Shares of Magnite (MGNI 1.05%) were heading lower last month as investors seemed to believe that the supply side adtech platform (SSP) was one of the losers in the antitrust ruling that allowed Alphabet's (GOOG +0.48%) (GOOGL +0.69%) to retain ownership of its Chrome web browser.

The decision was seen as a loss for Google's adtech competitors like Magnite, as the Chrome web browser helps Google's advertising business function and improves its ad targeting.

Later in the month, Magnite sued Google, becoming the third SSP to do so, a sign that it believes Google is not competing fairly. It also shows that this is unlikely to be the end of Google's legal saga.

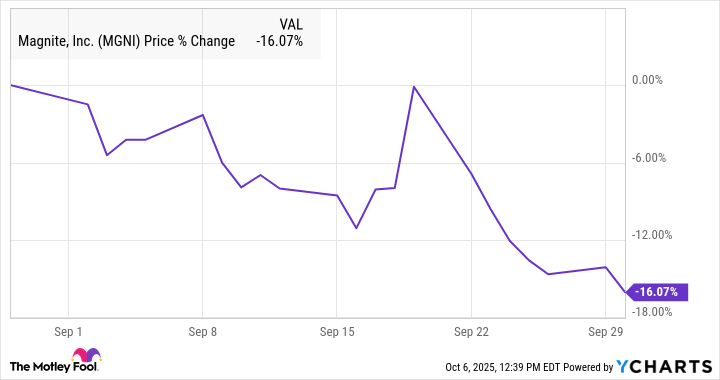

As a result of the downward pressure from the ruling on Google, the stock finished the month down 16%, according to data from S&P Global Market Intelligence.

As you can see from the chart below, the stock mostly headed lower last month, except for a brief spike that came after it filed its own lawsuit against Google.

Google still dominates

Google is the 800-pound gorilla in the digital advertising industry, and what happens to the tech giant can have a lot of influence over the rest of the industry, so it wasn't a surprise to see Magnite pull back on the favorable antitrust ruling for Google. Magnite stock lost 4% on Sept. 3, the same day that Alphabet stock soared.

In addition to being able to keep Chrome, Google will not be forced to divest the Android operating system.

The more direct news for Magnite came later in the month when it filed a lawsuit against Google on Sept. 16. Magnite said it was seeking financial damages and other remedies in response to the U.S. District Court's earlier ruling that Google had "willfully engaged in a series of anticompetitive acts to acquire and maintain monopoly power" in ad exchange and ad server markets.

By doing so, Magnite became the third SSP to sue Google in the last two months.

Image source: Getty Images.

What's next for Magnite

A potential breakup at Google was never a great investing thesis for a stock like Magnite, which has struggled to reassert itself following the pandemic-era boom.

While the digital advertising market continues to grow, Magnite revenue was up just 6% in the second quarter.

The company is profitable, but it will likely have to deliver faster growth than that to drive a rebound in the stock from here.