Some say data is the new oil. This is especially true in the artificial intelligence (AI) space, where increased computing costs are the primary bottleneck on growth. As many readers will know, Nvidia (NVDA 2.08%) has benefited tremendously from the growing importance of data center computing. The computer chip designer is now the largest company in the world by market capitalization, and the $46.7 billion in revenue it posted last quarter was up 56% year over year.

Large data center builders such as Meta Platforms (META 1.86%) are now spending tens of billions of dollars on Nvidia's chips every year. In a bid to cut down on these costs, Meta just acquired an AI computer chip start-up called Rivos. Did this just turn one of Nvidia's top customers into a competitor overnight? The answer is more complicated than it seems.

Custom semiconductors to decrease costs

With plans to spend around $70 billion on capital expenditures this year and even more in 2026, Meta is putting considerable sums toward feeding its insatiable need for Nvidia chips to train and power AI systems. Meta had already been in talks with Rivos about building chips using the RISC-V architecture, an open-source chip design platform. Now, after its acquisition, Rivos will focus on building AI chips for Meta's internal use.

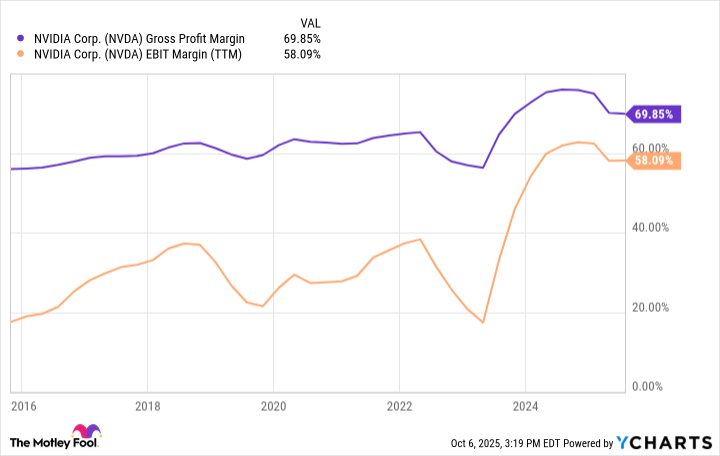

This could impact Nvidia's dominance. Not only could it decrease its unit volume, but it could eliminate the company's sustained pricing power, which has sent gross profit margins up to 70% and EBIT (earnings before interest and taxes) margins up to 58% over the last 12 months. Pricing power is a huge reason why Nvidia now has the largest market cap in the world. A reversal of this trend could mean pain for its shareholders.

Image source: Nvidia

Nvidia will not get disrupted overnight

Nvidia shareholders should keep a close eye on increased competition from customers trying to build their own AI chips to ease its choke hold on the AI data center market. Conversely, investors in Meta should keep close track of its progress in designing its own computer chips and bringing them into production, as that could result in huge cost savings for the business over the long term.

Regardless of what happens, Nvidia will not get disrupted overnight. It can take a full year or longer to design and validate a chip, which then has to wait in line at a foundry to get manufactured. Even then, first iterations for chip designers are usually years behind the latest offerings from more-established competitors. It is not like Nvidia is going to sit tight and just wait for the competition to catch up.

NVDA Gross Profit Margin data by YCharts.

One AI company thought far ahead of Meta

Meta is smart to start designing its own chips. The Nvidia tax is large and not going away anytime soon. Even if it takes Meta years and billions of dollars in investment, the tens of billions of dollars it could eventually save every year through vertically integrated chip design will make it well worth it.

One company learned this lesson many years ago: Alphabet. The parent of Google and YouTube started using its first tensor processing units (TPUs) in early 2015, and has slowly been scaling up the usage of these computer chips in its own data centers ever since. This is the only example of an Nvidia customer actually producing computer chips that are close to equivalent to its wares in terms of cost-effectiveness. Compared to every other AI player, Alphabet now has a competitive advantage because of its TPUs.

Even so, Alphabet remains a major customer of Nvidia 10 years later. Taking the TPU as a case study, it is highly unlikely that Meta's acquisition of Rivos is going to kill Nvidia's business. Don't use it as a reason to sell the stock.