Palantir Technologies (PLTR +2.46%) has turned out to be a stunning investment in the past year. The stock has shot up a remarkable 385% during this period, which means that it has multiplied by almost 5x in a very short time.

However, Palantir's rise can't be just attributed to its healthy financial performance. Though its growth rate has been picking up in recent quarters on account of the robust demand for its artificial intelligence (AI) software platform, there is an element of hype as well to Palantir's red-hot rally. That's the reason why it can be said that the stock may have gotten ahead of itself, and that's evident from its expensive valuation.

But will the valuation keep Palantir stock from flying higher in the next year? Or will the AI hype train send shares of this software specialist higher? Let's find out.

Palantir Technologies' valuation makes it clear that it is priced beyond perfection

Palantir's sales multiple of 130 and price-to-earnings ratio of 592 make it clear that the market is expecting outstanding growth from this tech stock. However, at this valuation, Palantir will have to keep delivering extraordinary levels of growth quarter after quarter. Any cracks in its growth story could lead investors to press the panic button.

NASDAQ: PLTR

Key Data Points

Not surprisingly, analysts aren't confident of any more upside from Palantir in the coming year. It has a median 12-month price target of $165, as per 29 analysts covering the stock. That points toward an 8% drop from current levels. But then, Palantir stock has remained disconnected from reality in the past year, and there is a good chance that this trend may continue in the coming year as well.

These two reasons could keep driving the stock higher

The primary reason why Palantir's stock has taken off in the past year is because of the success of its Artificial Intelligence Platform (AIP). This offering has not just helped boost its customer base at an impressive pace, but is also allowing the company to get more business from existing customers.

That's not surprising, as Palantir points out that AIP allows its customers -- both federal and commercial -- to integrate generative AI into their operations. They can build apps, automate actions, and create AI agents using their data in real-time, eventually enabling them to improve operating efficiency and remove redundancy.

The cost and operational advantages that AIP is delivering to customers across various industries explain why this product has been a huge hit. There are several instances in which Palantir's AIP customers have reduced the time taken to execute their workflows from weeks to minutes, from years to months, and even from several days to seconds.

As a result, Palantir is now adding new customers at a faster pace. Its overall customer count was up 43% in the second quarter of 2025, an acceleration of two percentage points when compared to the prior-year period. Even better, the advantages of AIP have helped Palantir expand its relationships with existing customers, leading to bigger contracts. For example, the number of $5 million-plus deals struck by Palantir doubled year over year in Q2.

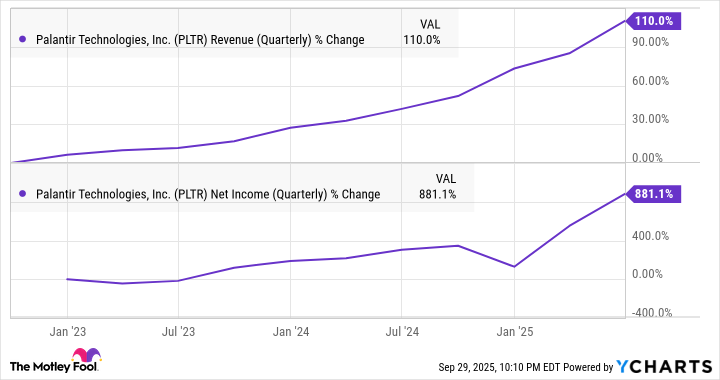

This is precisely why Palantir's earnings are growing at an incredible pace and outpacing the growth in its revenue.

PLTR Revenue (Quarterly) data by YCharts

Another thing worth noting in the chart above is that there has been an uptick in Palantir's growth rate since it launched AIP in April 2023. So, the possibility of Palantir sustaining impressive growth levels seems solid considering that its revenue pipeline of $7.1 billion at the end of Q2 showed an outstanding jump of 65% from the year-ago period and outpaced the 48% spike in its top line.

The AI software platforms market is reportedly growing at an annual pace of 41% and is expected to generate annual revenue of $153 billion in 2028, according to IDC. So, there is a good chance Palantir's growth could keep accelerating in the coming year and beyond, considering the huge end-market opportunity on offer. And that leads to the second reason why Palantir's rally could continue.

The size of the AI software platforms market, the demand for Palantir's AIP, and the company's superiority in this space could continue lifting its revenue and earnings growth rates in the next year. That could continue to feed the AI hype train that the stock has been riding in the past year, as it will become clear that Palantir is on its way to becoming a much bigger company in the long run, given the size of the AI software market.

If that's indeed the case, there is a possibility of Palantir's stock price approaching the Street-high 12-month price target of $215, which would be a 20% increase from current levels. But don't be surprised to see it go higher than that in the coming year if it manages to keep outpacing Wall Street's expectations, a feat that it is definitely capable of reaching.