U.S. President Donald Trump's trade policies have been the talk of the town this year on Wall Street, perhaps even more so than exciting investing opportunities like artificial intelligence. The administration has sought to impose tariffs on imported goods coming from most countries.

This is a constantly evolving situation. According to research conducted by The Motley Fool, ongoing legal challenges are being raised regarding the legitimacy of certain tariffs. Others are subject to various exemptions, and trade deals are being negotiated.

With all that going on, it's a good idea for investors to adjust their portfolios accordingly and buy shares of companies that can navigate this challenge. No corporation is entirely tariff-proof, but let's consider why Netflix (NFLX 0.06%) and Coca-Cola (KO 0.09%) could be attractive investments in the current landscape.

Image source: Getty Images.

1. Netflix

Netflix provides a digital service. Unlike companies that manufacture physical products abroad and ship them back into the U.S., the streaming specialist won't have to deal with tariffs on imported goods it intends to sell to customers. The situation could still harm the company in various ways, perhaps if tariffs lead to inflation and increased expenses and costs for Netflix. Even so, the company appears better positioned than most to handle the current situation, especially since its business is currently running smoothly.

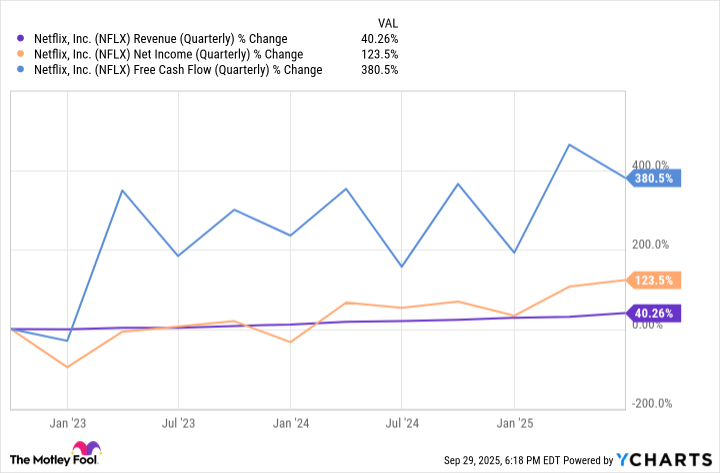

Netflix's revenue, earnings, and free cash flow have been growing at a good clip in recent years.

NFLX Revenue (Quarterly) data by YCharts.

While streaming now seems ubiquitous, the fact that Netflix continues to expand its ecosystem suggests that there is still at least some remaining whitespace to be exploited. The data on television viewing time supports this. Netflix is currently second only to YouTube (which, strictly speaking, isn't a direct competitor) among streaming platforms in terms of TV viewing time in the U.S., but the company still captured just 8.7% of that total in August.

NASDAQ: NFLX

Key Data Points

Has Netflix peaked? Hardly. In August, streaming accounted for less than half of TV time in the U.S. That number should grow substantially over the long run, taking Netflix along with it. Then there is the more recent advertising opportunity for the company. Netflix's ad business may still be in its infancy, but it boasts significant potential due to the company's competitive advantage: Its vast data trove. Netflix has precise statistics on viewer preferences and habits -- what people watch, when they watch it, and for how long.

This data can allow it to launch precise, targeted, and successful ad campaigns. Growing engagement will only strengthen this competitive edge, which in turn helps Netflix direct its content production strategy effectively, ultimately leading to great success.

Netflix's robust and (mostly) tariff-proof business can help it perform relatively well, despite an uncertain economic landscape, and the company's economic moat and prospects also make it an attractive long-term option. Although the streaming giant has crushed the market this year, its shares remain a buy.

2. Coca-Cola

Coca-Cola, a well-known beverage company, is a great tariff-resistant play for several reasons. First, as a leading consumer staples company in a defensive industry, it is likely to perform relatively well even when the economy slows. The word "staple" here is key. It refers to products that people buy consistently, regardless of economic conditions. So, even if tariffs lead to a meltdown, Coca-Cola should fare better than most.

Second, although the company manufactures and sells its products in nearly every country, Coca-Cola's manufacturing tends to be local. The company makes most of the products sold to U.S. consumers in the U.S., which limits the degree to which tariffs will affect its sales.

NYSE: KO

Key Data Points

Third, Coca-Cola is a terrific dividend stock. The company is a member of the elite Dividend Kings club, which is comprised of corporations that have increased their payouts for at least 50 consecutive years. Coca-Cola's streak stands at 63.

Why is this relevant? If economic and market conditions worsen and volatility increases, consistent and reliable income from dividends can help mitigate market losses -- provided, of course, that a company does not suspend its dividend program. Coca-Cola should remain in place regardless of the circumstances. The beverage leader's long-term streak shows that it can navigate almost any situation while still raising its dividends.

Lastly, Coca-Cola has solid long-term prospects. The company has remained successful thanks to its brand name, which carries considerable cachet, and its ability to evolve along with market needs. Coca-Cola has a vast portfolio of products and consistently launches new products to respond to customer needs. The company should remain a resilient business for many years to come, regardless of how the evolving tariff wars ultimately conclude.