The cryptocurrency market has historically been driven by passionate retail investors. In recent years, however, several high-profile executives have also started embracing digital assets.

Tesla CEO Elon Musk has frequently joked about Dogecoin, while Ark Invest CEO Cathie Wood has consistently voiced strong optimism around Bitcoin (BTC 0.58%). Another corporate leader who has gone even further is Strategy co-founder, Michael Saylor.

Saylor has become one of the most outspoken Bitcoin advocates, going as far as to add the cryptocurrency directly to Strategy's balance sheet. More recently, he projected a long-term price target of $21 million per coin by 2046. For perspective, that represents more than 18,000% upside from Bitcoin's current price of roughly $114,000 as of this writing.

The question, then, is what underpins Saylor's extraordinary bullish outlook -- and how realistic is such a forecast? Let's examine the core drivers of Saylor's thesis and consider whether this path is truly feasible.

Michael Saylor and the power of 21

In June, Saylor spoke at a Bitcoin seminar in Prague, where he outlined 21 principles for building wealth -- many of which, unsurprisingly, touched on Bitcoin.

One of his core themes was the idea of scarcity. Unlike fiat currencies, which can be printed in unlimited quantities, Bitcoin's supply is permanently capped at 21 million coins. This hard limit creates a unique supply-and-demand dynamic: During periods of economic uncertainty, investors are more likely to seek out Bitcoin as a store of value or even a hedge against inflation.

Saylor also contends that the growing tokenization of traditional asset classes on the blockchain will accelerate institutional adoption of Bitcoin. He takes this a step further, pointing to recent developments such as the launch of spot Bitcoin ETFs by major financial institutions as well as the emergence of sovereign interest, with some nations already building -- or actively considering -- strategic Bitcoin reserves.

Understanding the math behind $21 million per Bitcoin

If Bitcoin were to reach $21 million per coin, its implied market capitalization would be about $441 trillion.

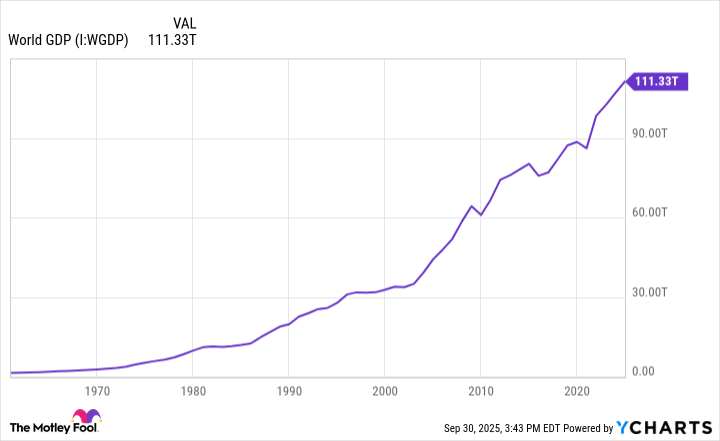

To put this into perspective, global gross domestic product (GDP) currently stands at about $111 trillion. Even assuming steady annual growth of 2.5%, worldwide GDP would only expand to roughly $186 trillion by 2046 -- less than half of Bitcoin's projected market value under Saylor's forecast.

For Bitcoin to reach this price target, its value would need to compound at an average annual rate of about 28% over the next two decades. This growth is nearly four times the long-term compounded return of the S&P 500.

Will Bitcoin reach $21 million by 2046?

Based on the analysis above, I view Saylor's model as overly aggressive and think his $21 million target serves best as a thought experiment. That said, his broader bullish perspective shouldn't be dismissed. The strength of his argument is not supported by an exact dollar figure; rather, it lies in the directional insight.

While Saylor's projected price appreciation is unlikely to be realized literally, he does a great job of underscoring the asymmetric nature of Bitcoin: a strictly fixed supply set against the possibility of expanding demand. If institutional investors and governments continue to adopt Bitcoin, its value could rise far more sharply than many skeptics anticipate.

For investors, the takeaway is to separate vision from probability. Saylor may be overstating the magnitude, but he is likely correct about the long-term trajectory of Bitcoin. For this reason, I see exposure to Bitcoin as a good idea for investors with a long-term time horizon and a willingness to accept pronounced volatility as the cryptocurrency landscape continues to evolve.