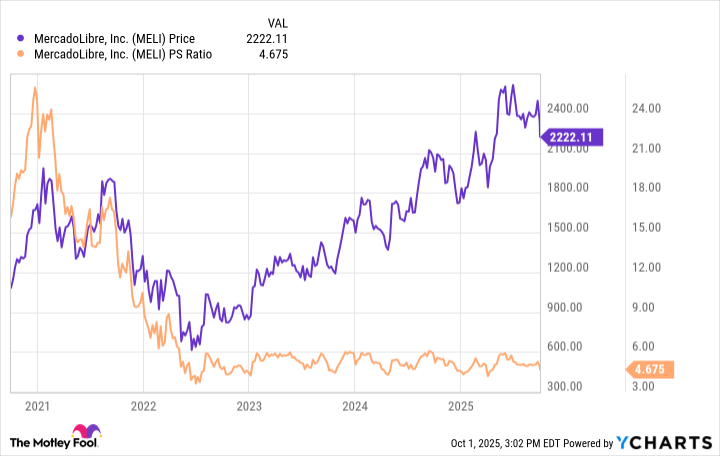

When some investors look at shares of MercadoLibre (MELI +8.86%) trading at close to $2,200, they see an expensive stock. But I see one of the best bargains on the entire stock market for long-term investors.

One of the very first lessons an investor must learn is that the price per share doesn't matter without crucial context: How many shares are there?

Imagine with me for a moment that there were only 10 shares of MercadoLibre stock in existence. In this made-up reality, the entire company could be purchased for $22,000 (10 shares multiplied by $2,200 per share). Considering it makes $2 billion in annual profit, this would be absurdly inexpensive.

Image source: Getty Images.

The point is that the price per share for MercadoLibre might look expensive, considering it has four digits. But this really doesn't tell investors whether it's a good deal or not. Indeed, a penny stock could be extremely overvalued, whereas a stock trading at $2,200 per share could be a bargain.

And in fact, I believe MercadoLibre stock is a good deal today. I'd like to explain why.

But first, why does the market have doubts?

MercadoLibre is up more than 7,000% since going public nearly 20 years ago. During this entire time, the company has been under CEO and cofounder Marcos Galperin. But 2025 will be his final year holding the reins. In January, commerce president Ariel Szarfsztejn will take over as CEO.

Investors are confident in Galperin's ability to lead MercadoLibre because he's proved it. Investors probably wouldn't be pleased with a transition away from Galperin, regardless of the successor. He's a hard CEO to replace.

NASDAQ: MELI

Key Data Points

Additionally, MercadoLibre is profitable, but its profit margins recently took a hit. For example, in the second quarter of 2024, the company's net profit margin was 10.5%. But in the second quarter of 2025, its profit margin dropped to 7.7%. For perspective, this difference in the profit margin cost the company roughly $200 million in a single quarter.

I personally don't believe that investors should be overly concerned about either of these issues. While management stability is usually ideal, new CEO Szarfsztejn has a history with MercadoLibre, which is far more stable than bringing in a new CEO from the outside.

In short, Galperin will be missed, but I don't think this should be a big issue for investors.

Regarding profit margins, investors should seek to understand why MercadoLibre's margins contracted. For starters, the margin went down because of changes in exchange rates with the U.S. dollar. This is just part of investing in an international stock that's doing business in Latin America -- an advantageous market for long-term growth.

MercadoLibre's profit margins also went down due to changes in its cost structure for its e-commerce marketplace. For example, it lowered the required spending threshold to qualify for free shipping in Brazil. There's a cost to this, but the company may more than make up for it in the long run by boosting adoption from customers. So again, I think it's premature to view this is a systemic problem.

Why strong investment returns could be ahead

MercadoLibre's management makes business decisions that ultimately increase adoption for its products and services. This includes things such as building a top logistics network, providing financial services to consumers, extending credit to merchants, and more. There's a cost to all of these things, but for the company, it's always paid off with revenue growth.

I believe the same thing continues to happen today. Consider that MercadoLibre has about 71 million total active buyers as of Q2, and 55% of its commerce revenue comes just from Brazil. Therefore, it stands to reason that the company has somewhere around 40 million active buyers in Brazil, even though more than four times this many people live in urban areas in the country, according to census data. In short, offering free shipping on more orders could be an easy way to drive adoption and boost long-term growth.

Moreover, MercadoLibre has a budding advertising business. The company could possibly replace its losses from free shipping with advertising income, further highlighting how this could turn out to be a good move, even if it hurts profit margins temporarily.

MercadoLibre stock currently trades at less than 5 times its sales, which is usually an attractive valuation to buy shares.

Why MercadoLibre is a buy

In conclusion, MercadoLibre is still attractively profitable even with a contraction in its profit margin. But the contraction will likely prove temporary. Moreover, the company is likely poised for many more years of growth, and management is doing things to drive ongoing adoption from users. The stock price might have four digits, but the stock's valuation remains cheap nonetheless, and MercadoLibre stock should reward investors nicely from here.