The Global X MLP ETF (MLPA +1.28%) boasts a trailing dividend yield of 7.8% and provides passive income-seeking investors with a compelling way to secure quarterly income. Still, yields are far from being the only or the most reliable metric for determining total returns for investors. Let's take a closer look at the ETF and what it has to offer.

What is the Global X MLP ETF?

The ETF invests in master limited partnerships (MLPs) operating in the midstream pipelines and storage facilities industries. MLPs trade publicly, but they carry the benefits of limited partnerships for taxation purposes. MLPs don't pay corporate taxes, so they pass on more of their income to investors in the form of distributions.

NYSEMKT: MLPA

Key Data Points

Since the ETF only invests in midstream pipeline and storage facility stocks, you can think of the ETF as offering a constant stream of income from its fee-based contracts, whether they be from gas transportation based on volumes of gas, take-or-pay fees, or gas storage fees, directly to the investor in the form of distributions.

Not correlated to energy prices

One of the major drawing points of the ETF is the idea that it invests in stocks that receive a relatively stable level of income based on gas volumes, supported by take-or-pay contracts. As such, the ETF's management claims that the 20 MLPs it invests in "have less sensitivity to energy prices." For reference, the ETF also invests in its sister ETF, the Global X MLP & Energy Infrastructure ETF, which also holds gas pipelines and storage companies, as well as midstream energy infrastructure companies.

Image source: Getty Images.

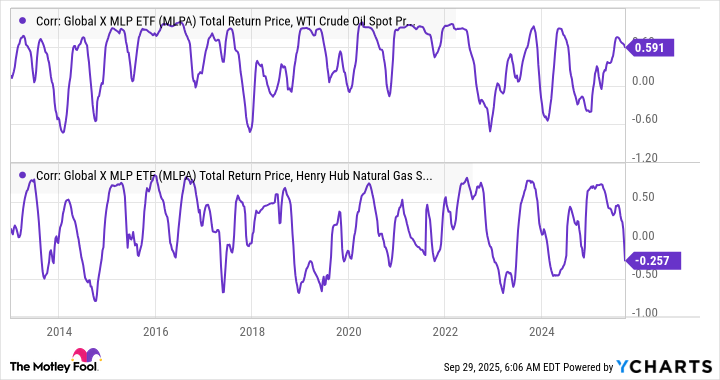

One way to test the idea that the ETF isn't sensitive to energy prices is by comparing its correlation with that of the oil price and the natural gas price. The result is shown below. As a rough rule of thumb, a figure close to 1 or minus 1 indicates perfect correlation, and a figure of about 0.8 or minus 0.8 indicates strong correlation.

On this basis, the ETF offers the prospect of high income without correlation with energy prices -- something many investors might want, as it means they don't have to take a view on where energy prices are heading.

Fundamental Chart data by YCharts

An alternative viewpoint

That said, it's always essential to understand what viewpoint you are manifesting by buying into an ETF. This is especially important with an ETF, because although the spread of holdings (currently 20) helps diversify stock-specific risk, it locks in risk to the overall investment theme. In other words, you are buying into the idea that gas, and to a lesser extent oil, pipeline, and storage are good industries to invest in.

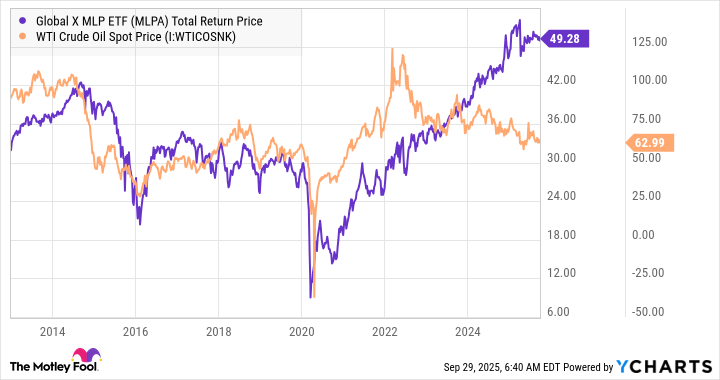

The following chart shows the total return price. It's a price that assumes reinvestment of the distribution into the ETF and is adjusted to the current price.

The chart illustrates three phases: first, weak performance up to 2020; second, a strong recovery thereafter; and third, a marked period of outperformance from 2024 onward.

MLPA Total Return Price data by YCharts

The first phase took place in a period when optimism over the pace of the energy transition (shift from fossil fuels, such as oil and gas) toward more sustainable fuels, such as renewables, took place. The second phase took place as the recovery from the lockdowns led to a series of supply chain issues and soaring costs for renewable energy, which led to the market negatively reassessing the pace of the transition and recognizing the importance of gas as a source of energy for many decades to come, even as the transition continued.

The third phase occurred as the market priced in the more energy-friendly policies (reducing regulations, unfreezing the export permit pause, and prompting U.S. energy exports) of the Trump administration.

Image source: Getty Images.

A no-brainer investment?

The ETF is not a no-brainer investment, as you must assume that natural gas will continue to play a significant role in the global economy for many years to come and factor in the sector's sensitivity to political developments. While take-or-pay and other long-term customer contracts are fine, the price and willingness to enter them are dictated by demand for energy, and the cost of energy is obviously a function of that.

All told, the ETF is attractive for many reasons, but it's not a no-brainer; investors need to consider how it fits into their portfolios.