Producing 10x returns on a single investment is an impressive achievement. Some stocks never achieve this return level, but it's not uncommon to deliver 10x returns in a reasonable time frame. One area where investors are searching for stocks with this potential is in the artificial intelligence (AI) realm, as there is a ton of investment dollars flowing into this space to build out AI computing capabilities.

However, a lot of the easy money in the artificial intelligence hardware space has been made, so it's time to look at some AI application investments. One of the most popular is SoundHound AI (SOUN +1.83%). SoundHound combines audio-recognition technology with generative AI, giving it a massive range of industries where it could be implemented.

Management is bullish on its long-term outlook, and if they're correct, SoundHound AI could transform $10,000 into $100,000 within a relatively short time frame.

Image source: Getty Images.

SoundHound's reach is expanding

SoundHound's technology isn't anything innovative; digital assistants like Siri and Alexa have been messing up audio prompts for years. What sets SoundHound's products apart is that they can outperform their human counterparts in many scenarios, such as drive-thru order taking.

SoundHound's product is seeing adoption in many areas, including automotive (generative AI-powered digital assistants in cars), healthcare, retail, and financial services. In the second quarter, SoundHound announced that seven of the top 10 global financial institutions were customers, and four of them had either renewed contracts or expanded their spending. This shows that SoundHound's product is useful and could continue to automate more systems as clients become comfortable with the results they're seeing out of the software.

NASDAQ: SOUN

Key Data Points

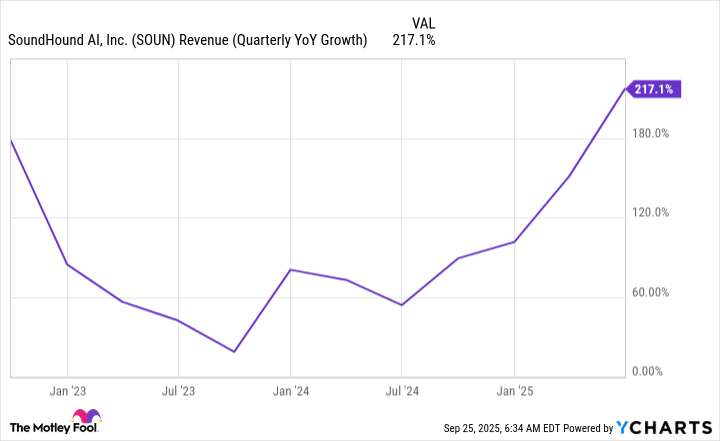

SoundHound's popularity has resulted in monstrous growth for the company, with revenue rising 217% year over year to $42.7 million during Q2. That's impressive growth, but with SoundHound's revenue being under $50 million per quarter, it showcases how small a business it is. This makes it easier to grow quickly, and it ties into management's long-term projections.

Organic revenue growth is an important metric for SoundHound investors

Part of the reason SoundHound has grown so rapidly is that it has acquired a few companies to bolster its product lineup. Acquiring companies artificially inflates a company's growth rate, as they add a chunk of revenue that they acquired but didn't earn.

When companies are in an acquisition phase, investors will insist on knowing the organic growth rate. Organic growth is how much growth is derived from pre-existing business units. This gives investors a clearer picture of how the base business is doing and makes it easier to determine whether all the growth is bolt-on or a combination of acquired revenue and growth.

During its Q2 conference call, management noted that its impressive 217% growth rate was a combination of strong organic growth and acquired growth. However, moving forward, management sees organic growth rates of 50% or greater as possible for the foreseeable future. That's an impressive figure, and if the company can deliver on that projection, SoundHound will be a tremendous stock pick.

SOUN Revenue (Quarterly YoY Growth) data by YCharts. YoY = year over year.

If SoundHound's revenue growth directly translates into stock growth, SoundHound could turn a $10,000 investment into $100,000 in about six years. That would be a massive quick win for investors, but there's no guarantee that SoundHound can sustain that growth for that time frame. Furthermore, there could be rising competition from other companies that disrupt SoundHound's business model.

As a result, investors must balance portfolio sizing with risk. That way, if the stock goes to zero, it doesn't affect the portfolio as much. But if it can truly 10x, a meager 1% to 2% investment can turn into a much larger part of your portfolio. Time will tell whether SoundHound is a successful investment, but with the wide use case and bullish market projections from management, I wouldn't be surprised if it is a huge winner.