Contract electronics manufacturer Jabil (JBL +5.42%) reported its fiscal 2025 fourth-quarter results (for the three months ended Aug. 31) on Sept. 25, and the stock dropped despite delivering stronger-than-expected results and guidance.

The company has been in fine form on the stock market this year. It has registered 51% gains in 2025 as of this writing. But it looks like the weaknesses in certain areas of Jabil's business led investors to press the panic button.

However, on closer scrutiny, the post-earnings drop in Jabil stock looks like a buying opportunity. Let's look at the reasons why.

Image source: Getty Images.

Jabil's artificial intelligence business is getting bigger

Jabil provides design, engineering, and manufacturing solutions to customers across several industries, such as automotive, healthcare, data centers, semiconductors, telecommunications, and connected devices. Not surprisingly, the company's cloud and data center business has been growing at an impressive pace of late thanks to the artificial intelligence (AI) boom.

NYSE: JBL

Key Data Points

Jabil delivers end-to-end rack-scale computing solutions (which involve integrating different types of hardware using server racks to tackle specific workloads) for AI servers. It introduced purpose-built AI servers suited for integrating chips from the likes of AMD, Intel, and Nvidia. The company is seeing the benefits of the fast-growing AI server market already, as its AI revenue jumped 80% in the previous fiscal year to $9 billion. That was much faster than the company's annual revenue growth of just 3% to $29.8 billion.

Jabil now gets 30% of its top line from the AI business. That figure could move higher in fiscal 2026. The company expects a 25% spike in its AI revenue this fiscal year. Overall revenue, meanwhile, is expected to jump just 5%.

These forecasts may not seem very enticing at first. However, investors would do well to note that Jabil could end up delivering stronger growth than management currently projects. After all, the growth of the AI business helped the company deliver a 17% year-over-year increase in revenue last quarter, along with an even better jump of 43% in earnings.

Moreover, the growth of Jabil's AI business in fiscal 2026 is only going to be curtailed by capacity constraints. Management pointed out on the latest earnings call that AI-driven "demand continues to be extremely strong." That's the reason why Jabil recently announced that it will invest $500 million in a new facility in North Carolina for manufacturing cloud and AI data center components.

This is a smart thing to do considering that the AI server market could clock an annual growth rate of almost 39% through 2030, according to Grand View Research. So, Jabil's AI revenue growth can be expected to pick up in the current fiscal year and in the long run as it brings online more capacity to support this market.

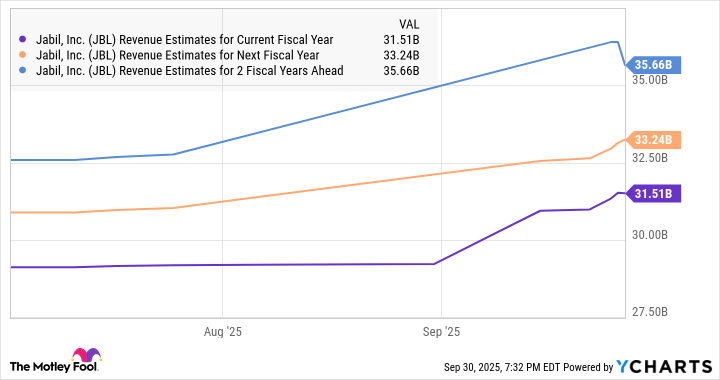

That probably explains why analysts project the company's growth rate to pick up going forward.

Data by YCharts.

Strong earnings growth potential and the valuation point toward more upside

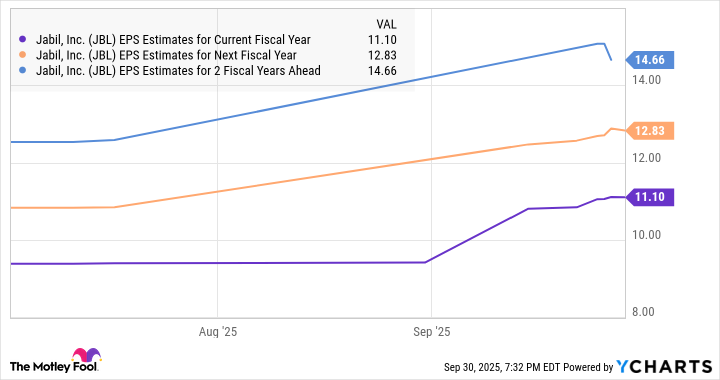

Jabil reported a 15% increase in its non-GAAP (adjusted) earnings in the previous fiscal year to $9.75 per share. Management forecasted a 13% jump in the current fiscal year to $11.00 per share. Given that Jabil is likely to see faster growth in its top line going forward, it is easy to see why analysts forecast a pickup in its bottom-line growth as well.

Data by YCharts.

The stock currently trades at a very attractive forward earnings multiple of 20. That's lower than the tech-laden Nasdaq-100 index's forward earnings multiple of 27 (using the index as a proxy for tech stocks). Assuming Jabil can indeed clock $14.66 per share in earnings in fiscal 2028 (see chart above), its stock price could jump to $396 (based on the Nasdaq-100's forward earnings multiple).

That points toward a solid jump of 82% from current levels. So, savvy investors might want to consider using the drop in this AI stock following its latest quarterly report to buy, as it seems like a potential long-term winner.