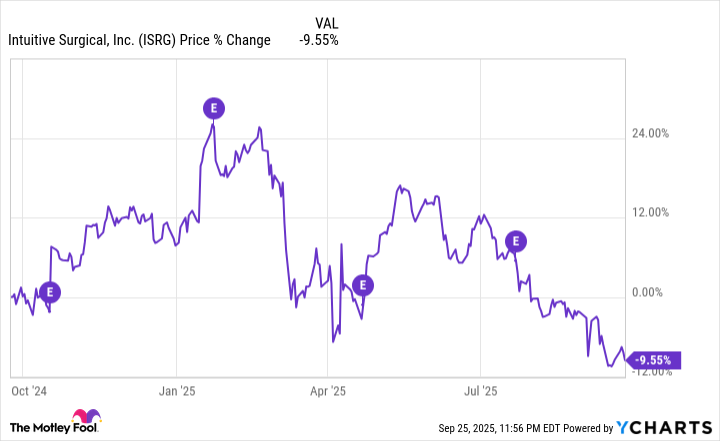

Intuitive's stock is down 14% since its Q2 earnings

On July 22, Intuitive last reported its earnings numbers. That day, its stock closed at a price of $511. In a little over two months, it has declined by 14%, to just over $438 as of Sept. 25. Over the past year, the stock has experienced some considerable volatility, alternating between large increases and drops after reporting earnings.

Based on the above trends, you might assume that Intuitive is due for a rally, and that it might get a boost from its upcoming earnings report. But that's by no means a guarantee.

What likely sank the stock in July was all the talk about tariffs impacting its business. On its earnings call, the company estimated an increase of more than 1% to its cost of sales due to tariffs. And CFO Jamie Samath noted that "future tariff rates could have a significant incremental impact on our cost of sales," acknowledging the uncertainty that remains around tariffs. Investors may be hesitant to invest in Intuitive's stock until there is more clarity around what the full financial impact will be.

Intuitive's business has looked strong of late

While Intuitive is battling some challenging economic conditions, the business looks more than fine right now. The number of da Vinci procedures rose by 17% last quarter (which ended on June 30). Meanwhile, its install base totaled 10,488 systems, which was also a double-digit increase of 14% compared to the same period a year ago. It was a solid quarter overall as revenue of $2.4 billion grew by 21% and Intuitive's net income increased by 25%.

The company expects a slight hit to its gross margin and for it to be in the range of 66% to 67% for the full year, compared to 69% a year ago. But it's by no means a catastrophic forecast. Investors, however, may have been spooked by all the tariff talk and may be anticipating much worse numbers ahead.

NASDAQ: ISRG

Key Data Points

Why I'd buy Intuitive's stock today

I believe the market is overreacting to tariff-related concerns when it comes to Intuitive. Year to date, the healthcare stock is down 16%. But if you're willing to hang on for several years, this can be a no-brainer stock to buy.

Although the stock's not cheap (trading at more than 60 times its trailing earnings), the company's surgical systems are potential game changers for the healthcare sector, and it's the big picture that matters, not how the business does from one quarter to the next. The surgical robot market is still in its early stages (it was worth approximately $4.3 billion last year, according to data from Grand View Research), with plenty more growth ahead, and with Intuitive leading the way.

While Intuitive may face some challenges in the short term due to tariffs and unfavorable macroeconomic conditions, it looks like a solid investment to hang on to for the long haul.