Shares of Upstart (UPST 1.59%) pulled back in September on signs that delinquency rates on its loans could be rising.

There was no direct report from Upstart, but investors reacted to third-party market research and other news that seemed to show poor performance in its loans. That conclusion also makes sense given other signs of a weakening economy, including a sharp slowdown in the labor market.

Investors may also be wary of a repeat of 2022, when the stock crashed as its growth ground to a halt and profits flipped to losses, though that was driven by rising interest rates, which is not what's happening now. Other fintech stocks, including those in the BNPL sector, pulled back on signs of rising credit risk last month as well.

Image source: Getty Images.

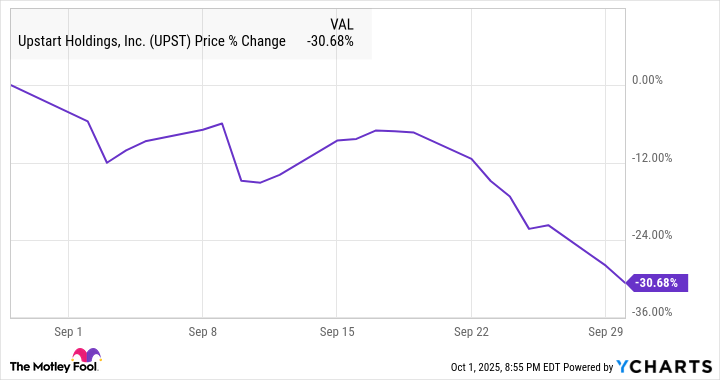

By the end of the month, Upstart had fallen 31%, according to data from S&P Global Market Intelligence. As you can see from the chart below, the bulk of the decline came toward the end of the month.

Investors turn skeptical on Upstart

The deteriorating credit picture for low-income Americans, a core market for Upstart, seemed to be the main reason for the sell-off last month.

NASDAQ: UPST

Key Data Points

Upstart's worst day of the month came on Sept 10, as it fell 9.4% on high volume. The trigger seemed to be the bankruptcy of Tricolor Holdings, a used-car dealer known for lending to borrowers with no credit. Fraud also played a role in the bankruptcy. Though the company isn't directly connected to Upstart, the bankruptcy seemed to weigh on credit markets broadly, impacting volatile stocks like Upstart.

The stock recovered those losses, benefiting from the Federal Reserve's rate cut on Sept. 17. However, the stock began sliding after that as concerns about weakening credit arose again.

On Sept. 29, the stock fell 8% after BTIG issued a note saying it was surprised by the increase in delinquencies in Upstart's asset-backed securitizations, though the analyst corrected their figure two days later, essentially retracting the earlier comment. That helped the stock gain 2.6% to start October.

What's next for Upstart?

At this point, it's difficult to say how the changing credit markets are impacting the company, as we haven't heard directly from Upstart. Management participated in a Goldman Sachs conference on Sept. 9, but didn't seem to comment on any material changes in credit or delinquencies.

Toward the end of the month, First Brands, an auto-parts maker, also filed for bankruptcy, adding to fears about auto loan delinquencies.

For now, the sell-off in Upstart seems premature as second-quarter results were strong and so was guidance for the third quarter. If the business held up in the third quarter, the stock could be due for a rebound.