Investors have long been intrigued by the MercadoLibre (MELI 3.13%) growth story. The company pioneered e-commerce and fintech in Latin America, and it stood out with a sort of "market jiu-jitsu," turning the region's weaknesses to the company's advantage.

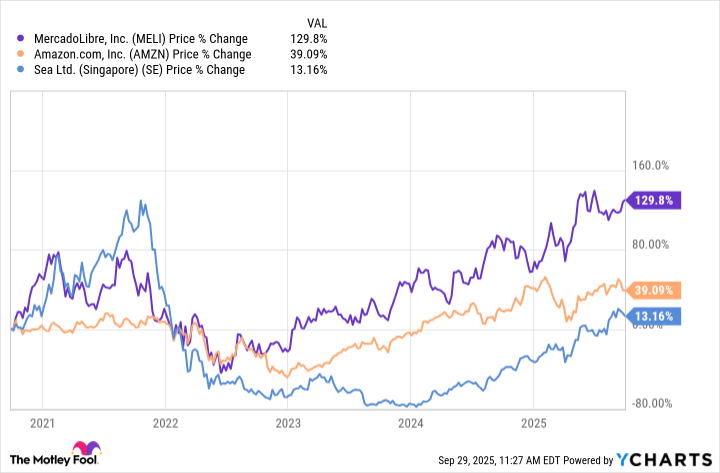

Despite those successes, its returns over the last year have not significantly exceeded those of the much larger Amazon and dramatically underperformed its competitor in Brazil, Sea Limited.

But instead of giving up on MercadoLibre, investors have reasons to treat this recent performance as a pause, and instead prepare for market-beating returns over the next five years. Here's why.

The MercadoLibre growth path

MercadoLibre operates e-commerce, fintech, and logistics businesses in 18 Latin American countries. These enterprises work both separately and together to drive returns for investors, and, as previously mentioned, it has succeeded in a sort of "jiu-jitsu" in its markets.

When Marcos Galperin co-founded MercadoLibre, he faced a challenge to sell online in a cash-based society. To address that issue, the company launched Mercado Pago to sell financial products to reach these consumers. It was so successful that it began serving customers who were not buying on MercadoLibre.

Grand View Research forecasts a compound annual growth rate (CAGR) of nearly 20% for Latin American e-commerce through 2033. Also, various studies point to a 7% to 19% CAGR in Latin American fintech, which should bode well for the long-term future of its industries.

This "jiu-jitsu" approach of using what you have to build a dominant position continued with Mercado Envios, its logistics company. Mercado Envios has made it easier for sellers to get orders processed and fulfilled and made shipping more efficient. Consequently, many parts of Latin America now offer the same-day and next-day shipping that American consumers may take for granted.

Additionally, as an e-commerce conglomerate, MercadoLibre is often compared to Amazon. That is understandable, and like Amazon, it leverages its extensive e-commerce site to sell advertising. Although it does not publish specific numbers on the ad business, MercadoLibre told investors that year-over-year ad revenue increased by 50% in the first quarter of 2025 and 38% in Q2.

NASDAQ: MELI

Key Data Points

What the results tell us

In terms of overall revenue, MercadoLibre generated $13 billion in the first half of 2025, a 35% yearly increase, far ahead of the aforementioned forecasted CAGRs.

The largest revenue driver is total payment volume, presumably from Mercado Pago, which rose 41% annually to almost $123 billion. Over the same period, MercadoLibre's gross merchandise volume grew by 19% to nearly $29 billion.

The struggles appear to stem from operating expenses. Although MercadoLibre earned $1.4 billion in the first half of 2025, net income growth was 24%, dramatically lagging the increase in revenue.

The challenge came from the 57% rise in the provision for doubtful accounts as Mercado Pago struggles with more debtors not paying back loans. Mercado Pago has prospered despite this challenge, but it shows its success comes with consequences that may have soured the stock to a degree.

Nonetheless, when pondering what MercadoLibre might do over the next five years, it makes sense to examine its performance over the last five.

Fortunately, it did not face the post-pandemic missteps of Sea Limited. Also, since MercadoLibre's $127 billion market cap is a tiny fraction of Amazon's $2.35 trillion market cap, high percentage growth comes more easily. Thus, it dramatically outperformed both stocks over the last five years.

Admittedly, some investors may balk at the lack of company guidance. Analysts expect MercadoLibre to achieve 36% annual revenue growth in 2025, though forecasts for 2026 point to 27%, which would amount to some slowing.

Also, MercadoLibre's performance has taken MercadoLibre's P/E ratio to 62, far above Amazon's earnings multiple of 34. Still, investors should remember that Amazon often exceeded 100 times earnings during its growth phase, a fact that should make MercadoLibre's somewhat elevated multiple more tolerable.

MercadoLibre in five years

Over the next five years, MercadoLibre is on track to continue earning market-beating returns.

The high provision for doubtful accounts and the slowing revenue growth may be causes for concern, but the company has successfully turned challenges into opportunities for expansion. Also, the financials for the next year and forecasted industry CAGRs point to continuing growth.

As MercadoLibre continues to perform "market jiu-jitsu" and capitalizes on opportunities in its region, its successes should translate into stock gains over time.