Robinhood Markets (HOOD 0.52%) operates one of the most popular investing platforms for young people, allowing them to buy and sell stocks, options, cryptocurrencies, and more. The platform was a haven for highly speculative trading at the height of the pandemic in 2020 and 2021, particularly in meme stocks like GameStop, but Robinhood itself has become a meme-like stock with a staggering 288% gain this year (as of Oct. 7).

It's currently outperforming some of the best artificial intelligence (AI) stocks in 2025, including Nvidia, which is up 38%, and even Palantir Technologies, which has soared by 143%.

Investors are enthusiastic about Robinhood's recent pivot into NFL and college football prediction markets in partnership with Kalshi. Its stock also received a boost when it was added to the S&P 500 in September. But its business is facing some structural challenges that could disrupt its momentum heading into 2026.

Image source: Getty Images.

Sports betting is a growing opportunity in the U.S.

Platforms like Kalshi don't offer sports betting in the traditional sense. Instead of placing a wager on a binary outcome, like the winner of a National Football League game, prediction markets allow users to trade in and out of contracts (or shares) that represent the likelihood of a particular event. The odds constantly change based on market activity, which differs from traditional sports betting platforms where a bookmaker can adjust the odds when they need to balance their ledger.

With that said, prediction platforms are certainly trying to eat the sports betting industry's lunch. According to Grand View Research, this could be a $20 billion opportunity in 2025, which will grow to more than $33 billion annually by 2030. Kalshi operates one of the biggest prediction platforms, but the company was recently valued at just $2 billion based on a private funding round, which leaves plenty of room for growth.

The U.S. financial securities brokering industry is about 10 times larger than the sports betting industry, so Robinhood's recent partnership with Kalshi might not sound like a game changer. However, the company could capture a significant share of the budding prediction industry since it's an early entrant, whereas it faces stiff, entrenched competition in the securities brokering space.

Robinhood's core business faces headwinds

Robinhood ended 2024 with a record $672 million in transaction revenue in the fourth quarter, which is the money the company earns from processing stock, option, and cryptocurrency trades for clients. Crypto trading revenue made up more than half of that figure alone, coming in at $358 million.

Unfortunately, crypto revenue fell 55% in the second quarter of 2025, to just $160 million. The sharp decline has dragged Robinhood's total transaction revenue lower on a sequential basis for two straight quarters, even though other important revenue sources like options trading continued to grow.

Many popular cryptocurrencies have declined significantly from their recent peaks, which is pushing many investors onto the sidelines. Dogecoin is down 48% from its 52-week high, Shiba Inu is down by 64%, and even XRP has declined by 21%. This doesn't bode well for Robinhood's crypto trading revenue as we head toward the new year.

Long-term Robinhood investors might be feeling a sense of déjà vu right now. The company's crypto revenue soared by 4,560% year over year during the second quarter of 2021, and accounted for half of its total transaction revenue. But by the second quarter of 2022, its crypto revenue was down by a staggering 75%.

The crypto bust in 2022 contributed to a peak-to-trough collapse in Robinhood stock of more than 90%, which is something for investors to keep in mind.

NASDAQ: HOOD

Key Data Points

Robinhood stock is trading at a sky-high valuation

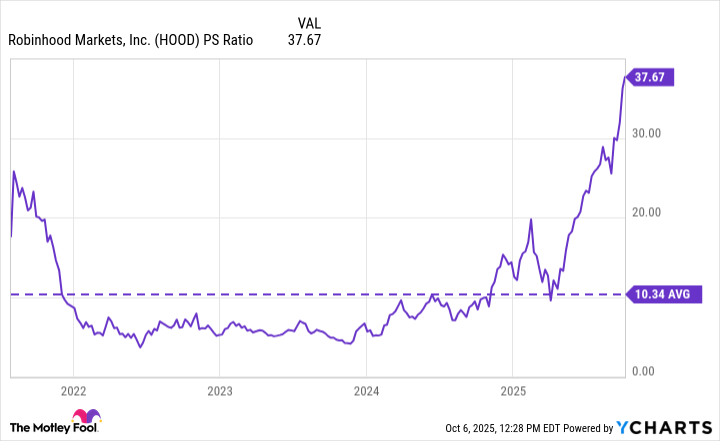

The eye-popping surge in Robinhood's stock price this year doesn't exactly align with the current state of its business, considering its revenue is shrinking sequentially. Robinhood's price-to-sales (P/S) ratio is now more than 37, so this is the most expensive the stock has ever been since it went public in 2021.

In fact, Robinhood's P/S ratio is now about 3.6 times higher than its long-term average of 10.3. The stock would have to decline by more than 70% from here just to return to that average valuation, unless the company generates significant revenue growth in the near future, which doesn't seem likely based on its results in the first half of 2025.

HOOD PS Ratio data by YCharts

It's possible Robinhood's deal with Kalshi becomes an important source of revenue over the long term, but prediction markets don't appear to be big enough to make a tangible difference to its business just yet.

As a result, I don't think Robinhood stock is a good buy heading into 2026. I actually believe it's more likely to head lower in the short to medium term.