Unless you pay zero attention to the news, it's likely you know that the political divide between Republicans and Democrats has resulted in a partial shutdown of U.S. government operations. Certain essential operations continue, even though many of the workers doing those jobs are not being paid. The troubling situation highlights how U.S. politics have stalled, potentially putting the U.S. economy at some risk of stalling as well if it goes on long enough.

As an investor, such situations raise questions that need to be considered. This article will focus on one question in particular: Are global exchange-traded funds (ETFs) a smart play today?

The answer is maybe, but you need to think long-term to understand what that answer means.

Polish stocks are rocking and rolling!

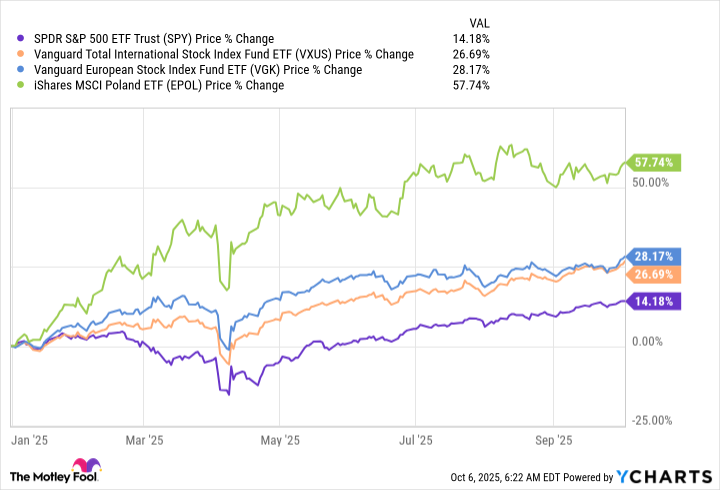

A look at the markets at the moment shows the government shutdown hasn't stopped the S&P 500 index from rising around 14% so far in 2025. The trading suggests the market has barely noticed the shutdown. But the fact that many U.S. government services are essentially shut down is a sign that there are, perhaps, some problems that need to be addressed. Elsewhere, though, things are looking up.

The iShares MSCI Poland ETF (EPOL 0.22%), for instance, is trading up 57% so far in 2025, more than four times as much as the S&P 500 index! If the name didn't provide enough of a clue, the iShares MSCI Poland ETF tracks a broad-based index exclusively composed of Polish stocks.

Image source: Getty Images.

That's not to say you should rush out and buy the MSCI Poland ETF based on that comparison. In fact, it is probably a bad idea in general to buy into any stock or ETF that is already up over 50% in less than a year. It seems highly likely that you will be late to the party.

Moreover, you have to take into consideration how much you actually know about Poland, its economy, and its stock market. Most investors, myself included, probably don't know nearly enough to justify a material investment in an exchange-traded fund that is limited to just that one country.

Which is why it is worth noting that more diversified international ETFs exist. For example, the Vanguard Total International Stock ETF (VXUS 1.16%) and the Vanguard FTSE Europe ETF (VGK 1.40%) have also been outperforming the S&P 500 in 2025. And they both provide more diversification, so you don't need the kind of specialized knowledge required to justify buying an ETF focused on just one country.

Data by YCharts.

Diversification has its positives and its negatives

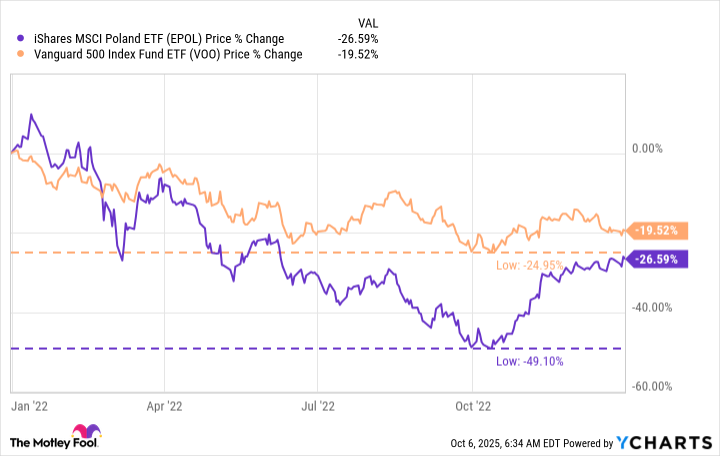

In hindsight, it would have been a great choice to buy the iShares MSCI Poland ETF at the start of 2025. But hindsight is 20/20. If you had made the same call at the start of 2021, the numbers would have looked much different, as the chart below highlights.

In other words, don't put all of your eggs in one basket. Which is also why owning only U.S. stocks may not be the best choice, either. If you do, you are also betting on just one country (but at least you know more about that country).

Data by YCharts.

A better choice is to layer in some well-diversified foreign-focused ETFs. The two Vanguard offerings are great options. Its Total International Stock ETF is one of the most diversified choices you can own, since it basically provides exposure to all of the world's stocks outside of the United States. It is a quick and easy way to add foreign diversification, and at a fairly low cost, given its very low 0.05% expense ratio.

If you want to be a little more focused, you could emphasize a specific region without upending the diversification of your portfolio. That's where an ETF like the Vanguard FTSE Europe ETF comes in.

As the name implies, it owns European stocks, including some from Poland (the country makes up 0.9% of the overall portfolio). The expense ratio is a still-modest 0.06%.

Don't focus on performance in 2025

That said, don't use the 2025 performance of the Vanguard FTSE Europe ETF or the Vanguard Total International Stock ETF as a reason to buy either of these funds right now. That's no better a choice than buying the iShares MSCI Poland ETF because it is trouncing the S&P 500 -- right now. Think about the diversification of your portfolio and whether or not any of these ETFs add value as long-term holdings.

In the end, the benefit of adding a diversified international ETF probably does make sense for most investors. Just don't go too far to the extreme and try to play market-timing games with specific foreign markets or, conversely, shift too much money out of the U.S. market.

This country remains one of the largest and most important economies in the world, even though it sometimes suffers from a little political dysfunction.