A few years ago, SoFi Technologies (SOFI 7.47%) and Robinhood Markets (HOOD 1.04%) were consistently unprofitable companies that seemed to be going nowhere. However, both have turned things around impressively and have seen their share prices skyrocket in the process.

SoFi Technologies is up 75% this year alone, while Robinhood's has climbed by a whopping 300%. The great news is that these companies still have excellent long-term prospects and could deliver superior returns over the long run. Here's the rundown.

Image source: Getty Images.

Recent financial results

First, let's briefly review the businesses and most recent financial performances of these two companies. Starting with SoFi Technologies, it was originally founded to help college graduates refinance their student loans. Although the company now offers a far wider range of products, its origin story continues to have an impact on its business. SoFi generates a significant portion of its revenue from interest on lending products, including student loans and various other personal loans.

The company's financial services also now include a range of banking products, such as checking and savings accounts, credit cards, and stock trading, among others.

During the past couple of years, soaring demand for SoFi's lending products and expanding success have sent sales and earnings through the roof. In the second quarter, SoFi's revenue soared by 44% year over year to $858 million, while its net income skyrocketed 459% year over year to $97.3 million. SoFi had 11.7 million customers as of the end of the period, representing a 34% increase from the prior-year quarter. Meanwhile, product growth rose 34% year over year to 17.1 million.

Now turning to Robinhood, the company helped pioneer the commission-free trading model. It is now one of the most popular stock and crypto trading apps, earning money through this business, as well as interest on its clients' cash balances, its premium Gold subscription service, and several other sources.

Although Robinhood has been criticized for gamifying stock trading and exposing novice investors to potentially risky trades, the company's success stems from the fact that it has helped bring Wall Street to Main Street, making equity and crypto markets easily accessible to even more people. Robinhood is being handsomely rewarded for its efforts.

The company's financial results have improved significantly during the past few years. The company's second-quarter revenue rose 45% from a year ago to $989 million, with average revenue per user of $151, up 34%. Robinhood's net income more than doubled to $386 million. Robinhood's total platform assets jumped 99% year over year to $279 billion, while its small yet growing Gold subscription service ended the quarter with 3.5 million members, up 76% compared to the year-ago period.

These two fintech leaders are firing on all cylinders.

The future of banking

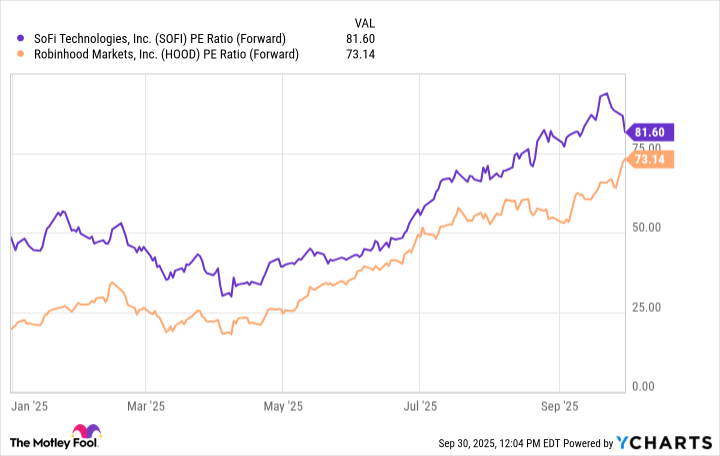

Some might complain that SoFi Technologies and Robinhood are getting too expensive. The fintech leaders' forward price-to-earnings look incredibly high compared to the financial services industry average of 16.6.

SOFI PE Ratio (Forward) data by YCharts

However, considering how fast both are growing -- and since they have turned a profit -- SoFi and Robinhood are worth a premium. Still, they might not deserve this much of a premium, and if they fail to meet the market's expectations, investors should expect a correction. Even with this caveat, those prepared to hold onto these stocks for the next decade should still consider initiating positions today. One thing SoFi and Robinhood have in common is that they are the financial services companies of the future.

They are well adapted to the digital age and especially appeal to younger generations, such as millennials and Gen Z, some of whom are still coming of age. As younger people who grew up in a world where apps are the new way to do banking start participating more and more in the economy, SoFi and Robinhood will benefit. Even within their current crop of members, both companies still have significant potential. SoFi has just 1.5 products per member and can increase its revenue by cross-selling additional services to existing users.

Robinhood's Gold membership offers a range of perks, and these users tend to spend more on the platform. More of the company's clients signing up for that service should also boost revenue across the platform. Furthermore, SoFi and Robinhood will benefit from offering new services, which they have done routinely over time, and expanding internationally. In my view, we have barely scratched the surface of these stocks' potential. Even after their recent runs, they can still offer explosive growth over the long run.