Rocket Companies (RKT 3.76%) has been a roller coaster ride since its initial public offering (IPO) on the stock market in 2020. After rising as high as $43 per share in March 2021, Rocket's journey went into reverse in 2022 as rising interest rates contributed to a slowdown in the housing market.

At one point, the stock plummeted as low as $6 per share. However, there has been a notable bounce back, and shares are currently priced at about $18, which is 58% off its all-time high (as of Oct. 2). Here's why Rocket stock may be worth a closer look.

Image source: Getty Images.

Higher interest rates have weighed on Rocket's business

Rocket Companies went public in August 2020 as the largest retail mortgage originator in the U.S. Initially buoyed by low interest rates and a pandemic-driven mortgage refinancing boom, Rocket posted strong earnings and solid growth.

NYSE: RKT

Key Data Points

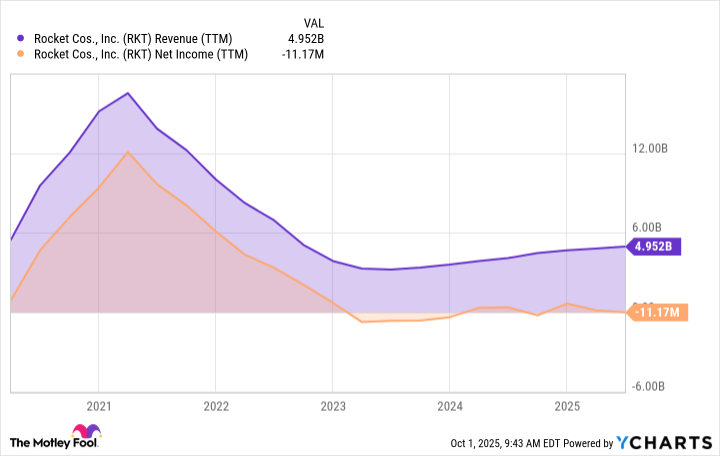

However, interest rates climbed in response to inflationary pressures, and mortgage demand cooled as a result. Rocket's operating earnings fell sharply, exposing its reliance on cyclical mortgage origination activity. Investors grew skeptical, and the stock struggled to maintain momentum as Rocket's volumes declined.

RKT Revenue (TTM) data by YCharts

The housing market and mortgage rate volatility have left it in a tough spot, and Rocket has made some big moves to diversify its earnings and be more resilient across different market environments.

How Rocket looks to become more resilient

Rocket Companies has a strong position with its digital-native home lending products. However, this hasn't prevented it from being subject to the cyclical nature of the business. As a result, Rocket has made several moves to expand from being a mortgage originator to a platform company focusing on controlling the entire home-buying experience, from search through closing and servicing, angling to maintain a lifetime relationship with its customers.

The company has made two significant acquisitions in recent years: Mr. Cooper Group and Redfin. These acquisitions transformed it into a fully integrated real estate and mortgage company.

Earlier this year, Rocket announced its acquisition of Mr. Cooper Group, which closed on Oct. 1. The acquisition gives Rocket the nation's largest mortgage servicing platform -- over $2.1 trillion in unpaid principal balances. This generates stable, recurring fee income that cushions Rocket against some of the fluctuations in its mortgage origination business.

It also provides constant customer contact, opening doors for cross-selling, refinancing, insurance, and personal loan products. For shareholders, this stabilizes cash flows and reduces earnings volatility, making Rocket less sensitive to interest rate swings.

Meanwhile, its Redfin acquisition, which closed in July, adds to the top of the funnel. Redfin's brokerage and widely used real estate search platform bring millions of potential home buyers directly into Rocket's ecosystem.

Pairing Redfin's agent network and property listings with Rocket's origination, title, and servicing capabilities creates a one-stop shop for buying, financing, and managing a home. This vertical integration improves margins by capturing a larger share of the transaction value, while reducing acquisition costs.

Rocket has made its business more resilient

Rocket will continue to be sensitive to changes in interest rates and the conditions surrounding the housing market. However, the company has made strategic acquisitions to strengthen its position in the housing market and expand its revenue streams, making it more resilient in the cyclical industry.

If interest rates do fall in the coming years, Rocket could benefit from a thawing housing market and the potential for a refinancing boom for any homeowners who took out high-interest mortgages during the past couple of years.

With its digital platform and growing scale, as well as recurring revenue in the Mr. Cooper Group, Rocket has done a good job of making it a one-stop shop for customers' mortgage needs, which is why the stock is a solid buy today.