The big draw for most investors with Pfizer (PFE 0.08%) today is likely to be its lofty 7.2% dividend yield. That compares to 1.2% for the S&P 500 index and about 1.3% for the average pharmaceutical stock. But before you rush out and buy that high yield, you should understand these three things.

1. Pfizer is a pharmaceutical survivor

After the lofty dividend yield, the next big reason to buy Pfizer is its proven ability to survive in the highly competitive pharmaceutical sector. Not only is it a giant in the industry, with a $135 billion market capitalization, but it has existed for well over 100 years. This is not some upstart or some one-trick wonder.

Image source: Getty Images.

Pfizer has a long history of making the investments needed to continue moving the business forward. That notably includes putting money and time into the difficult process of creating new drugs. But, when it has to, it will also act as an industry consolidator, buying companies to gain access to attractive drug candidates.

It did just that recently when it agreed to buy Metsera (MTSR +0.00%) to gain access to a promising weight loss drug after Pfizer's own weight loss drug flamed out. The multibillion-dollar deal shows both Pfizer's capacity for quick action and its ability to change its approach as needed to ensure the company's long-term survival.

2. Pfizer has to take action now, which is a problem

Given that quick backdrop, it sounds like Pfizer's fat dividend yield is an attractive opportunity for dividend investors. But don't rush out to buy the stock just yet.

One of the other reasons why Pfizer has agreed to pay $47.50 per share (roughly $4.9 billion) for Metsera with the opportunity for an additional $22.50 in potential earn outs is that it is facing a patent cliff. Drugmakers are granted temporary rights to sell a new drug without competition. When that patent runs out, generic versions can be created. That normally leads to material revenue declines for the original drug.

NYSE: PFE

Key Data Points

Pfizer's oncology drug Ibrance is set to lose patent protections in 2027. Its cardiovascular drugs Eliquis and Vyndaqel will see generic competition in 2028. The company is buying Metsera to strengthen its pipeline of drugs so it can withstand patent losses. That's normal for the drug industry, but it is important to keep in mind that Pfizer's high yield is at least partly a reflection of the fact that it hasn't yet solved its patent cliff issue.

3. Pfizer's dividend may not be as safe as it seems

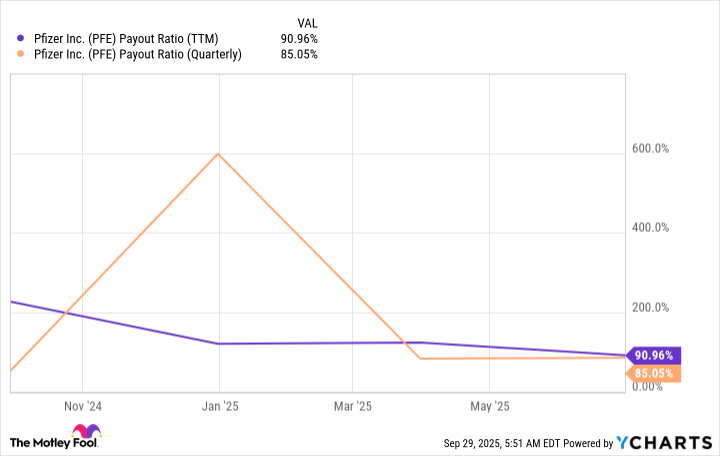

The patent cliff becomes even more worrying when you consider Pfizer's dividend payout ratio. The payout ratio was 85% in the second quarter of 2025 and over 90% on a trailing-12-month basis. That is worryingly high. If the drug maker can't find a replacement for the revenue that it is set to lose in 2027 and 2028, it could have trouble sustaining its dividend.

PFE Payout Ratio (TTM) data by YCharts

But there's another problem to consider here as well. Pfizer cut its dividend in 2009 when it acquired Wyeth Pharmaceuticals. The Wyeth transaction was larger, at around $68 billion. But the board of directors has clearly shown that it will adjust the dividend to accommodate large corporate actions like acquisitions. In other words, you can't buy Pfizer without giving great consideration to the risk of a dividend cut. That's especially true right now, in light of the pending acquisition of Metsera.

Pfizer is probably best viewed as a turnaround stock

Pfizer's stock has lost roughly 60% of its value since hitting a peak in late 2021. Although that high water mark was partly driven by the coronavirus pandemic, it still seems like long-term investors could benefit from the recovery potential in the business. And that suggests that Pfizer is an attractive turnaround stock, particularly given the moves it is making in the obesity drug space.

But tread carefully if you are looking at Pfizer as a dividend stock. It could be that, too, but history suggests that the dividend story may not be as strong as you think.