The S&P 500 (^GSPC 2.00%) is made up of 500 companies from 11 different sectors of the economy. To be considered for a spot in the index, there are multiple criteria, including that companies must have a market capitalization of at least $22.7 billion and must be profitable. But even after ticking those boxes, a special committee ultimately decides which candidates make the cut.

The S&P 500 is rebalanced once per quarter, meaning stocks that no longer meet the criteria are removed in favor of more suitable names. The most recent rebalance occurred on Sept. 22, when casino operator Caesars Entertainment was replaced by Robinhood Markets (HOOD 2.85%), which operates a popular online investing platform.

Robinhood stock is trading up 208% so far this year, crushing the comparable performances of artificial intelligence (AI) powerhouses Nvidia and Palantir Technologies, which have returned 28% and 136%, respectively. That's a ton of gains already for Robinhood. Does it mean it's too late for investors to board this train? Read on.

Image source: Getty Images.

Concerning trends are emerging in Robinhood's core business

There are two parts to Robinhood's total revenue:

- Transaction revenue, which comes from processing stock, option, and cryptocurrency trades for clients.

- Net interest revenue, which is the interest income Robinhood earns on its own cash, and the cash clients store on its platform. The company also earns interest on margin loans, which clients use to buy stocks and other financial assets.

Transaction revenue is the more important component, because it reflects the performance of its core business. President Donald Trump's election win last November drove a boom in trading activity, but especially in the cryptocurrency space, as he promised to slash regulation and adopt policies that would boost economic growth. This change ended up being great for Robinhood.

NASDAQ: HOOD

Key Data Points

In the fourth quarter of 2024, the company's transaction revenue hit an all-time high of $672 million, with crypto transaction revenue making up $358 million of that figure. However, the Trump bump quickly faded -- just six months later, in the second quarter of 2025 (ended June 30), Robinhood's transaction revenue was down 20% to $539 million, with crypto transaction revenue plummeting 55% to just $160 million.

Many popular cryptocurrencies are losing ground right now, so investors are being more cautious. Dogecoin is down 51% from its 52-week high, Shiba Inu is down 63%, and XRP has declined by 24%. Even Bitcoin has lost around 11% of its peak value.

This isn't the first time Robinhood has suffered a sharp downturn in its crypto business. The company's crypto revenue soared 4,560% in the second quarter of 2021 and accounted for half its total transaction revenue. But in the second quarter of 2022, just one year later, its crypto revenue had plummeted by 75%.

Robinhood's shrinking revenue doesn't align with its surging stock price, and this could be a major problem for investors -- but more on this later.

Falling interest rates could be another headwind

The U.S. Federal Reserve cut the federal funds rate (the overnight interest rate) three times in the final months of 2024, and a few weeks ago, on Sept. 17, the central bank executed its first cut of 2025. Falling interest rates would normally be a headwind for Robinhood's net interest income, but it's being offset by a sharp increase in margin loans and client cash balances.

At the end of the second quarter, clients were holding $8.7 billion in cash on Robinhood's platform, which nearly doubled from the year-ago period. The company's margin loan book was also at a record high of $9.5 billion.

As a result, second-quarter net interest income actually grew by 25% year over year to $357 million. However, I wouldn't expect the growth in the company's margin loan book and client cash balances to outrun the decline in interest rates forever.

A stock market correction, for example, could trigger a decline in margin loan balances as investors pare their exposure to risk. Moreover, investors might pull cash out of their trading accounts in the event of an economic recession, as they prioritize day-to-day expenses.

Robinhood stock could be heading for a sharp correction

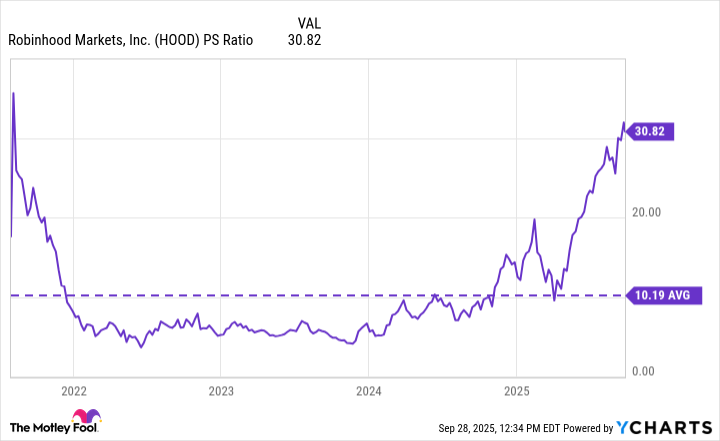

The incredible 208% gain in Robinhood stock this year, combined with the company's shrinking revenue, has sent its price-to-sales ratio (P/S) surging to 30.8 -- three times higher than its average of 10.2 since it went public in 2021. This is known as a multiple expansion, and an extreme one like this is almost always unsustainable.

Data by YCharts; PS = price to sales.

As a result, unless Robinhood can find a way to deliver significant revenue growth from here, its stock might be destined for a sharp correction. It would have to decline by 67% just for its P/S to align with its long-term average of 10.2, which isn't out of the question because it plummeted by more than 80% from its 2021 peak after the last crypto boom.

Robinhood's monthly active user base shrank in both the first and second quarters this year, and it won't be easy for the company to find more revenue with fewer clients actively trading on its platform. Therefore, it probably isn't a good idea to buy Robinhood stock right now, and investors who already own it might want to cash in some of their gains.