D-Wave Quantum (QBTS 4.00%) is one of the most prominent quantum computing companies on the market, positioning itself as "the first commercial quantum computing provider."

The company, alongside others like IonQ and Rigetti, has captured the imagination of investors who believe that its technology could prove revolutionary, and quantum investment has exploded as D-Wave and its peers race to create viable quantum computing systems. D-Wave's stock price is up 313% in 2025 and a whopping 3,670% over the past year.

NYSE: QBTS

Key Data Points

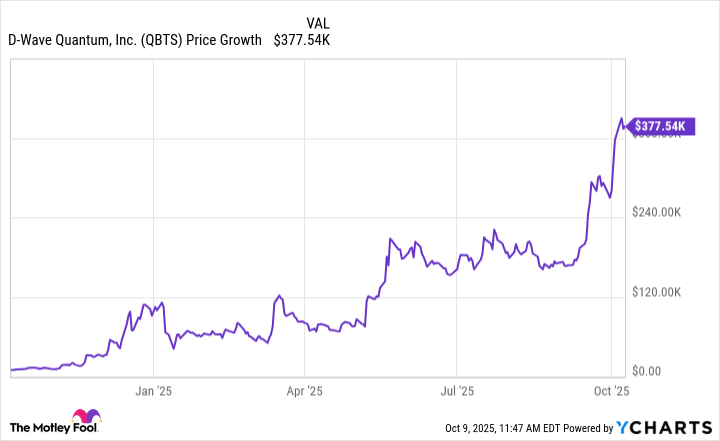

So, how much would you have if you'd invested $10,000 in D-Wave stock just one year ago? A whole lot. A $10K investment one year ago would have already grown to $377,650. You can see the incredible gain in the chart below.

Data by YCharts.

Quantum investors are getting ahead of themselves

While that is an absolutely incredible gain, I don't think that it will hold. The potential of quantum is incredible; that's undeniable. The problem is that the technology has a very long way to go before it is commercially viable. We are early enough in its development that it's still an open question if that is even possible, let alone when.

Image source: Getty Images.

Given this, D-Wave's $11.9 billion market capitalization is just not reasonable. While it claims to be already solving real-world problems with its hybrid solutions, its trailing-12-month revenue was still just $22.3 million, and it's operating deep in the red. I would stay away from D-Wave and other pure-play quantum stocks until they can show that they can make money from their products. Their valuations just don't make sense at this point.