If you're trying to figure out if a particular stock is worth buying, you might consider using the price target as a metric. It isn't a very precise method of evaluating stock values, but it can help you see how other analysts feel about the future of your favorite companies.

What is a price target?

A price target represents an analyst's estimate of the future price of a stock or other security. For stock analysts, the timeline is generally 12 to 18 months, but technical traders also use price targets.

For stock analysts, the purpose is to help advise investors as to where their stocks might be headed and to highlight stocks that could be very good values (or very bad ones) in the future. These analysts often work for large firms that may also give buying guidance.

Technical traders, on the other hand, may calculate price targets for any reason. Many times, they calculate price targets for buying and for selling, configuring their trading bots to buy at certain points and sell at others based on short-term pricing models that could be measured in as little as hours or days.

What do price targets tell you?

Price targets, like weather forecasts, are influenced by a lot of factors outside of anyone's control. So, if you're worried that a price target for a favored stock is lower than you expect, you may really be stressed for no reason.

Price targets are an attempt to predict future prices based on current information. That information is often incomplete since companies tend to keep anything they're not required to disclose close to their chests until it's time to show investors how well they're doing. And rightfully so -- the daily drama of the balance sheets might get to be too much if we had to hear about it more than once every few months.

Ultimately, the goal of price targets is to predict the future, but it's often through a foggy crystal ball. A 2006 study showed that share prices met or exceeded the price target at some point over the following year for just 53% of observations and only met or exceeded the price target in 30% of cases at the end of those same 12 months.

How do you calculate price targets?

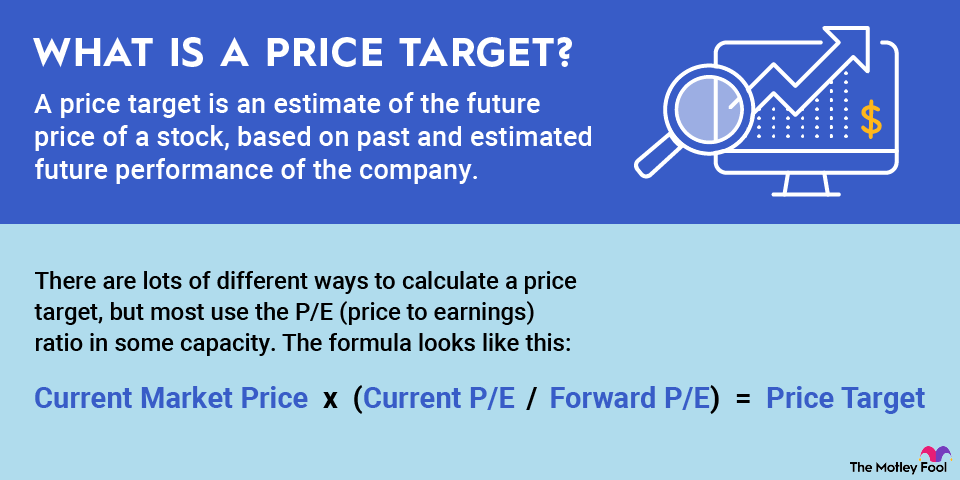

There are many different ways to calculate a price target, but a common method involves using price-to-earnings ratios. If you divide the current P/E by the forward P/E and then multiply by the current price, you should have a reasonable prediction for the price target a year from now.

The current P/E gives you the earnings for the last 12 months as a ratio of the current market price to the average earnings of the prior 12 months. The forward P/E does the same but is calculated by dividing the market price by the average estimated earnings for the next 12 months. Using both balances the equation so that it's (theoretically) not relying too much on either ratio (although the forward P/E is calculated based on past performance to some extent).

The formula looks like this:

Current Market Price x (Current P/E / Forward P/E) = Price Target

Remember that this is only an estimate, and there are a lot of other factors that should be taken into consideration when you're trying to decide whether to buy, sell, or continue to hold any financial instrument in your portfolio.

Related investing topics

Why are price targets important to investors?

Neither investors nor analysts are always at the forefront of everything all the time. That's why there are thousands of analysts who crunch piles of data to create price targets for companies. Even though price targets aren't always accurate, that doesn't mean they have zero value.

A price target is good for telling you where analysts think that companies' stocks are going to be in a year or so. You'll always see a range of prices from them since analysts are hardly a hive mind. That should give you some idea of how to plan for the future, assuming nothing serious changes between now and the point where you plan to rebalance.

It's just one of many metrics you should be watching as a DIY investor, and if you have the time, calculating for yourself, if only to better understand how it really works.